This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Wednesday, July 6, 2022

Newbie Investment Portfolio - End 2022 06

Thursday, June 30, 2022

Newbie SGD50k Equity Portfolio - End 2022 06

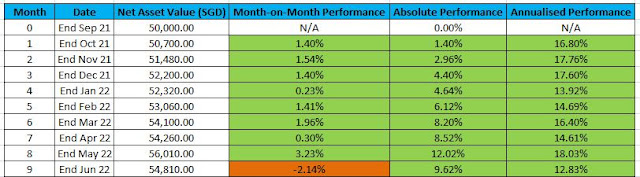

All good things must come to an end. All streaks will end.

Sadly, my 8 month streak of gains has been broken! Even though I had made a number of small and profitable trades for the month, the realised gains from those trades were not enough to offset the mark-to-market loss from Twitter, DBS, and Suntec Reit!

Current market, even the supposedly resilent Singapore Market, seems bearish and I am going to adopt a cautious stance. Still have about SGD25k of cash which I will only use when the market gets cheaper.

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Saturday, June 18, 2022

Newbie Crypto FLASH!

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Wednesday, June 8, 2022

Newbie Investment Portfolio - End 2022 05

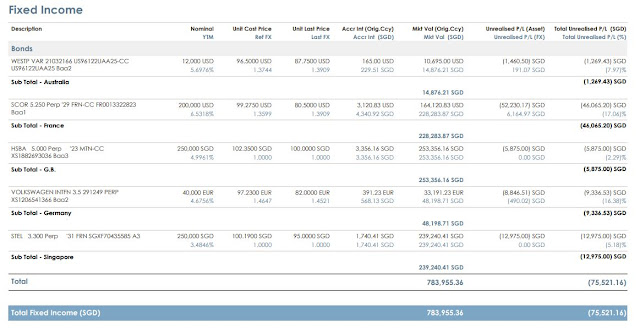

Bonds have rebounded a bit from their lows, but my timing in buying 2 new bonds wasn't that good as they declined more after I used bulk of the Shell proceeds to purchase them. But once again, I would repeat: If a bond price drops after you purchase it, it isn't really a 'loss'. It just means you have locked in a lousier yield than what you could have locked in now. For example 4% yield vs 4.8% yield.

Details on the 2 small sized bonds (credits to Fund Supermart):

Factsheet | WSTP 5.000% Perpetual Corp (USD) (fundsupermart.com)

Factsheet | VW 3.500% Perpetual Corp (EUR) (fundsupermart.com)

I still have some GBP cash from Shell proceeds left to add more of those small size bonds. The GBP cash is currently still being held in Interactive Brokers, so I have manually added it into the table.

My margin ratio remains very healthy/low at 75% so I would still be able to add one lot of usual sized bonds.

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Newbie SGD50k Equity Portfolio - End 2022 05

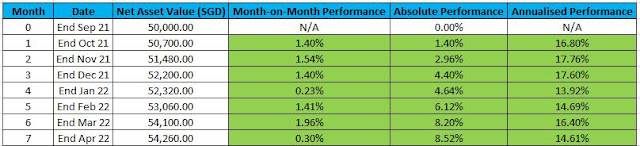

Small and consistent gains. It remains a nice 8 month upward gain streak, demonstrating how frequent buy/sell trades using cheap brokers on stable SGX stocks can work well consistently, if you have a tested and proven method.

Now if only Elon will just shut up and complete the Twitter $54.20 deal already!

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Monday, May 9, 2022

Newbie Investment Portfolio - End 2022 04

Not a very good month as almost all asset classes have declined. The main reason used by everyone appears to be "CAUSED BY INFLATION FEARS" (seems virus fears are out the window now).

All Shell shares of this portfolio have been sold and proceeds are currently being held as GBP cash in the account (currently still held at Interactive Brokers). Average Sale Price achieved (inclusive of commissions paid) was GBP20.98 per share.

This portfolio received bond interest from Singtel Bonds in this month.

Margin Ratio remains low at 73.48%. As this small portfolio has limited bullets (probably can only add one more USD or SGD bond), I am waiting patiently for the correct bond to add to this portfolio. Most likely I would be aiming a higher coupon USD perpetual bond.

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Saturday, April 30, 2022

Newbie SGD50k Equity Portfolio - End 2022 04

Another small upward gain for this mini $50k sample portfolio.

Interactive Brokers have updated the $2.36 Cash Offer proceeds for the SPH shares.

I decided to take a punt on Twitter Shares. As we all know, Elon Musk will be offering USD54.20 cash for each Twitter Share with the deal expected to close about October to December 2022. Of course there is always the chance that the acquisition could fail. So do your own due diligence and only buy what you can afford to lose. If the acquisition by Elon Musk falls apart, Twitter Shares could drop below USD40. But I'm fairly optimistic, considering Elon Musk sold about USD8 billion (varying news sources reporting he sold between USD4-9 billion worth) of Tesla shares to partially finance the deal, I would use that as an indication he is serious.

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

.JPG)