Another month has passed without much excitement. I was supposed to write a lengthy discussion on my newly purchased Allianz bond but it will be cut short (more on that below).

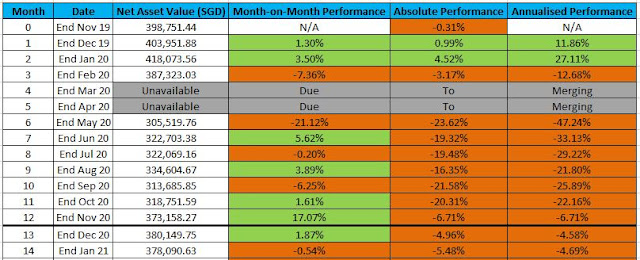

Net Asset Value is slightly lower compared to last month due to slight movements in asset prices, nothing interesting to highlight. As at date of writing (5th Feb), Shell had announced its full year 2020 results (so so results in my view) and raised its dividend slightly. I am still positive on Shell equity and will continue holding on to it. Crude oil also appears to be on an uptrend.

What was supposed to be a detailed analysis and discussion on why I added Allianz 5.5% Perpetual Bond into the portfolio is now going to be a short one. Reason being Allianz has announced this bond will be called on 26th March 2021.

I had decided to buy the Allianz 5.5% Perpetual bond because the price had come down from 101-102 to a price where I calculated I would make no loss even if Allianz called the bond. Sadly, Allianz indeed called the bond, and I ended up at breakeven after I include the bond interest I earned in the short 1-2 months of holding.

The current Margin Ratio of 92.67% is considered high and I typically won't recommend any Investors keep their Margin Ratio so high (ideal is always 80-85%). It is as such because the Allianz bond was so attractive I had to add it into this mini portfolio (as a matter of fact, I bought the Allianz bond for many of my other portfolios as well). The Margin Ratio will come down to a comfortable level after 26th March 2021 when the Allianz bond is redeemed by the Issuer.

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

1 comment:

Great post thank yoou

Post a Comment