Portfolio Performance (Start Date: End November 2019 with SGD400k Cash)

Month 00 End Nov 2019 NAV: SGD398,751.44 (N/A mom) (-0.31% absolute) (N/A p.a.)

Month 01 End Dec 2019 NAV: SGD403,951.88 (+1.30% mom) (+0.99% absolute) (+11.86% p.a.)

As at End November 2019, it appeared as if I had utilised all of the SGD400k cash I started out with. To the ordinary investor, that would seem the end of the road. No further investments can be made.

However, if you are more sophisticated and are open to the idea of Security Financing, you would be able to continue to make investments, specifically: Leveraged Investments.

Leveraged Investments is a concept whereby you pledge Securities to a Financial Institution ("FI") and in return, the FI provides you with a Loan to finance your Purchases.

What this means is with the SGD400k cash that I have used to purchase Keppel Corp and HSBC Coco Perp, I would be able to obtain Loans against them as well as Loans against future purchases.

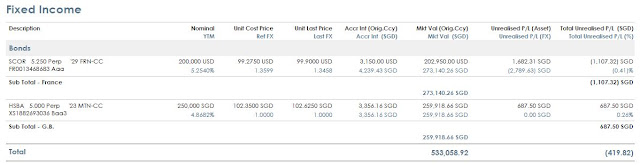

Let me show my Portfolio as at End December 2019 so this concept can be clearer:

Assets: SGD803,858.92

Liabilities: SGD399,907.04

Total NAV: SGD403,951.88

The Liabilities figure may be something new to some Investors, but I assure you that this is "Good Debt" and if used wisely, it can be used to amplify your Investment Returns.

In short, my Assets have doubled from SGD400k to SGD800k, financed by a loan of SGD400k from the FI. So how have I used this additional SGD400k?

My entry yield is approximately 5.35% YTC 5.3% YTM. The bond was purchased below par price.

This is one of the larger Reinsurers in the world, with France Country of Risk. For more information on the Issuer, please refer to: SCOR SE About Us

The specific security that I had purchased was a Re-tap of an existing Coco Perp that was issued about 1 year ago. It will funge into ISIN FR0013322823 sometime in January 2020. The main issue is rated A- by S&P.

More information: Retap of existing Coco Perp

My second action for the month was to add more shares of Keppel Corp. This does not require more elaboration as I remain confident that the Partial Offer by Temasek will have a high probability of upside from my entry levels. Any dip in the share price of Keppel Corp would be seen by me as a buying opportunity.

One new screenshot I would like to include in this blog entry would be the Currency breakdown of my Assets and Loans:

It can be observed that my USD Asset and Liability exposure almost offsets each other, which means that I have hedged out almost all of my USD FX exposure (remember my portfolio started off with SGD400k cash and I measure this portfolio returns in SGD equivalent). This is one of the beauties of using Loans to finance a purchase that is not in your home currency: FX exposure is largely hedged out. Whether USD appreciates or depreciates against SGD, my portfolio measured in SGD will not be significantly impacted.

So what can be taken away from the above lengthy messages?

The above portfolio currently has a size of SGD800k and is earning Investment Returns on the entire SGD800k, with a need to service the interest cost of a SGD400k loan.

I think that's enough discussion for this post. In my next update, I will detail further about Portfolio Margin calculations.

Regards,

Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.