This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Wednesday, July 6, 2022

Newbie Investment Portfolio - End 2022 06

Thursday, June 30, 2022

Newbie SGD50k Equity Portfolio - End 2022 06

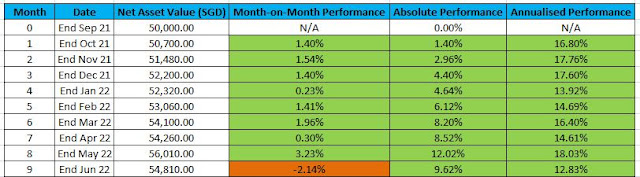

All good things must come to an end. All streaks will end.

Sadly, my 8 month streak of gains has been broken! Even though I had made a number of small and profitable trades for the month, the realised gains from those trades were not enough to offset the mark-to-market loss from Twitter, DBS, and Suntec Reit!

Current market, even the supposedly resilent Singapore Market, seems bearish and I am going to adopt a cautious stance. Still have about SGD25k of cash which I will only use when the market gets cheaper.

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Saturday, June 18, 2022

Newbie Crypto FLASH!

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Wednesday, June 8, 2022

Newbie Investment Portfolio - End 2022 05

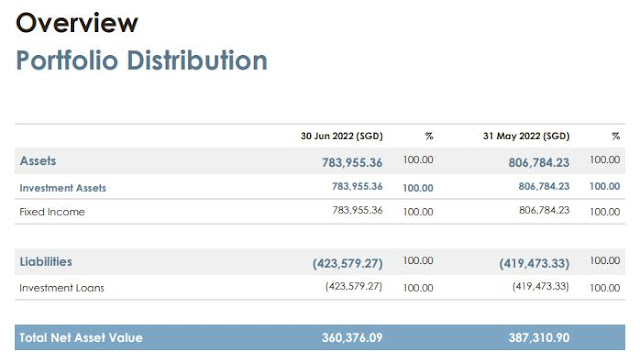

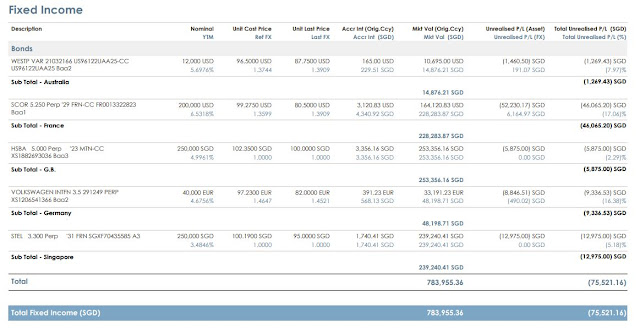

Bonds have rebounded a bit from their lows, but my timing in buying 2 new bonds wasn't that good as they declined more after I used bulk of the Shell proceeds to purchase them. But once again, I would repeat: If a bond price drops after you purchase it, it isn't really a 'loss'. It just means you have locked in a lousier yield than what you could have locked in now. For example 4% yield vs 4.8% yield.

Details on the 2 small sized bonds (credits to Fund Supermart):

Factsheet | WSTP 5.000% Perpetual Corp (USD) (fundsupermart.com)

Factsheet | VW 3.500% Perpetual Corp (EUR) (fundsupermart.com)

I still have some GBP cash from Shell proceeds left to add more of those small size bonds. The GBP cash is currently still being held in Interactive Brokers, so I have manually added it into the table.

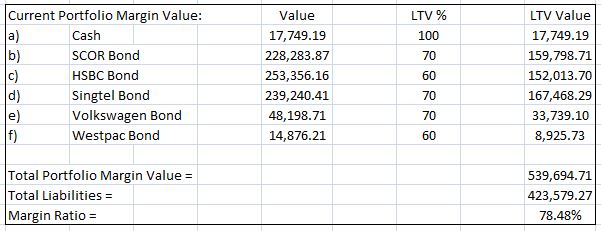

My margin ratio remains very healthy/low at 75% so I would still be able to add one lot of usual sized bonds.

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

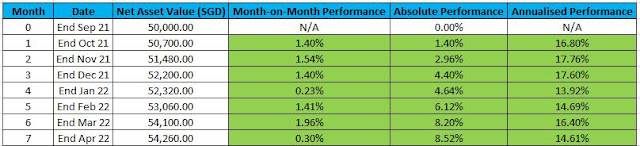

Newbie SGD50k Equity Portfolio - End 2022 05

Small and consistent gains. It remains a nice 8 month upward gain streak, demonstrating how frequent buy/sell trades using cheap brokers on stable SGX stocks can work well consistently, if you have a tested and proven method.

Now if only Elon will just shut up and complete the Twitter $54.20 deal already!

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Monday, May 9, 2022

Newbie Investment Portfolio - End 2022 04

Not a very good month as almost all asset classes have declined. The main reason used by everyone appears to be "CAUSED BY INFLATION FEARS" (seems virus fears are out the window now).

All Shell shares of this portfolio have been sold and proceeds are currently being held as GBP cash in the account (currently still held at Interactive Brokers). Average Sale Price achieved (inclusive of commissions paid) was GBP20.98 per share.

This portfolio received bond interest from Singtel Bonds in this month.

Margin Ratio remains low at 73.48%. As this small portfolio has limited bullets (probably can only add one more USD or SGD bond), I am waiting patiently for the correct bond to add to this portfolio. Most likely I would be aiming a higher coupon USD perpetual bond.

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Saturday, April 30, 2022

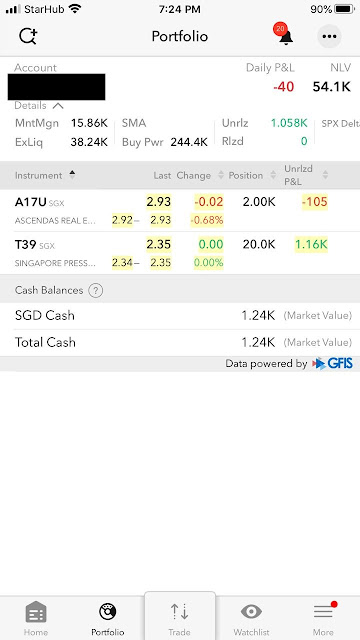

Newbie SGD50k Equity Portfolio - End 2022 04

Another small upward gain for this mini $50k sample portfolio.

Interactive Brokers have updated the $2.36 Cash Offer proceeds for the SPH shares.

I decided to take a punt on Twitter Shares. As we all know, Elon Musk will be offering USD54.20 cash for each Twitter Share with the deal expected to close about October to December 2022. Of course there is always the chance that the acquisition could fail. So do your own due diligence and only buy what you can afford to lose. If the acquisition by Elon Musk falls apart, Twitter Shares could drop below USD40. But I'm fairly optimistic, considering Elon Musk sold about USD8 billion (varying news sources reporting he sold between USD4-9 billion worth) of Tesla shares to partially finance the deal, I would use that as an indication he is serious.

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Wednesday, April 6, 2022

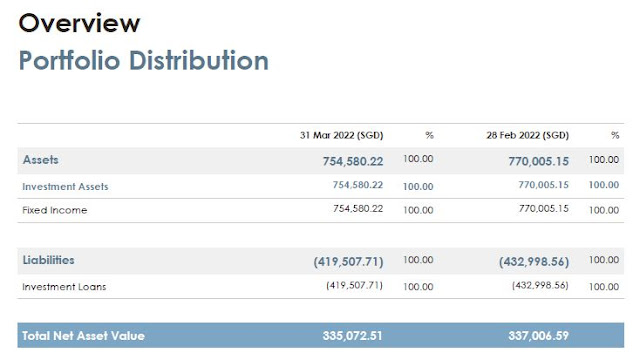

Newbie Investment Portfolio - End 2022 03

Not much changes to the Portfolio Value. This Portfolio received Coupon Payments from both SCOR and HSBC bonds this month! Shell Dividends were also paid.

I have been selling this Portfolio's Shell shares using Interactive Brokers (I transferred out all the Shell Shares) and as at End March 2022, a total of 1,200 Shell Shares have been sold and 800 Shell Shares remaining.

Once all Shell Shares have been sold, I will likely convert the GBP cash into either USD or SGD and bring it back into this Portfolio. In the meantime, I am manually adding the GBP value of the Shell Shares + GBP Cash held in Interactive Brokers.

Since my Margin Ratio is relatively low at 73.5%, I was actually tempted to add SGD250k of Singpost 4.35% SGD Perpetual Bond into this Portfolio, but I thought I would wait a bit more since this Portfolio already has 2 SGD Bonds. Adding a more exciting USD Bond might be a better idea. Since this Portfolio has limited bullets, I thought it might be a better idea to wait a bit.

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Friday, April 1, 2022

Newbie SGD50k Equity Portfolio - End 2022 03

Portfolio is up month-on-month again, continuous win streak for 6 months. Yeah mike, 100% winning (realised) trades!

SPH shareholders have finally voted and approved the Cuscaden Scheme. Now just have to wait until early May to receive the SGD2.36 cash per SPH share (I will definitely be choosing ALL CASH regardless of the price of SPH Reit).

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Saturday, March 5, 2022

Newbie Investment Portfolio - End 2022 02

Thanks to the combination of Geo Political conflicts and the threats of rising inflation and the impending Fed rate hike, it was a bad month for Bonds as can be seen by the downward price movement especially in my USD SCOR SE bond.

An observation from being involved in USD, EUR, GBP, and SGD bonds would be SGD bonds tend to be more resilient in the face of world wide developments. Maybe most SGD bond investors are buy and hold and don't really trade much, which means the price of the SGD bonds won't really react/move much whether it is good or bad macro news.

Lloyds 12% USD Bond has been regulatory called/redeemed on 4th February 2022 with the USD cash proceeds received used to reduce USD loan, which majority explains why the Assets and Liabilities figured have dropped month on month.

The other significant mention (that caused the Assets figure to drop) would be the fact that I had moved all 2,000 Shell shares out to my Interactive Brokers account so I can slowly take profit on the position. I have manually added the Market Value of 2,000 Shell shares as at 28th February close to this portfolio. Going forward, I would also be manually adding the Market Value of remaining Shell shares as of month end + Cash held in Interactive Brokers from the Sold Shell shares.

I am still considering what I would do after I have sold off all the Shell shares from the mini portfolio. Would I convert the GBP cash into SGD or USD or EUR cash to buy a SGD or USD or EUR bond? Would I use the GBP cash to buy a GBP bond? This is related to the fact that my current Margin Ratio of 76% is below my target 80%-85%, and the Margin Ratio will continue to go down as I sell off the Shell shares. I have to buy something else to replace the Shell shares or else I would be under invested!

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Wednesday, March 2, 2022

Newbie SGD50k Equity Portfolio - End 2022 02

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Sunday, February 6, 2022

Newbie Investment Portfolio - End 2022 01

With US Fed expected to raise interest rates faster than initially expected, bond prices have come down. I am not too worried as I am holding bonds for the long term. The key figure that affects me would be the bond yield locked in upon purchase of the bond.

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Tuesday, February 1, 2022

Newbie SGD50k Equity Portfolio - End 2022 01

HAPPY LUNAR NEW YEAR!

Nothing much this month again as I continue to wait for SPH deal to complete.

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Thursday, January 6, 2022

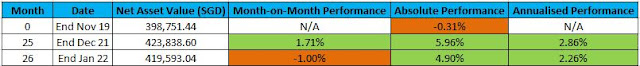

Newbie Investment Portfolio - End 2021 12

The first month of the 3rd year for this $400k Mini Portfolio!

It is a decent start with this $400k Mini Portfolio continuing to register a positive Month on Month performance, Absolute Performance, as well as Annualised Performance.

One sad piece of news that I received on 4th January 2022 was the Regulatory Call Notice for the 12% Lloyds USD bond. The bond will be called at 100 on 4th February 2022. This unfortunately means that I will lose about 1% (USD1k thereabouts) net on this $112k Original Investment. My breakeven point was March 2022 but sadly the Issuer Lloyds decided to not be nice and call it on the second business day of 2022 (although it can be argued if they wanted to be evil, they could have given notification on 1st December 2021 to call the bond on 1st January 2022).

After this bond is called on 4th February 2022, I will probably be on the lookout for another decent bond to add to this Mini Portfolio as my Margin Ratio will drop below 80% (which to me means under utilising leverage). No rush, rates are going to rise and I am sure there will be better USD bonds to buy soon.

My current Margin Ratio before Lloyds Bond is called = 84.17% (within my target 80-85%).

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Friday, December 31, 2021

Newbie SGD50k Equity Portfolio - End 2021 12

Another month of small but consistent profits! Just waiting for the SPH deal to complete. I will definitely be choosing the SGD2.36 All Cash Offer!

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Saturday, December 4, 2021

Newbie Investment Portfolio - End 2021 11

With markets believing that interest rate rises are round the corner, bonds have generally come down in prices. Notably my Singtel 3.3% SGD Bond is now below 100. I am not too worried as I am holding the bonds in the portfolio long term with no intention to trade them. As long as the locked in Bond Yield is above my Loan Rate, I am still having positive Carry Yield.

End November 2021 is also the 2 Year Anniversary of this SGD400k Mini Portfolio. It has managed to return a positive return of 2.09% p.a. My self critique is that this figure is mediocre but considering this portfolio was started just before Covid 19, bearing the brunt of March 2020's market crash, fighting its way back to positive territory is already very respectable.

The next test would be whether leaving this Mini Portfolio on auto pilot for the next 1-2 years will gradually bring the Average Medium Term Returns to 5-8% p.a. Only time will tell!

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

.JPG)