Thursday, April 23, 2009

Citibank trade for free and rebates

Subsequently, new account or existing account holders will get to enjoy $30 rebates for every three successful trades executed. That is effectively $10 rebates for every one trade. The rebates may be less than half of the minimum commission but still every dollar counts especially during times like now.

Investors should seek more opportunities like this brokerage promotion to gain as much rebates as possible. As an investor and in my opinion, features of a platform are secondary considerations. Cost should be the primary concern.

Just take note that there is no contra at Citibank platform. As such you need to transfer your money first into the Citibank trading account before doing your purchase. Click the link to read more about the Citibank Trade for free and rebates promotion.

Thanks to cukcuk for highlighting this promotion

Monday, March 16, 2009

Online trading services with DBS iBanking

Under the new change, you can get to enjoy a preferential commission rate of 0.18% or minimum of S$18 for all your online Singapore trades. However the lower commission rate is possible only for cash upfront settlement. In other words, DBS Vickers has done away with the T+3 settlement policy. I believe you can still do contra trading but of course you won’t be able to get to enjoy the preferential rate.

I find the change beneficial for those long term investors as they don’t do contra trading. You just need to pay cash upfront first and then make your online purchases when there is sufficient money in your account.

In order to take advantage of the preferential rate, of course you need to have DBS Vickers online trading account and also DBS iBanking ready. Upon logging in to your DBS iBanking, there is a new Trading Services menu on the left. You need to link DBS iBanking to DBS Vickers if you are doing it the first time. From then onwards, you can do your stock purchases through DBS iBanking. For more information, you can visit DBS website.

Wednesday, January 7, 2009

Lim & Tan promotion

Just recently my online cash trading account with Lim & Tan was credited with $118. I am an NTUC union member and thus participated in the Lim & Tan NTUC Union promotion when I opened a trading account with them. The cash rebate is equivalent to having four free trades. In order to enjoy the cash rebate, you simply need to do four trades within six months of your account opening.

There is also an ongoing promotion called Member-Introduce-Member program (MIMP) by Lim & Tan. There are incentives for both the referral and new member upon successful opening of trading account. You can read more about this program from their website. If anyone is interested to open an account with them and wishes to have me as a referral, please do contact me. :)

Article was originally posted on 22 May 2008

Tuesday, January 6, 2009

8.88% rebate with CIMB-GK

If you see the above rates for SGX listed stocks, the new online rates shall be 0.25% or a minimum of $22.78 for SGD denominated stocks under this promotion. Comparing the 0.25% with other brokerages, there is nothing much to shout about actually but the minimum commission is on par with Citibank minimum of $22.

I hope CIMB-GK or the other brokerages can come out with more exciting promotions in future. As long as the promotion is attractive, the company will deserve my execution of trades. If not I will just stay with Lim & Tan for all my long term stocks purchases.

Tuesday, December 9, 2008

Review on CMC Markets

Basically CMC Markets is an online trading company which deals in Foreign Exchange (FX) CFD. CFD means Contract For Difference (CFD). Apart from foreign currencies, their account allow allows you trade a huge range of local and overseas stocks, market sectors, global indices and treasuries. For a full list of tradeable products, please click on the link.

I have always told myself if I want to do short term trading in stocks, it is advisable to trade through CFD because of the lower costs involved for a round trip of buy and sell. Moreover there are some important tools available with a CFD account like CMC Markets that most other traditional trading accounts don’t offer. The useful trading tools that I am talking about are risk management orders.

- Limit orders

- One Cancels the Other orders (OCO orders)

- If Done or Contingent orders (If Done orders)

- Good ‘Til Cancelled orders (GTC orders)

- Guaranteed Stop-loss orders (GSLO orders)

I don’t think I can go through explaining each type of orders but let me just touch on an OCO order. In my opinion this a very useful order that you can implement on your trades. It allows you to manage the risk and reward of your trades efficiently. For example, you see bullishness in a Stock XYZ and decided to go long at $1. You wish to take profit when the price reaches $1.20 and cut loss when the price reaches $0.90. Therefore you should do an OCO order for such a scenario without the need to monitor the market constantly after the OCO order is made.

In order to trade with CMC Markets, you have to install their award winning MarketMaker software into your computer. My computer is an AMD Athlon 2600+ with 512 MB of RAM. I find the Java built-in software a little bit CPU intensive on my hardware configurations and thus causing the software to slow down at times. I believe those computers with higher end configurations should not have any lag with the software. Nevertheless I really like the interface inside. The following picture is a screenshot inside the MarketMaker software.

What you see in the picture is a saved layout of my workspace in the software. You can customize your own layout, save and reload your favorite layout at any time in future. On the top left of the picture is a summary of cash balance in the account. Beside it are all the single pricing windows of some of the major currency pairs. The software has good charting features and you can view live charts of any counter down to a scale of one minute.

The other good thing about CMC Markets is the in-house educational courses. Regularly they will organize training courses for traders at absolutely free of charge. I think they are useful courses especially for those who wish to learn about technical analysis and foreign currency. For a list of trading courses, please click on the link.

In overall, I am impressed with their platform. I didn’t manage to touch many other aspects of CMC Markets like their mobile trading platform. But I hope this brief review can give you a rough guide of what they can offer. If you are interested, you may open a demo account with them and practice your trading skills at the same time. You don’t need a deposit to try out the demo account but you are given a virtual amount of cash to trade. Good luck.

Monday, September 1, 2008

CIMB-GK $1 commission

The promotion is applicable to new cash trading account opened with them from 16 August to 31 December. The S$1 commission is applicable to SGX trades executed during the same period.

Wednesday, August 6, 2008

Lim & Tan rewards comparison

Let me do a comparison on the two.

Lim & Tan reward points

The table below shows the commission rates for SGX trades in Singapore dollar. If you notice from the effective rates, there is a discount of 5% on all tiers of brokerage fees. Taking on the minimum brokerage fee of $25 for example, the discount is actually $1.25 (5% of $25).

| Contract Size SGD | Online Rates | Effective Rates After Reward Points |

| Up to $50,000 | 0.28% | 0.27% |

| > $50,000 - $100,000 | 0.22% | 0.21% |

| > $100,000 | 0.18% | 0.17% |

| Min. Brokerage | $25 | $23.75 |

NTUC Linkpoints

Now assuming you choose to receive in NTUC Linkpoints. For every $1 of brokerage fee you paid, you will earn 5 NTUC Linkpoints. Taking on the minimum brokerage fee of $25 again, you will earn 125 NTUC Linkpoints for the brokerage fee that you paid. Now bear in mind that the conversion rate of 150 NTUC Linkpoints is equivalent to $1. Therefore the effective discount is actually $0.83 only.

As you can see from the comparison above, it shows that Lim & Tan reward points worth more than the NTUC Linkpoints. I have decided to do a switch into receiving Lim & Tan reward points instead.

Monday, August 4, 2008

Redeem brokerage fees - Part 2

Lately due to bad market condition, trading volume over SGX has plummeted as investors or traders shun away from stocks and shares. On the other hand, banks do come up with promotions on their cash line facilities to encourage customers to trade or buy stocks.

Basically you need to pay your stock purchases using those banks’ cash line facilities, incur interest on debit balance at the end of the month and then your brokerage fees will be returned back. If you put sufficient amount into the cash line account in advance and pay from that account for stock purchases, your interest charged can be minimal. Therefore you can have a portion of your brokerage fees being redeemed.

Currently Citibank Ready Credit, DBS Cashline and UOB Cashplus are having these brokerage promotions. The last two banks are offering $25 cash rebates each month when you pay at least $3000 to brokerage firms. Your account must be in debit balance of any amount at the end of the month in which the trade is made. For DBS Cashline, you can earn additional $5 when you pay to DBS Vickers.

Among the three banks, Citibank Ready Credit promotion gives the highest amount of cash rebate. You can earn up to $120 cash rebate when you participate in their promotion. However the requirement is slightly different. You need to maintain an average daily debit balance of $1000 in your Ready Credit account.

Take note the minimum interest for both DBS Cashline and UOB Cashplus is at $5 while the minimum interest for Citibank Ready Credit is at $15. Therefore net of those interests, you can still earn some cash rebates from those promotions if you put sufficient funds into their cash line accounts in advance.

For more information, you may refer to the respective websites to read further.

Citibank Ready Credit Brokerage Promotion

DBS Cashline Brokerage Promotion

UOB Cashplus Brokerage Promotion

Below is a matrix table of participating brokerage firms for each bank cash line facilities.

| DBS Cashline | UOB Cashplus | Citibank Ready Credit | |

| DBS Vickers Securities Online (S) Pte Ltd | X | X | |

| DBS Vickers Securities Pte Ltd | X | X | |

| DMG & Partners Securities Pte Ltd | X | X | X |

| AmFraser Securities Pte Ltd | X | X | X |

| CIMB-GK Securities Pte Ltd | X | X | X |

| Kim Eng Securities Pte Ltd | X | X | X |

| Lim & Tan Securities (S) Pte Ltd | X | X | X |

| Philips Futures Pte Ltd | X | X | X |

| Philips Securities Pte Ltd | X | X | X |

| UOB Kay Hian Pte Ltd | X | X | |

| OCBC Securities Pte Ltd | X | ||

| Citibank Brokerage Services | X |

Monday, July 7, 2008

New contra period for Lim & Tan

Now clients have two extra days to make their stocks settlement when they transact through Lim & Tan platform. That is a piece of good news for contra traders.

The information was sent through email from my remisier. So please note that I couldn’t find the official announcement from their website though. Therefore it is advisable that you consult the dealer or remisier of your own account for confirmation. But my remisier did inform me that the policy applies to all clients.

Thursday, June 19, 2008

Lim & Tan offers mobile trading

Currently any mobile phones with Symbian operating system are supported to use Lim & Tan mobile trading software. Below is a list of mobile phones that are supported:

O2: XDA 2

Dopod: D810

Nokia: 3230 / 6280 / 6300 / E61 / N91

Palm: Treo 650

Sony Ericsson: K700i / K750i / K800i

Motorola: E398 / L6 / RAZR V3

I am surprised that my Sony Ericsson P1i is not listed in there. But in the guide, it is mentioned to choose a compatible phone if not listed. I shall do a test when I have an opportunity tomorrow.

To promote the launch of this mobile trading feature, Lim & Tan has given first 3 trades free of commission charges if executed before 29 Aug 2008. For more details, you can refer to Lim & Tan website.

Saturday, June 14, 2008

Unit share market with Lim & Tan

In case you do not know, let me explain what a unit share market is. Most of the time, investor buys shares in 1000 for most of the stocks like Capitaland. If there is a number behind a particular counter, that number represents the counter Board lot. For example, you buy or sell in 50 shares for Creative50 counter. If there is no number behind the particular counter that means by default the Board lot size is 1000. You buy or sell Board lot from the SGX Ready market.

However if you intend to buy or sell Odd lot of 900 Capitaland shares, you need to do so in the SGX Unit Share market. You can always call your trading representative or remisier to execute that for you or alternatively, you can do it online with POEMS or Lim & Tan.

An important point to take note is the commission charges. POEMS charges a minimum fee of $10 for trading in the unit share market while Lim & Tan charges the same fees like you trade in the ready market.

Wednesday, May 14, 2008

Enjoy 0% brokerage charge with Citibank Ready Credit

However you can enjoy a higher cash rebate of 0.5% on the settlement amount if you trade with Citibank. The minimum cash rebate is $10 and maximum cash rebate is $150. For more information, you can refer to Citibank Ready Credit Brokerage Promotion website. Below is a list of eligible brokerage firms.

CIMB-GK Securities Pte Ltd

DBS Vickers Securities Pte Ltd

DMG & Partners Securities Pte Ltd

Kim Eng Securities Pte Ltd

OCBC Securities Pte Ltd

Phillip Securities Pte Ltd

UOB Kay Hian Pte Ltd

Saturday, March 22, 2008

Brokerage comparison

Please do take note that these reviews may not be comprehensive enough as I don't really have a chance to make full use of them. I am writing based on my personal exploration and experience. I would appreciate if anyone can add on to their reviews. In the mean time, I will update this post if I can think of anything.

POEMS

About

Phillips' Online Electronic Mart System, or more commonly known as POEMS, is the pioneer for Singapore's online share trading. Established by Phillip Securities Pte Ltd in 1996, it has undergone tremendous changes since then to better fulfill your needs whilst harnessing the power of modern technology. The furious pace of change has meant that new products and services are continuously being evolved, with unsuitable products discarded whilst promising ones being improved upon. From the first generation of POEMS in 1.44 inch diskettes to the entire POEMS system being made available on the Internet, the idea is to allow you with better control of your own trades and be equipped with the essential tools to make a better investment decision. If you are our POEMS clients who have been with us since the beginning, we would like to thank you for your continuous support all this while and make POEMS what it is today. If you are not a POEMS client, do not hesitate any further and check out what POEMS can do for you now.

Screenshot

Pros

- I would say POEMS provides an almost complete solution for traders with a wide range of financial services offered like stocks and shares, unit trusts, CFD, futures, treasury bills, etc

- The only brokerage that gives investor an option in allowing their funds left in cash management account to be automatically invested in mmf yielding higher return

- It is one of the few brokerages that offers mobile trading using a handphone

- The only brokerage that gives access to SGX unit share market. You can sell your odd lot shares with POEMS

- The loading speed of this trading platform is very fast

- For new users, they may find difficulty to navigate around the not so friendly user interface. Even at times, I may get lost while navigating

- I find the rewards not that useful as you can only redeem trading or market related items. On top of redeeming with points, you still have to top up in cash for most of the items

DBS Vickers

About

DBS Vickers Online is committed to offering investors in Asia superior experiences in self-directed investing. DBS Vickers Online provides self-directed investors with a broad range of global investment services through multiple channels, including the Internet, call centres, and customer centres. Through us, customers can invest in stock markets in Singapore, Hong Kong, the United States and Canada as well as UK and B-shares listed on the Shanghai and Shenzhen Markets. They can also choose from a variety of investment products that may suit their different needs. In addition to equities, we offer fixed income products, mutual funds and unit trusts, as well as opportunities to participate in IPOs and IPO private placements. What's more, we provide customers with real time market information and professional tools and research to make informed and educated investment decisions. Our operations provide investors in both Singapore and Hong Kong with the local offerings that best meet their needs.

Screenshot

Pros

- The user interface is very nicely designed. You can easily navigate all the pages with minimal clicks

- I find Clarity a very comprehensive and useful tool to help investors in doing their stock research. You can do stocks screening with this tool based on your fundamental or technical input requirements

- You can view each counters complete historical financial data like balance sheet, income statements and cash flow in one page

- You can access to all DBS Vickers research reports on each counters if available

- There is also a nice charting tool. It is as good as you can get with any other professional charting software like chartnexus

- The loading speed of this trading platform is very crippling slow. It is the slowest among all brokerages that I reviewed

- Clarity tool is only available after SGX market closes

- Your money left in the trust fund yields very low return

Lim & Tan

About

Lim & Tan Securities Pte Ltd was incorporated in Singapore on 1 June 1973, commencing activity as a member of the Singapore Exchange (SGX) that year. Lim & Tan Securities main activity is stock broking and the main focus of the company is the retail market. Believing in providing cutting-edge technology to its clients, Lim & Tan Securities was amongst the first to introduce Internet Share Trading in Singapore in October 1998. In Jan 2000, Lim & Tan Securities is again proud to be amongst the first in Asia to introduce V.A.S.T., the Voice-Activated Stock Trading system. V.A.S.T. is positioned, not as a product on its own, but rather to complement internet share trading under its online trading brand name, limtan.com.sg.

Screenshot

Pros

- I like the reward system with this brokerage. You can choose whether to accept rewards in terms of NTUC linkpoints or their in-house points system. The former is more practical to me

- You have free access to Netresearch Asia, an established third party research company

- As a complement to online trading, you can trade through telephone with their V.A.S.T, an interactive voice response system

- Your money left in the trust fund yields very low return

- You need to inform your remisier or broker if you want to withdraw money from the trust funds

- On high resolution display, I find the buttons on the top right too small to click

About

In June 1987, Fraser was converted from a partnership into a corporate entity. The Company's name was changed to Fraser Roach & Co Pte Ltd and it became a wholly-owned subsidiary of Frasers International Pte. Ltd. (FIPL). In July 1991, Arab-Malaysian Merchant Bank Berhad(AMMB) bought a 49% stake in FIPL, thus making AMMB FIPL's largest single shareholder. Following this transaction, Fraser was renamed Fraser Securities Pte Ltd. The ownership structure changed in September 2006 when AMMB, restructured as AmInvestment Bank Berhad under the Amlnvestment Group, bought the remaining 51% stake in FIPL making the Company a wholly owned subsidiary. In July 2007, the Company’s name was changed to AmFraser Securities Pte. Ltd. As at 31 March 2007 AmFraser Securities has a capital base of S$46 million and is now a member of the AmInvestment Group Berhad, which has shareholders' funds of RM2.3 billion. The AmInvestment Group is ranked as the largest investment banking group in Malaysia with interest spanning from merchant banking, commercial banking, stockbroking, consumer finance to fund management. With effect from July 2007, Fraser Securities Pte Ltd will be renamed AmFraser Securities Pte. Ltd.

Screenshot

Pros

- The loading speed of this trading platform is very fast

- The user interface is newly designed and is quite user friendly

- You have free access to Dow Jones News

- When you trade, there is a "Good till date" instruction for your transaction

- There is no loyalty rewards at the moment but there is an online lucky draw conducted monthly

- You need to inform your remisier or broker if you want to withdraw money from the trust funds

- There is no shortcut function to list counters by the same initial of either A to Z

- Your money left in the trust fund yields very low return

Citibank

About

Not available from official website

Screenshot

Pros

- The user interface is very nicely designed. You can easily navigate all the pages with minimal clicks

- As your brokerage account is linked with Citibank internet banking, you can manage all your banking, investments and trading accounts with one convenient access

- When you trade, there is a "Good till date" instruction for your transaction

- You can instantly transfer money between cash trading and checking accounts

- You have free access to award winning Smith Barney Citigroup equity research

- It offers the lowest minimum commission at $22 for online trading

- There is no loyalty rewards

- There is no shortcut function to list counters by the same initial of either A to Z

- Your money left in the trading account yields very low return

The above are some of the pros and cons I can think of for these brokerages. I have been using POEMS since I started investing. Only recently I decided to switch to Lim & Tan because of the NTUC linkpoints. There is an ongoing promotion if you complete four transactions within six months, you earn $118 cash or 6000 linkpoints. You can see this for more detail.

I have also heard good reviews about Kim Eng trading platform. That shall be the next brokerage I intend to open an account with.

Friday, February 1, 2008

Redeem full brokerage fees

If you have a Standard Chartered XtraSaver account, use the nets card to settle your DBS credit card bill. As you can earn rebates of 0.5% on your nets transaction with XtraSaver card, it can effectively offset your brokerage fee which is at 0.27% of your trading amount. You can read more on XtraSaver account here.

Isn't that wonderful? Now it makes it more compelling for me to open an XtraSaver account. The only drawback is that you have to deposit $6000 into the XtraSaver account.

I would like to thank a Channelnewsasia forummer by the nick of Verbatin for highlighting to me on this kind of arrangement. Well I am sure there are some who have known this kind of payment method but I am sure there are many others who are not aware. So I hope this tip can give you a bit of cost savings while you are on your road to financial freedom by reducing costs of investment.

Friday, January 11, 2008

US shares - Custody fees

To my surprise, the consultant told me that I will be imposed a minimum custodian fees of US$5 regardless whether I am holding any US shares or not. Initially I thought the custodian fee is imposed only if I hold US shares but I was wrong. In other words, you need to pay custodian fees if you wish to see live US stock prices in Citibank even though you are not trading yet. So I decided not to open the USD trading account with them at the moment.

I believe the definition of custody fees is similar across all brokerages. As far as I know, DBS Vickers does not impose any custodian charges on US Shares. So for those who wish to see live US stocks prices but have no intention to trade yet, it is worthwhile to open a USD trading account with DBS Vickers.

Sunday, January 6, 2008

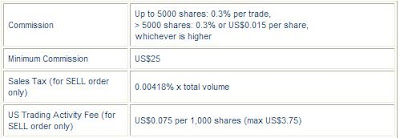

Brokerage charges - US

Note that if there is no charges, I would explicitly mention as no charge. Also some brokerages do not mention the other charges like custody, corporate interest and dividend interest charges from their respective websites, so I did not mention them. The information listed here serves as a rough guide to all the charges but you might need to refer to individual websites to know in greater detail.

I have uploaded the compilation into a word document. I would appreciate if anyone can complete the missing information. Click here to download.

Saturday, January 5, 2008

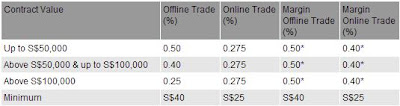

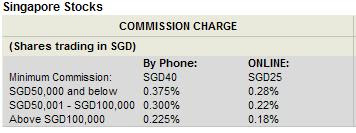

Brokerage charges - SG

The other common charges that include Clearing Fees, SGX Trading Access Fee and GST are at the bottom of the list.

Citibank

DBS Vickers (Non-advisory)

POEMS (SGD Settlement)

DMG & Partners

1. Clearing Fee of 0.04% charged by CDP on the contract value, subject to a maximum of S$600

2. SGX Trading Access Fee of 0.0075% charged by SGX on the contract value

3. Prevailing GST applies to the brokerage rates, CDP Clearing Fee and SGX Trading Access Fee

.JPG)

.JPG)

.JPG)

.JPG)

.JPG)

.JPG)