Nothing much to say for this boring month. Just Shell having some upward momentum.

Net Asset Value is slightly higher compared to last month due to slight movements in Asset Prices, particularly Shell Equity.

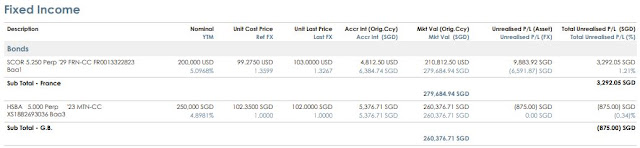

As mentioned in last month's blog post, Allianz 5.5% Perpetual Bond has been called and it will disappear from my portfolio at the end of March 2021 (along with a reduction of Investment Loans). The Portfolio Margin Ratio will come down to a comfortable level.

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.