Monday, August 10, 2020

Effective Annual Interest Rate Calculations

https://www.citibank.com.sg/loans/paylite/index.htm

$250 loan with upfront 2% service fee with 6 equal instalment payables.

On face value the EIR appears to be way lesser. However, it is way MORE! In fact, Citibank is correct to publish the EIR figure at 9.78%.

This is because this is a loan (like a car loan) where interest is being charged based on the ORIGINAL PRINCIPAL (what a crappy method right?).

Monday, September 28, 2009

Calculating stock returns

| Date | Cash Flows |

| 1-Jan-08 | $(1,000.00) |

| 31-Mar-08 | $25.00 |

| 30-Jun-08 | $25.00 |

| 30-Sep-08 | $25.00 |

| 31-Dec-08 | $25.00 |

| 31-Mar-09 | $25.00 |

| 30-Jun-09 | $25.00 |

| 30-Sep-09 | $25.00 |

| 31-Dec-09 | $25.00 |

| 31-Dec-09 | $1,000.00 |

| Return (per annum) | 10.38% |

In this example I am assuming that I buy a dividend paying stock worth $1000 on 1 Jan 2008 and I sell the same stock worth $1000 at the end of 2009. I assume also that this stock is priced at a constant of $1 and the stock pays out quarterly dividends of $0.025 per share. If you put those cash flows in Excel and use the XIRR function, the annualised return works out to be 10.38% per annum. Now my question is does this 10.38% per annum return include dividends reinvested or without dividends reinvested into account?

If you think the 10.38% per annum is the return without dividends reinvested, I am sorry to say that you got it wrong just like me in the beginning. The 10.38% per annum as computed by Excel XIRR gives a return assuming that you reinvest the dividends at the same rate of return. This is an important point that I wish to point out in this article. It is difficult to explain mathematically but let me present the same example in a different manner.

| Date | Stock Price | Dividends | New Shares from Dividends Reinvestment | Total Shares | Stock Value |

| 1-Jan-08 | $1.00 | $- | 0.00 | 1000.00 | $1,000.00 |

| 31-Mar-08 | $1.00 | $0.025 | 25.00 | 1025.00 | $1,025.00 |

| 30-Jun-08 | $1.00 | $0.025 | 25.63 | 1050.63 | $1,050.63 |

| 30-Sep-08 | $1.00 | $0.025 | 26.27 | 1076.89 | $1,076.89 |

| 31-Dec-08 | $1.00 | $0.025 | 26.92 | 1103.81 | $1,103.81 |

| 31-Mar-09 | $1.00 | $0.025 | 27.60 | 1131.41 | $1,131.41 |

| 30-Jun-09 | $1.00 | $0.025 | 28.29 | 1159.69 | $1,159.69 |

| 30-Sep-09 | $1.00 | $0.025 | 28.99 | 1188.69 | $1,188.69 |

| 31-Dec-09 | $1.00 | $0.025 | 29.72 | 1218.40 | $1,218.40 |

| Date | Cash Flows |

| 1-Jan-08 | $(1,000.00) |

| 31-Dec-09 | $1,218.40 |

| Return (per annum) | 10.38% |

All the numbers are exactly the same here except that new shares are included to give an easier illustration of a dividend reinvestment scheme. Since all dividends are reinvested, there are only two cash flows remaining which are the starting and ending values. The return works out to be 10.38% per annum for this case too!

At this point, you know that there are two methods of calculating returns with dividends reinvested. How about the return of a stock if you choose to hold or spend the dividends instead? It is important to know how to calculate since this scenario can be a more likely case for everyone too. Under this scenario, you simply add all dividends collected to your final stock value (ie $1000 + 8 dividend payouts).

| Date | Cash Flows |

| 1-Jan-08 | $(1,000.00) |

| 31-Dec-09 | $1,200.00 |

| Return (per annum) | 9.54% |

A few points that you need to take note. The last example shows the effect of return if you choose to spend or hold the dividends instead. It also means that you reinvest the dividends at a rate of return being equal to 0% per annum and rate of inflation is assumed to be 0% per annum. Of course in reality inflation rate is not 0% so you are better off spending it now than spending it later or holding the dividends in your hands. And lastly for this example, the overall return falls to 9.54% per annum if you choose not to reinvest the dividends. It is lower due to a lesser compounding effect.

Now I hope you have a better understanding in calculating the annualised returns of your stocks investments after taking into account the effect of dividend payouts. And your decision on the dividends received can affect your overall returns.

Friday, August 21, 2009

Calculating CPF interests

- Monthly interest earned is computed using the formula [Lowest balance in the month x interest rate per annum] ÷ 12 months

- Any contribution (including refund into your account) received at any time in a month will start earning interest in the following month

- CPF interest earned in the preceding year will be credited to CPF account before the 4th working day of January. For example the interest earned in 2009 will be reflected on 4 January 2010

Monday, February 2, 2009

Capital protected is NOT guaranteed

| Capital Protected | Capital Guaranteed | |

| Risk of Loss Upon Maturity | Yes | Generally No |

| Potential Returns | Higher | Lower |

The table above gives an overall picture of their differences. As everyone should know by now that risk and return go hand in hand. In order to achieve higher return, the product has to be more risky in nature. In short, a product which is capital guaranteed will have lower potential return than a product that is not guaranteed in capital ie a capital protected product, unit trust, endowment, etc.

But what does capital guaranteed fund means? MAS has provided some guidelines for capital guaranteed funds. Below are extractions of the guidelines:

2. Capital guaranteed funds are unit trusts that promise to return the full

principal invested, usually after a certain period of time or at particular

points of time.

3. Under the guidelines, every capital guaranteed

fund must have a qualified guarantor, which is usually a bank of sound financial

standing.

Therefore the keywords that you need to take note are return of full principal on maturity and the guarantee must be made by a bank of good standing. Even a 50% guarantee on principal is not considered a guaranteed fund.

Now what is a capital protected fund? First of all, you need to be aware that capital protected does not equate to a guarantee of capital. From the table, you can see that such funds may face risk of loss of capital upon maturity. In other words, there is no guarantee that you will get back your invested capital.

In a capital guaranteed fund, the principal is usually guaranteed by a third party guarantor. However in a capital protected fund, the principal is guaranteed by the issuer of the product itself. The capital protection in the fund may involve a variety of complicated instruments including Collaterised Debt Obligations (CDOs), debt securities, options, swaps, deposits, etc. Protection with a variety of instruments is supposed to limit the loss of the fund should there be any defaults in the securities. That is how the name protection comes about.

So in future, don’t take the impression that a capital protected product would not make you lose money upon maturity. Always think of risk and return that will definitely go hand in hand together. You can also think 2.5% risk free CPF rate as a benchmark. Any products that can offer better rate than that have some risks associated with it.

Thursday, January 29, 2009

CIMB bank time deposits

For the benefits of some fixed income lovers, I just would like to bring up a SGD time deposits promotion which was promoted by CIMB Bank quite some time back. Below is a summary of terms and conditions for the promotion.

- Minimum deposit of SGD10,000 up to a maximum of SGD1,000,000

- Promotion applies to both new and existing customers

- Rates are subject to change in line with prevailing market conditions

- Premature withdrawals are not entitled to published rates and interest payments will be calculated at the Bank’s discretion

- All Singapore and Foreign Currency deposits placed in banks licensed by MAS are guaranteed by the Singapore Government until 2010

Frankly speaking, I don’t quite understand the third term which states that rates are subjected to change. You need to check with the bank whether the rate is locked once you deposit your money inside. If the rate is not locked, that means the rate is not guaranteed!

Friday, January 9, 2009

Singapore Treasury Bills

SGS Treasury Bills (T-Bills) are short-term debt securities that are issued by the Singapore Government. The tenors for T-Bills range from 7 days to 1 year.

T-Bills are a useful and low risk investment tool that investors could take advantage of.

Why Invest in Treasury Bills?

Why leave the rest of the money in your savings deposits when you could earn higher interest investing in T-Bills? The current yield for a 3 month T-Bill is better than the local banks' savings rate.

T-Bills offer flexibility with no lock-in period; thus you will be able to liquidate your investment whenever you need the money. You can even choose to liquidate just part of it (in multiples of 1000 units).

While some fixed deposits might offer higher interest as a promotion, they usually require you to lock up your deposit for the entire tenure, and require a minimum investment of quite a significant sum. Unlike those, T-Bills only require a minimum investment of less than $1000. If you are unwilling to lock-up a huge chunk of your funds in fixed deposits, T-Bills could be suitable for you.

For equities investors, T-Bills could come in useful during occasions when you are standing on the sidelines and waiting for the next opportunity. Make your money work harder for you by parking your spare cash in T-Bills to earn some interest.

How do Treasury Bills work?

T-Bills have a fixed maturity date and have zero coupons. During the tenor, the owner of the T-Bills will not receive any interest payments. Instead, the T-Bills are sold at a discount and redeemed at par value upon maturity.

For example, if you purchase 1000 units of a 1-year T-Bill at a yield of 1% per annum, you will only need to pay $990 and you will receive $1000 upon maturity a year later.

Similarly for 1000 units of an 86-day T-Bill at a yield of 1% per annum, you will need to pay $998 and you will receive $1000 upon maturity 3 months later.

To find out more on Treasury Bills, visit our website, email dcm@phillip.com.sg or call 6531 1603.

Article extracted from Phillip Capital

Friday, December 19, 2008

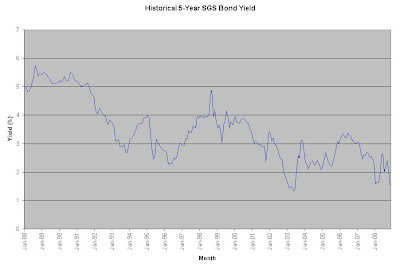

5-Year SGS bond yield

It is interesting to see how low the yield can go before investors decide that bonds are not attractive anymore to them. When that happens, more money will get pumped into equities. I say it will not be long before the 5-Year SGS bond yield to start reversing its trend. I really wonder why anyone would want to lock their money in SGS bonds for 5 years at such a miserable rate.

Sunday, November 9, 2008

Credit Default Swap (CDS)

Below is the definition of Credit Default Swap (CDS) as written by InvestorWords:

A specific kind of counterparty agreement which allows the transfer of third party credit risk from one party to the other. One party in the swap is a lender and faces credit risk from a third party, and the counterparty in the credit default swap agrees to insure this risk in exchange of regular periodic payments (essentially an insurance premium). If the third party defaults, the party providing insurance will have to purchase from the insured party the defaulted asset. In turn, the insurer pays the insured the remaining interest on the debt, as well as the principal.

The definition is quite long and complicated but it is actually easy to understand. Let me give a simple scenario relating to CDS. For example, John wants to borrow a sum of money from you and agrees to pay back the loan with interests at the end of a certain period. You wish to lend the money to John but you are afraid that John may go broke and you may not be able to receive back your capital. Therefore you will go to Insurance Company A and request for a CDS to insure against default of payment from John. Insurance Company A will assess credit rating of John and thus will charge you a premium for the insurance underwritten.

Well that’s roughly what CDS is all about. The interesting article that I was reading at the website of Bespoke Investment Group is about country default risk as measured by CDS prices. Guess which country came out top of the list? They are mostly the emerging countries and Argentina came out top.

Table courtesy of Bespoke

Monday, September 15, 2008

NTUC Thrift

I find their saving account currently giving out good interest at 2% per annum. While SIBOR is low and money market funds giving out lower interests, I am surprised NTUC Thrift can still give 2% per annum.

The last saving account that I have was Citibank Step-Up account which I managed to step-up till 2%. That account I need to wait patiently for 1 year to step up the interest rate but Thrift account starts off from 2% instead.

I read the FAQ section but did not manage to settle a few questions. Below are some questions which I wrote to NTUC Thrift.

Letter to NTUC Thrift

Hi,

1) May I know the historical yield of dividend payout for Subscription Capital Account?

2) Is the money in the Subscription Capital Account capital guaranteed?

3) I understand full redemption of Subscription Capital is allowed only upon cessation of membership. Which membership is this? Is it The NTUC union membership or thrift membership?

Thanks

Reply from NTUC Thrift

Dear Mr. Mike,

Thank you for your feedback.

The past few years dividend payout is as follow:

Yr Mar 2002/Apr 2003 - 2%

Yr Mar 2003/Apr 2004 - 0.5%

Yr Mar 2004/Apr 2005 - 4%

Yr Mar 2005/Apr 2006 - 5%

Yr Mar 2006/Apr 2007 - 5%

Yr Mar 2007/Apr 2008 - 0%

The money in Subscription Capital A/c is principal protected. If Thrift is not doing well, we are not required to have any dividend payout. For example, the financial year that just ended has no dividend payout because of "paper loss" Thrift suffered.

For every member, they need to open Subcription Capital A/c with a min deposit of $20. This $20 is refundable when a member cease membership with Thrift.

In case if you are not aware, you need to make a one time payment of $20 to NTUC Thrift when opening a Thrift membership. This money is so called your membership fee which will be contributed to your Subscription Capital account. You can potentially earn dividend payout from that account. You may deposit more funds into this capital account if you wish to.

If you don’t wish to contribute more into the capital account, you may make use of NTUC Thrift saving account, fixed deposits and loans to enjoy attractive rates.

Thursday, September 4, 2008

Maybank inflation rider structured deposit

I find the terms very simple to understand. The most basic rule of investment is NOT to invest in anything that you don’t understand. Now let us see what the benefits of this structured deposit are.

According to the website, the structured deposit is capital guaranteed. Thus you are assured to get back your principal at the end of the term. It is a short term investment that requires to be locked in for 21 months and the minimum payout is at 0.9% of your capital. It means if you were to put $10,000 then the payout at the end of the term can potentially be higher than $10,090 which works out to be at least 0.51% per annum.

Now on the upside, you are able to earn a maximum payout of 17.5%. Based on the $10,000 amount again, then your payout can potentially be $11,750 which works out to be 10% per annum.

Even though I really got no idea of how the money is invested as there is no information from the website, I consider this structured deposit to be low risk but gives the potential of earning higher returns. The key point in this structured deposit is the guarantee of capital.

Since the investment period is short, you can consider it as a 21-month fixed deposit with 0.51% returns per annum. Anything above is considered a bonus to you. Before putting your money in, it is good to check with Maybank to find out how your money is invested.

Tuesday, August 19, 2008

Understanding a balance sheet

Balance sheet is one of the three important financial statements that summarises a company Total Assets, Total Liabilities and Total Equity at a particular point of time. This point of time can be the last day of the financial year or quarter (ie 31 Dec 2007).

The fundamental balance sheet equation which consists of Total Assets, Total Liabilities and Total Equity can be expressed in the following equation:

Total Assets = Total Liabilities + Total Equity

For example if you have $500k worth of assets and out of which $200k is borrowed from the bank, therefore your asset is $500k and your liability is $200k. Total equity or your net worth in this example becomes $300k.

To elaborate further, the variables in the above equation can be broken down in the following expressions.

Total Assets = Current Assets + Non-Current Assets

Total Liabilities = Current Liabilities + Non-Current Liabilities

In the new expressions, current and non-current variables are added into the picture. Just note that current assets have a life span of one year or less. They include cash or anything that can be converted into cash easily. On the other hand, non-current assets are those that cannot be converted into cash within a year. They may also include intangible assets like goodwill and patents.

As for the liabilities portion, the same life span is applied to the variables. Current liabilities are those financial debts or repayments that need to be settled within a year while non-current liabilities are considered longer term debts that can be settled after one year.

Now let us relate the new equations to the earlier example. Lets assume that your loan of $200k is taken from separate banks and half of the loan need to be repaid within a year while the other half after one year. Assume that $400k of property value and $100k of cash make up your total assets. The balance sheet of this example may look like the following table:

What you see in the table above is a simplified example of a balance sheet. They may look similar if you see an actual balance sheet. I suggest that you look at Vicom’s balance sheet. It is one of the cleanest balance sheets that I can think of. For a start, if possible try to avoid balance sheets of financial companies. They may confuse you with their long list of debts and complicated structures.

After looking more into a company’s balance sheet, my confidence level and understanding improves further. There are many things that you can pick up from the balance sheet of a company but I think those concept requires a separate topic to explain.

Thursday, August 14, 2008

Average daily calculator

I have been monitoring these daily balances on an Excel spreadsheet. Every time I need to do a calculation for a new month, I need to rewrite the functions to calculate the average. Therefore I decided to automate and make life easier in future.

With this new spreadsheet, now I just need to enter the daily balances at end of day and the particular month I am interested to compute. So I don’t need to check how many days are there in that month and I don’t need to rewrite the average function again. The file is actually a very simple practice in excel but I thought of sharing it for the benefits of some people.

If you are interested, you may download this average daily calculator from the link.

Saturday, July 19, 2008

Why SIBOR is low

One reader came to ask me as to how SIBOR is affected. My answer to that question is the indirect relation to FED Funds rate in the US. I searched the internet on how the SIBOR is affected and the best source of explanation I can find is an article from Fundsupermart. You may want to read the whole article from the link I posted.

In a nutshell, some of the factors that may affect SIBOR are the following:

Level of liquidity (M2 Money Supply)

Strength of Singapore Dollar

Level of Inflation

The first factor is quite straight forward. If our country is flushed with excess liquidity, there is less incentive for banks to raise interest rate in order to attract investors. The second and third factors are directly related. We must understand that unlike in the US which makes use of Fed Funds rate to control growth and inflation, our country makes use of exchange rate to ensure price stability.

Due to high increase in the price of oil and commodities in the beginning of the year, MAS has allowed Singapore currency to appreciate in order to combat inflation. As our currency appreciates, it may have attracted more foreign investors to place their cash reserves in Singapore dollars. Thus the influx of monies may have caused liquidity here to increase further.

For a layman person, it may be difficult to understand the exact mechanism on how SIBOR changes in the short term. But if you look at the long term charts, you can see a close correlation between SIBOR and FED Funds rate except during the Asian Financial Crisis period in 1997. During that period, SIBOR had to be raised to induce greater liquidity in the financial market.

In my opinion, low SIBOR presents good opportunity for home owners to finance their mortgage at attractive rate. As the downside is already quite minimal, there is greater tendency for SIBOR to rise in future.

Monday, June 30, 2008

Convert absolute return to annual return

You can make use of Excel XIRR function to do the calculation by inputting the cash inflow and outflow with their respective dates. But for the above example, it is a straight forward calculation and it would be faster if you just make use of the calculator.

Let me just show the formula how you can calculate the annualised return. You may contact me if you are interested to know the derivation steps.

Let A be Annual return (A > 0. Put 0.3 for 30% return)

Let B be Absolute return (B > 0. Put 0.3 for 30% return)

Let Y be the number of Years

Therefore if you were to use the formula on the above example, the return will be 0.091 or 9.1% per annum.

The formula may come in handy especially when you do not have an access to a computer. All you need is just a simple scientific calculator. Even if I have an access to a computer, the computation is faster with a calculator than using Excel XIRR for this kind of example.

Wednesday, June 4, 2008

Investment, savings and annuity calculator

I frequently used the financial calculators available online to compute my final investment values based on a certain projected returns. However, there is a limitation on all the online calculators. To compute final value of investment or savings, all of them accept only inputs with regular payments or withdrawals. For example, while making monthly contributions to my investment, I want to make some withdrawals and at the same time calculate the final values, I won't be able to do that with those calculators. Probably I have not scanned the World Wide Web completely for such a calculator.

I believe the irregular payments or withdrawals can be computed via software. Alternatively, I can make use of the formulas in Excel to do the job. As such, I came up with a flexible and all in one investment, savings and annuity calculator. You may download this investment, savings and annuity calculator from the link that I posted. Below is a picture of how the calculator looks like in Excel.

I know I am not the first person to come up with such a calculator in Excel, but the completion of this calculator is considered an achievement to me, especially for a person who has a zero finance background just last year.

Saturday, April 5, 2008

Guide and understanding loan rate

The table below shows an illustration of how your monthly instalment will be for the various loan amount and tenure:

| Loan Amount = $5000 | Tenure | |||

| 24 months | 18 months | 12 months | 6 months | |

| Payment per month | $227 | $297 | $438 | $858 |

| Total payment at end of tenure | $5,448 | $5,346 | $5,256 | $5,148 |

| Loan Amount = $10000 | Tenure | |||

| 24 months | 18 months | 12 months | 6 months | |

| Payment per month | $454 | $594 | $875 | $1,717 |

| Total payment at end of tenure | $10,896 | $10,692 | $10,500 | $10,302 |

Now the question is what is the actual interest rate that you are incurring? In the first part of this article I am going to guide you on how to make use of excel RATE function. We shall take an example for a loan amount of $10000 and 24 months tenure of payment.

Step 1: Open a new excel worksheet and click on any cell. Then click fx -> select Financial in category box -> select RATE -> click OK

If you can't find XIRR function, do the following steps:

- On the Tools menu, click Add-Ins

- In the Add-Ins available list, select the Analysis ToolPak box, and then click OK

- If necessary, follow the instructions in the setup program

Step 2: When a function arguments window pops up, type the following values:

Nper = 24 -> since it is a 24-month instalment and you are paying monthly, this is the number of payment periods

Pmt = -454 -> monthly payment in negative because it is cash outflow

Pv = 10000 -> this is the loan amount taken

Fv = 0 -> you need to pay until the balance is 0

Type = 0 -> assuming payment is payable at the end of every month

Guess = 0.1 -> assuming rate is at 10%

Step 3: Computed result is shown as 0.00698 (you need to change format of cell) or 0.698% per period. In this example a period is one month. Therefore the actual or effective interest rate turns out to be 8.376% per annum.

As you can see from this example, a one time processing fee of 9% turns out to be at a rate of 8.376% per annum. No wonder the banks choose the former method to illustrate loan to consumers in order to make it more attractive.

I have computed a summary of interest rates for the rest of the loan amount and tenure in the table below. It is interesting to see that a shorter tenure actually resulted in a higher effective interest rate.

| Loan Amount = $5000 | Tenure | |||

| 24 months | 18 months | 12 months | 6 months | |

| Rate per month | 0.698% | 0.714% | 0.777% | 0.840% |

| Rate per annum | 8.378% | 8.568% | 9.320% | 10.078% |

| Loan Amount = $10000 | Tenure | |||

| 24 months | 18 months | 12 months | 6 months | |

| Rate per month | 0.698% | 0.714% | 0.759% | 0.857% |

| Rate per annum | 8.378% | 8.568% | 9.105% | 10.281% |

So I hope after reading this article, you will be better informed when dealing with loans in future. Most importantly you need to also calculate the actual or effective interest rate per annum and compare among the various options before deciding. So it is not fair to decide based on the total amount of payment at end of tenure alone.

Sunday, March 30, 2008

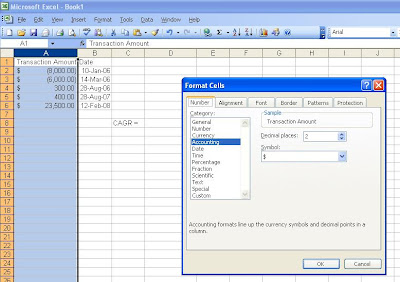

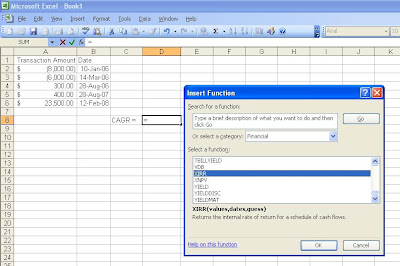

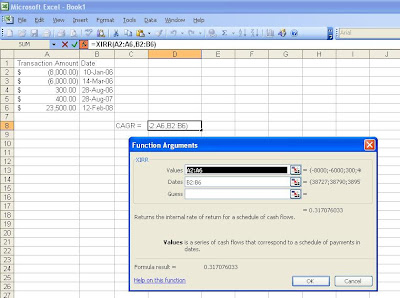

Guide using excel XIRR

- On the Tools menu, click Add-Ins

- In the Add-Ins available list, select the Analysis ToolPak box, and then click OK

- If necessary, follow the instructions in the setup program

Step 4: When a function arguments window pops up, type A2:A6 for Values and B2:B6 for Date. Then click OK

Step 5: Computed result of 0.317 will be shown on cell C8. To view the number as a percentage, click on cell D8 -> click Cells on the Format menu -> click the Number tab -> select Percentage in the Category box

Saturday, January 26, 2008

iSAVvy - e$aver comparison

iSAVvy account is offered by Maybank while e$aver account is offered by Standard Chartered. From the comparion, in terms of interest rate you can see that each bank targets a different group of savers. For amount below $5000, e$aver gives a much better rate while for amount higher than $5000 iSAVvy gives a much better rate. -> No longer true after iSAVvy revised rate wef from 4 Feb 2008

As for maintenance of account and in terms of fees, e$aver is the safest and cheapest compared to iSAVvy. A point to take note is that even though e$aver does not include an ATM card, you can still withdraw from ATM5 network if you have other Standard Chartered savings account that issues an ATM card.

The most important point to take note is those amounts deposited into either accounts are protected under the Deposit Insurance Scheme.

New rate updated on 2 Feb 2008

| iSAVvy | e$aver | |||

| Interest rate | Daily balance below S$5,000 | 0.25% p.a | Less than $50,000 | 0.80% p.a |

| Daily balance of S$5,000 to below S$50,000 | 1.08% p.a | $50,000 to $199,999 | 1.20% p.a | |

| Daily balance of S$50,000 and above | 1.28% p.a | $200,000 and above | 1.40% p.a | |

| Interest calculation | Calculated daily and credited monthly | Calculated daily and credited monthly | ||

| Passbook | No | No | ||

| Cheque book | No | No | ||

| ATM | ATM5 | No | ||

| Minimum initial deposit | $10 | $0 | ||

| Minimum average daily balance | $500 | $0 | ||

| Fall-below fee | $3 | $0 | ||

| Automatic account closure | If $0 for 30 days | If $0 for 5 consecutive months | ||

| Withdrawal service fee at branch | $15 | $5 | ||

| Deposit service fee at branch | $5 | $0 | ||

| Early account closure fee (within 6 months) | $30 | $0 | ||

| Number of branches in SG | 22 | 17 | ||

| Deposit Insurance Act 2005 | Protected | Protected | ||

Time value of money

Applying more to that concept, for example it is a better choice to receive a lump sum of $400 than to receive $100 in 4 different payouts. However the opposite analogy should apply for payment. Preferably it is better to defer payment as long as possible than to pay a lump sum amount now.

While investing, many times you will encounter the need to calculate that illusionary future figure of the amount you invested now. For example, if you are to invest a lump sum of $1000 at an interest rate of 6% annually, what is the investment amount after 5 years assuming the interest is compounded annually? Before I show the calculation for this example, let me just explain the definition of Future Value (FV) and Present Value (PV) first.

FV is the amount of money that an investment (the PV) made today will grow at a future date. Since money has time value, FV is greater than PV.

PV is an amount today that is equivalent to a future amount (the FV) discounted by an interest rate. Since money has time value, PV is less than the FV.

The relationship between FV and PV can be expressed as:

FV = PV (1 + i)^n

where i = interest rate per period

n = number of compounding periods

So back to the example that I quoted above, you can calculate the FV to be:

FV = $1000 (1 + 0.06)^ 5 = $1338.23

Now let us see what happens when the interest is compounded monthly. Since the annual interest rate is 6%, therefore its monthly interest rate or interest rate per period will be 0.5%. The number of compounding periods will be 60 in this case.

FV = $1000 (1 + 0.005)^60 = $1348.85

You can see the difference in FV for an investment that is compounded monthly and yearly. Therefore when looking into loans or investments, one of the important factor to consider before making a decision is the type of interest rate. I hope from the examples above you can have a better understanding of TVM.

Saturday, January 19, 2008

Citibank step-up interest account

As previously every month I credited my salary into POSB and all my transactions have been with POSB since I was young, I was a bit reluctant to switch to Citibank. After giving much of a thought, I decided to switch. Now almost 1 year and 1 month later, I am glad that I have made the decision to switch. After persevering for a year, I manage to earn 12 steps of higher interest rate and now my savings account is on the maximum of 2% interest rate per annum.

This account has disciplined me to save every month because if I fail to save, my base interest rate will be reset to 0.6875% per annum. So at the end of every month I am motivated to keep part of my salary in the savings account as I planned to use the accumulated savings for my new house needs in 3 years time.

However I still do maintain my first savings account with POSB till now which I opened since childhood. I consider my POSB account a temporary savings account as that is the account that holds my whole month pre-budgeted expenditures including all my giro transactions.

At the end of every month a fix part of my salary goes into Citibank while the remaining balance is transferred into POSB. I must say that the particular day at the end of the month, when I transfer my money from Citibank into POSB is one of the happiest moments in my life as I get to see my savings grow and interest compounded monthly in Citibank statement.

Now my worry is with interest rate dropping everywhere and Citigroup suffering billions of losses from sub prime issue in the US, can their Step-Up Interest Account continues to offer me at 2% interest rate per annum? Only time will tell.