Monday, June 1, 2009

Exchange Pasori card reader

According to EZlink, the new ACR 122 reader will be available for sale in July 2009. But if you are currently holding the Sony Pasori card reader, you can try your luck and register for a free exchange of a new card reader. You can visit the following EZlink website to register for the exchange.

Thanks to Verbatin for the update!

Friday, February 27, 2009

Ezlink is not error free

Since I bought a Sony Pasori card reader, I always top up my ezlink at home. The card reader not only giving me a convenience of topping up ezlink at home, it also allows me to check a limited number of past transactions for any ezlink. In other words, I can counter check whether my transportation fares are correctly deducted.

I did not expect to have any error in the fare deductions not until recently. After doing a top up for my wife’s ezlink, I went to check the card transaction details. Then I noticed there was a double deduction in one of her fares. The weird thing there was two minutes plus gap in the deductions. Even if she had made a double tap, why was there a gap in timing between the taps? Of course it was not possible for her to alight and board the same bus.

Upon checking with a TransitLink ticketing officer, there was indeed an error. I pity those commuters who are wrongly charged but got no way of finding it out. I suggest keeping track of the ezlink balance or to check its transaction details to be certain.

Thursday, February 12, 2009

Rebates calculator for credit cards

During a crisis like now, I know more and more people are aware about the needs to reduce expenses. However no matter how much expenses you try to lower, you do still need to pay basic necessities like bills, groceries and cost of transportations. But with credit card payments, you can squeeze more savings out of those expenses.

There are many popular cash rebate credit cards in the market. To name the popular ones, they are the Citibank SMRT and Dividend cards, UOB One, POSB Everyday and Standard Chartered Manhattan cards. Depending on your spending habit, different combination of credit cards used can yield different amount of savings. As for me, I try to consolidate all my expenses which include bills, groceries and ezlink transactions to UOB One card. All my expenses add up nicely to about $300 or more each month.

If you have bigger expenses you may try to use different combination of credit cards to optimize your savings. Take note, I mention the word optimize in the previous line. In order to achieve optimization in savings, it is advisable that you PLAN your expenses before hand.

To help in the optimization process, I have created my first version of Rebates calculator for credit cards. In the excel file, you can try to forecast or plan your expenses to be charged under various credit cards. Your objective is to achieve the highest effective rebates in percentage based on your spending inputs. A higher effective cash rebate simply means you can achieve more savings with those combinations. I post below a screenshot of my excel file.

Take note my Rebates calculator for credit cards is still in its raw stage. I believe further improvements can be made if I receive feedback or gather enough interest and support from multiple users. So try it out!

Thursday, January 1, 2009

Reward points or cash rebates

It is certainly a good thing of the author to come out with the input and output equation thing. But I feel the author fail to address the relationship between the input and output. Usually in an investment, you always find the return of your investment in order to do a comparison. So similarly, you should do the same for credit cards. At what expense of inputs will you get the outputs which are the vouchers or cash rebates? Therefore you need to calculate the conversion rate to compare.

It is quite straight forward to calculate for cash rebate credit cards. With the best cards in the market, you can easily earn a maximum of 3.33% or 5% cash rebates using UOB One or SCB Manhattan credit cards. Now what is the conversion rate of a reward or point based credit card?

Take for example, the author mentioned about Citi Clear Platinum credit card. This credit card rewards card holder in terms of Citi Dollars. In case you do not know, 1 Citi Dollar is awarded for every $5 spent. I dig through the latest rewards catalogue from Citibank and let me show the conversion rate of a particular voucher. You can exchange for a $5 voucher from Popular Bookstore with 260 Citi Dollars. In order to obtain 260 Citi Dollars, which means you have to spend $1300 with this card. The conversion rate is simply 0.38% ($5 / $1300). But I know you can earn up to 5X rewards from a particular merchant as advertised by the banks. But that will only bring up the conversion rate to 1.92% (0.38% x 5). And how frequent do you go to the particular merchant to earn the Citi Dollars? Do you shop at Tangs or Popular Bookstore diligently in a month like you diligently need to pay for your bills?

You can calculate the conversion rate of the other vouchers for Citi Dollars and I can bet those rates will be more or less around 0.38% or 1.92% (for extra rewards). Let me show the conversion rate of another bank like OCBC.

For OCBC, the bank uses OCBC$ as rewards and you can earn 1 OCBC$ for every $1 charged to your OCBC credit card. The OCBC$ has about 1.5 years validity period and it is logical that if your expiry is shorter, the conversion tends to get better as bank wants you to spend more in the same period. Let us see a typical conversion rate for OCBC. Using the same example as Popular Bookstore, you can exchange for a $20 voucher with 4100 OCBC$. That means the conversion rate is at 0.49% slightly better than Citi Clear Platinum excluding the extra rewards.

Therefore you can see that the conversion rates are usually low compared to the percentage rebates given by some of the best all rounder cash rebates credit cards like UOB One and SCB Manhattan. All rounder means you can pay for any transactions including bills as long as the merchants accept credit cards.

There are some other reasons why rewards or points are not the right way to go. You may tend to spend more or extra while aiming for a particular point or reward. This habit can erode your conversion rate. The author do mention about Miles too. Obviously Miles are not suitable for the low spender as you may need to spend many years just to redeem your air flight ticket. I did not do a conversion rate exercise for Miles but logically even no matter how good the rate is, the effective rate will get diluted as you need to spend more in overseas if you don’t need the traveling. Unless you really need to travel, the Miles is not so useful in my opinion.

Despite the above criticisms, I do agree with the author mentioning that good cards usually expire after a year or two. For example, Citi Dividend used to be the best cash rebate credit card but who cares to use it now if you can enjoy UOB One or SCB Manhattan which have much relax requirements and reasonable conversion rates. In short, consumers always have to keep a look out for any possible replacement of the cards that I recommended.

Friday, December 19, 2008

Login problem with Maybank IB

However to my disappointment, I have to spend almost the whole day troubleshooting my failed IB login. Maybank just don’t allow me to login as the input boxes are grayed out. You simply can’t type anything to continue the login.

My current browser is IE 7.0 and at the first time of login, my java was installed with JRE version 1.6 update 10. I have installed the latest JRE version 1.6 update 11 but still it does not work! I called the customer support and the standared advices given are already done by me. The customer support told me that the latest version 1.6 update 11 should work and suggested me to reinstall again. I almost giving up Maybank as reinstallation does not work too.

I am confident that there shouldn’t be any problem with my computer as I have never encountered such login problems with other banks. On the last attempt, I decided to install an older JRE version 1.6 update 7. Finally it works!

Luckily after going through those frustrations, I checked that $100 was credited into my account. So if ever you have login problem with Maybank IB under IE 7.0, I suggest you install version 1.6 update 7 or older. I think Maybank IB may not be supported on the latest Java version and I hope they fix this problem soon.

Thursday, November 27, 2008

Cards in my wallet now

I decided to make some changes and have chosen the following cards for my future transactions. These are the only cards apart from the ATM cards that make way into my wallet.

| Credit/Debit Card | Usage | Cash Rebates | Remarks |

| UOB One | Ezlink and phone, cable, internet bills | 3.33% | based on $30 per quarter rebate for $300 monthly spending |

| SCB Xtrasaver | Ezlink and miscellaneous | 2% | |

| OCBC FairPrice Plus | NTUC FairPrice | 1.33% (effective) | based on $1 spent = 2 linkpoints and 150 linkpoints conversion = $1 |

| Maybank Family & Friends | NTUC FairPrice Xtra | 5% |

My monthly total expenses are around $300 to $500. Therefore I have consolidated all of my bills to be charged under UOB One credit card. Since I have a Sony Pasori card reader, I manage to achieve exactly close but above $300 of bills for UOB One. My ezlink expenses are either charged under UOB One or Standard Chartered Xtrasaver cards. Therefore I am more flexible in achieving that minimum $300 goal. Only by this way, I am able to maximize the rebates from UOB One credit card.

I buy most of my groceries and household items from NTUC store that is nearby my house. My parents have higher expenses than me so all this while they have been holding on to my NTUC membership card to be scanned for Linkpoints. That is why previously I am not able to earn Linkpoints when I shop at NTUC store. Now I intend to use the OCBC FairPrice credit card to pay for my future marketing stuffs. But whenever I pass by NTUC Xtra, I intend to use the Maybank Family & Friends credit card which gives a higher rebate.

At the moment, I am happy with such combination of cards. Until I find a better combination, I will stick to such arrangement for now. If you have better suggestions, please do share your thoughts.

Monday, November 17, 2008

Overseas credit card transaction

Last week when I was in Malaysia, I decided to make purchases using four different credit cards on the same day. I purchased four different items and was curious to find out how much do these items cost in SGD. Later I will highlight those transactions and see if we can make any conclusions among the various credit cards. But now, let me share some of the information that I have gathered from the internet regarding foreign credit card transactions that we can take note of.

- On the banks credit card statement, there are transaction and posting dates. Transaction date is the date when you make your purchase while posting date is the date that the conversion or exchange rate is based on. But if there is only one date on the statement, you need to check with the banks, what that date refers to.

- Exchange rate losses are incurred to pay fee to the Card Association (ie MasterCard, Visa, etc) and admin fee to pay to the bank. For Visa, you can check their currency exchange rate from the link that I provided. As for the bank admin fee, it is usually about 1 to 2%. Let me show an example of a fictitious purchase to understand how the conversion is to be reflected on your statement.

a) Assuming you purchase an item worth USD$100 in overseas on 16 Nov. Assuming posting date is same as transaction date which may not necessarily be the same for all cases

b) From Visa currency exchange rate website, the rate as published on 16 Nov was 1USD:1.52SGD

c) Assuming bank admin fee is 1.5%, total amount to be reflected on your statement = (USD$100 * 1.52) + 1.5% = SGD$154.28

As far as I know, only Maybank charges an admin fee of 1% while most of the other banks that I checked charge a fee of 1.5% for MasterCard or Visa. For DBS AMEX, there is an admin fee of 2% imposed by the bank.

There isn’t any publication by MasterCard on their currency exchange rates. Therefore it is difficult to compare which one actually gives a better rate. But let us look at the following transactions made by me when I was in Malaysia.

| Item | Credit Card | Card Association | Transaction Date | Posting Date | SGD Amount | MYR Amount | Effective Exchange Rate |

| 1 | POSB Everyday | MasterCard | 12-Nov-08 | 13-Nov-08 | $22.03 | $51.20 | 2.32410 |

| 2 | Citibank M1 | Visa | 12-Nov-08 | - | $34.11 | $79.00 | 2.31604 |

| 3 | SCB Xtrasaver | MasterCard | 12-Nov-08 | 14-Nov-08 | $3.84 | $9.00 | 2.34375 |

| 4 | UOB One | Visa | 12-Nov-08 | 13-Nov-08 | $13.72 | $31.80 | 2.31778 |

| www.oanda.com | www.x-rates.com | |

| 12-Nov-08 | 2.40210 | 2.38143 |

| 13-Nov-08 | 2.39810 | 2.36801 |

| 14-Nov-08 | 2.37550 | 2.36468 |

There are a few conclusions that I think I can deduce from the table. It seems that MasterCard offers a better rate than Visa as the bank admin fee is the same for all credit cards (except for Xtrasaver which I did not find out). As for the Xtrasaver card, despite posting two days later when the official exchange rate is actually lower, it was reflected with a better rate in my credit card statement. I believe the bank admin fee for a debit card is lower than a credit card.

Take note the conclusions I have above may not be conclusive enough as I did not really do an exhaustive comparison among other banks or card associations. But I hope you have some idea on what the charges are when doing overseas transactions.

Friday, October 17, 2008

Making small but easy money

Now I am glad to say that I am at least a few hundred bucks richer every month from this blog. Take note the headline of this post. It reads small but easy money. I dare to say no risk at all as I am confident of what I am doing. Surely some people can make big money but of course with substantial risks at stake.

Some people are afraid to hold multiple cards and to sign up for personal lines of credit as they think they may spend more. The notion is not true if you know how to make good use of them to earn maximum rewards. Take for example the article which I posted on redeeming brokerage fees. If you are smart enough, you don’t even need to buy any shares but you can still earn from the rebates.

In this small community, we discuss on how to earn money through credit card promotions and such. I wouldn’t want to replace the word such with loopholes as all of them are legal acts that you can carry out.

Most of the tips and tricks are already posted in the articles of this blog. I don't think I need to mention again on the benefits as you can read them for yourselves. You may also want to read through the comments to find out more. As certain things are better not published to the public, we tend to discuss in the CBOX chat instead to keep a low profile on those tips and tricks.

The CBOX chat that you see at the top of this blog is a paid service subscribed by me. So I hope fellow visitors can utilise on its features. If you are new, please join the discussion and share anything you think that can be monetarily rewarding to all of us. A golden rule of being financially healthy is maximising source of income and minimising spending. Therefore only through sharing and learning, we can improve that financial standing.

Wednesday, September 24, 2008

Paying advance bills with Manhattan card (Revised)

Take note you need to spend at least $3001 in a month to qualify for the 5% rebates which will be credited 1 month after that quarter. For various bill sizes, I want to compute the cash values at the end of the year by paying in advance with Manhattan credit card and by making normal payment like Xtrasaver card for various bill sizes.

I created four scenarios with monthly bill sizes of $2000, $1000, $800 and $600. Under each scenario, two options of payment are used. They are payment using Manhattan and Xtrasaver cards.

I made a few assumptions to simplify my calculation.

2) Minimum monthly spending of $3000 instead of $3001 is used to qualify for Manhattan 5% cash rebates

3) Cash rebates are credited at the end of the quarter for Manhattan credit card

Scenario A

Monthly Bills = $2,000

Quarterly Bills = $6,000

Annually Bills = $24,000

Peter and Sam keep aside $6000 for bills every quarter

Remaining money are kept in bank with interest of 1.2% per annum

Scenario B

Monthly Bills = $1,000

Quarterly Bills = $3,000

Annually Bills = $12,000

Peter and Sam keep aside $3000 for bills every quarter

Remaining money are kept in bank with interest of 1.2% per annum

Scenario C

Monthly Bills = $800

Quarterly Bills = $2,400

Annually Bills = $9,600

Peter and Sam keep aside $10000 at the beginnning of the year for bills

Remaining money are kept in bank with interest of 1.2% per annum

Scenario D

Monthly Bills = $600

Quarterly Bills = $1,800

Annually Bills = $7,200

Peter and Sam keep aside $8000 at the beginnning of the year for bills

Remaining money are kept in bank with interest of 1.2% per annum

From all the above scenarios, the conclusion is a no brainer suggestion to use Manhattan credit card if you really have a huge chunk of bills to settle off. You can see a big difference in the remaining amount of money kept in the bank or money market funds at the end of the year if you choose this option.

I did not try to compute under other scenarios where the monthly bills get smaller than $600 though. You may try similar calculation yourself to see whether you are better off to pay in advance to earn that 5% rebates. The only drawback of choosing Manhattan credit card to pay for your bill is that you need to go down to the billing organisation to pay instead of setting up a recurring standing instruction to charge under Manhattan credit card. This is because the rebates is entitled only for retail spending.

In conclusion, it is not true that Manhattan credit card is beneficial only for spending on big tickets but it is also beneficial for those who have huge combined household bills. It can really help to save your bills annually.

Tuesday, September 2, 2008

Letter to EZlink regarding Sony Pasori

Letter to EZlink

Subject: Sony Pasori card reader

Message: I am utterly disappointed in hearing that the current EZlink card will soon phase out. The news came out few days after I bought the Sony Pasori card reader which was advertised at a discount at EZlink main website.

I am surprised to hear the new multi platform EZlink card is not readable by Sony Pasori card reader. If only I know of the news in advance, I would not have bought the reader earlier. In other words, I have bought a reader which will become obsolete soon.

I felt cheated as there isn’t any warning to inform buyers in advance of the unusability of the new card on Sony Pasori card reader. Therefore I hope EZlink can come out with an exchange or upgrade scheme to accept the old card reader as trade in for a new card reader. Please understand the customers concern especially those who just bought it recently. Thanks

Reply from EZlink

Dear Mike,

Thank you for your email.

Though the current readers are design to support the current ez-link cards only, we are working with the vendor, SONY to see to the upgrade of the readers to accept the new ez-link CEPAS Compliant ez-link cards. Please be assured that we will inform you again with more details once available.

We value every feedback as we aim to continually enhance our services to increase the satisfaction level of our users. Do keep the feedbacks / suggestions coming in as we constantly seek to meet the changing needs of the consumer markets.

If you have further queries, please feel free to email us at enquiries@ezlink.com.sg or call our Customer Service Hotline at 6496 8300 between 8.00am to 6.00pm daily except public holidays. In case you need to call outside these hours, you could leave a voicemail with us and we will get back to you by the next working day.

Saturday, August 16, 2008

Sony Pasori card reader

Previously my ezlink is linked to my UOB One card. I choose the maximum top-up of $50 and incur a convenience fee of $0.25 for each auto top-up. As of now, topping-up of ezlink online is free of charge. Thus I just need to make at least 156 top-up transactions to break even with the cost of the Sony Pasori card reader.

There are a few advantages of having the card reader at home. First of all is the waiver of the convenience fee. Even though the waiver may be temporary, I believe it is still worthy to have one in the house for the benefits of my family members.

With the reader, I can control the amount of top-up or balance in the ezlink card. It gives me the flexibility to charge under other credit cards should I already meet the minimum spending of $300 on my UOB One card. Now I no longer need to bring an ezlink with balance of up to $50 since the minimum amount for each top-up transaction is $10 if I do it online.

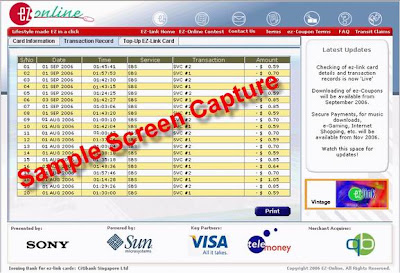

The other advantage is the ability to download the latest 20 transaction records of any ezlink card. Previously I really got no idea on how much is deducted for each tap unless I pay attention on the screen. From EZ-Oline website, I am now able to check for discrepancies in the transportation fares if there are any. You can see a sample screenshot of this feature from the picture below.

Since multiple top-up transactions can be done and if you are hardcore Singapore Pools fanatic, this card may come in handy for you. I am not sure of the maximum balance allowed for an ezlink, now you can effectively pay Singapore Pools using your credit card.

Installation of the Sony Pasori card reader is a breeze. Run the setup file from the cd provided, reboot your pc, plug in your reader to a free usb port and you are ready to experience the life of becoming a transitlink ticket officer. Don’t forget that you need to be connected to the internet to utilise the EZ-Online features.

Monday, August 4, 2008

Redeem brokerage fees - Part 2

Lately due to bad market condition, trading volume over SGX has plummeted as investors or traders shun away from stocks and shares. On the other hand, banks do come up with promotions on their cash line facilities to encourage customers to trade or buy stocks.

Basically you need to pay your stock purchases using those banks’ cash line facilities, incur interest on debit balance at the end of the month and then your brokerage fees will be returned back. If you put sufficient amount into the cash line account in advance and pay from that account for stock purchases, your interest charged can be minimal. Therefore you can have a portion of your brokerage fees being redeemed.

Currently Citibank Ready Credit, DBS Cashline and UOB Cashplus are having these brokerage promotions. The last two banks are offering $25 cash rebates each month when you pay at least $3000 to brokerage firms. Your account must be in debit balance of any amount at the end of the month in which the trade is made. For DBS Cashline, you can earn additional $5 when you pay to DBS Vickers.

Among the three banks, Citibank Ready Credit promotion gives the highest amount of cash rebate. You can earn up to $120 cash rebate when you participate in their promotion. However the requirement is slightly different. You need to maintain an average daily debit balance of $1000 in your Ready Credit account.

Take note the minimum interest for both DBS Cashline and UOB Cashplus is at $5 while the minimum interest for Citibank Ready Credit is at $15. Therefore net of those interests, you can still earn some cash rebates from those promotions if you put sufficient funds into their cash line accounts in advance.

For more information, you may refer to the respective websites to read further.

Citibank Ready Credit Brokerage Promotion

DBS Cashline Brokerage Promotion

UOB Cashplus Brokerage Promotion

Below is a matrix table of participating brokerage firms for each bank cash line facilities.

| DBS Cashline | UOB Cashplus | Citibank Ready Credit | |

| DBS Vickers Securities Online (S) Pte Ltd | X | X | |

| DBS Vickers Securities Pte Ltd | X | X | |

| DMG & Partners Securities Pte Ltd | X | X | X |

| AmFraser Securities Pte Ltd | X | X | X |

| CIMB-GK Securities Pte Ltd | X | X | X |

| Kim Eng Securities Pte Ltd | X | X | X |

| Lim & Tan Securities (S) Pte Ltd | X | X | X |

| Philips Futures Pte Ltd | X | X | X |

| Philips Securities Pte Ltd | X | X | X |

| UOB Kay Hian Pte Ltd | X | X | |

| OCBC Securities Pte Ltd | X | ||

| Citibank Brokerage Services | X |

Wednesday, July 23, 2008

SCB credit card funds transfer

Again as usual, different banks may have different one time processing fee and structure of payment. It is important to note that you can’t judge how cheap the rate from the processing fee alone. To be accurate, you need to list down the cash inflow and outflow; and then compute the rate using Excel XIRR. Then you can compare how cheap from the computed rate.

Below are examples of how the loans work and illustrations of how the effective annual rates are computed in Excel. SCB offers a 12-month and 24-month repayment periods for balance transfer.

Monday, July 21, 2008

DBS credit card funds transfer

Thanks to a fellow visitor of this blog Kurt who introduced to me DBS credit card funds transfer. Take note the offer is valid till 31 July 2008.

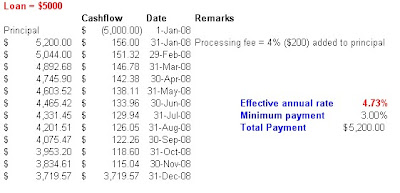

I did work out the effective rate per annum and to my surprise, it is only at 4.73%. I think that is the lowest rate I have ever seen so far?! As I am not really a credit card borrower, pardon me if I am wrong.

The rate seems to be very attractive for a 12-month repayment period; so I thought of sharing this piece of information. Below are an example of how the loan works and an illustration of how the effective annual rate is computed in Excel.

Loan = $5000

Repayment period = 12 months

Administration fee of 4% = $200

Wednesday, June 18, 2008

0% credit card instalment

The attractive thing is these hire purchase plans are marketed at 0% interest. But only God knows how much extra they have added to the selling price to compensate for the hire purchase payment.

The other group of people who prefers to be debt free would argue that you can get the same items cheaper when you go down to neighbourhood shops by making full cash payment. I would agree with that.

But as a savvy individual, I like to apply the concept of Time Value of Money (TVM). If I have the incentives to hold the cash in hands, why should I make full payment even if I have the money? By paying instalment, I can always put the remaining cash in some investments to generate me an income.

Therefore if you were to apply the TVM concept, the present value of all future instalment payments made can become cheaper than you pay in cash.

For example if you are given options to buy an item at $6000 in cash or pay in twelve monthly payments of $500, which option is cheaper? It is a no brainer that the latter is attractive. Even the money you put in savings bank can generate you some interest.

Now for example an item to pay in cash costs $6800. If you choose a 36 months instalment plan, you need to pay $200 monthly. So which option is cheaper in this case? To be exact, it all depends on the Internal Rate of Return (IRR) that you can achieve with the cash you hold in hands. The higher the IRR, the lower is the actual cost if you pay by instalment. Let me show how you can calculate the actual cost and compare the two options.

For simplicity sake, I will choose an IRR of 2.84% per annum because that is the current yield of a risk free SGS bond maturing in five years. You can be more conservative or aggressive in your calculation by choosing a different IRR.

Assuming you purchase the item in the beginning of the month and make the first payment at the end of the same month, the present value of all future payments turns out to be about $6900. It is expensive by $100 if you pay by instalment.

Don’t forget if you buy from the bigger stores, you are may be entitled to an extended warranty coverage on your product which the smaller stores won’t be able to offer. And also do consider the benefits of rewards or points awarded when you transact using credit cards. Therefore you need to weigh the pros and cons to decide which option is better.

Saturday, May 17, 2008

Citibank Ready Credit ATM promotion

On top of the cash rebates mentioned above, you can receive an additional S$20 cash rebate if the ATM ID stated on your ATM slip displays the digit combinations X20X or XX20. For further information, you can read at Citibank website.

I appreciate if you can share your findings of the different ATM ID in the comments. Good Luck!

Wednesday, May 14, 2008

Most effective method to increase credit limit

Previously my request to increase the credit limit was rejected when I submitted the request together with my monthly pay slip.

One day I met a nice credit card consultant who came in my company during one of the POSB/DBS credit card road shows. I asked him to why my request was rejected. He explained to me the best supporting document is the IRAS statement. Adhering to what he said and as soon as I received the latest IRAS statement, I requested a credit limit increase and sent together with the statement as a supporting document.

To my surprise, I just checked my account and the limit was indeed raised by 60%! Now I can potentially earn more interest with the higher credit limit.

Thursday, May 1, 2008

Pay Singapore Pools with credit card

If you read my previous article on the benefits of EZ-Link with UOB One card, you can see that payment by EZ-Link is accepted at the Singapore Pools branches. So that is a useful feature you can take advantage of.

But first of all you need to link your EZ-Link to a Visa credit card by setting up an auto top-up instruction. You can refer to EZ-Link website on how to set it up. Important point to take note is that the maximum top-up is only at $50. There are also convenience fees of $0.02 for each EZ-Link payment and $0.25 for each EZ-Link auto top-up.

The other point to note also is you can only pay your bets by EZ-Link if your total betting amount is less than EZ-Link card value. Thus the maximum betting payment per card is $50. To overcome this limitation, you can link up to seven EZ-Links for auto top-up.

If you have already linked your EZ-Link to a Visa credit card, therefore whenever you pay your bets by EZ-Link, you are effectively paying by credit card. Try to link your EZ-Link with a high rewarding credit card so as to offset the convenience fees. Now I am looking forward to pay a visit to Singapore Pools branch when Euro 2008 starts.

Monday, April 28, 2008

Credit card phising scam

Someone made an online purchase from dELiAS store with a credit card. Two weeks later, the purchaser received an email from their customer service as below:

"Thank you for shopping with Delia's. Your order ******* has been received and is being held for additional verification purposes.

We can verify your order via fax if it is easier for you. However, we are unable to verify via e-mail. We will need for you to fax us a copy of the front and back of your credit card along with a copy of your photo id. We also need a written statement from the credit card holder verifying the amount of the purchase and the signature of the credit card holder.

Please make sure that everything in the fax is clear and easy to read. You can fax this information to 001-614-818-2730 or call us at 001-614-891-8354. Please contact us or your order may be canceled."

So what clues can you gather from the above information. Photocopy your front and back of your credit card? Isn’t that sounds suspicious?

Firstly you are not supposed to give out your credit card details. By photocopying the front and back, you are indeed as good as giving out credit card information. Secondly this is the first time I heard a purchaser is contacted this way through email to confirm a transaction. Thirdly the site really looks crappy.

To me this is an obvious and classical case of phising scam. So you need to be aware with this kind of online transaction in future. Do not take any chance. When in doubt, it is better to give a pass.

Saturday, April 12, 2008

Benefits of EZ-Link with UOB One card

Food & Beverage

F&N Coca Cola Vending Machines

McDonald's Restaurants

Chills Café

Woko Pte Ltd

Ananda Bhavan Restaurant

Shangri-la Hotel (Staff Canteen)

Gaming

Singapore Pools Branches

Government Services

Immigrant & Checkpoints Authority

National Library Board

Singapore Land Authority (Temasek Tower Office only)

Health

Tan Tock Seng Hospital Pharmacy

Health Sciences Authority

Shopping, Retail & Leisure

Chinese Swimming Club

More Than Words Pte Ltd

Tertiary Institutions

National University of Singapore (Central Lib, Science Lib, CJ Koh Law Lib, Hon Sui Sen Lib)

Singapore Polytechnic (Service Kiosk)

MDIS

British Council

Campus Supplies Pte Ltd

Ang Mo Kio Sec Sch

Bedok North Sec Sch

Chung Cheng High (Main)

Raffles Girls School

PLMGS (Canteen and Bookshop)

City Harvest Sch

Jurong Junior College

Nanyang Junior College

Pioneer Junior College

Institute of Technical Education (Simei)

NTU (Broadway canteen, Mcd, 7 Eleven, Sakae Sushi, subway, Old Chang Kee)

Republic Polytechnic

Private Bus Services

Metro Tours Singapore

Transit Network Consortium Ltd

Ming Yu Jiang Express Pte Ltd

Others

WYWY Office Solutions Pte Ltd

Expresspoint Business Services

Top-up services and ez-link payments are available at the following merchants:

7 Eleven

MDIS

PLMGS (Pacific Bookstores Pte Ltd)

Republic Polytechnic (Booklink)

Now if you are a person who as much as possible tries to make every payment using a credit card, you may find the above places or merchants useful to take note of. As you know the above places or merchants do not accept a credit card but if your EZ-Link is enabled for auto credit card top-up, that means when you make payment using EZ-Link you are indirectly using credits from your credit card. Isn't that wonderful?

Since there is a convenience fee of $0.25 for every top-up, it is advisable that your EZ-Link is linked to a credit card that offers high rebate like UOB One card (max 3.3%). Take for example, if you use UOB One card, choose the maximum $50 per auto top-up and assuming you make $300 worth of payments by EZ-Link every month, in total you incur six times of convenience fees amounting to $1.50. However from that spending you can potentially stand to earn rebates of $10 and your effective rebates will be $8.50 per month or 2.83% which is still very attractive.

This arrangement is especially useful if you want to make up for any shortfalls in order to meet the minimum spending of $300 or $800 for each month using UOB One card. For example, if your One card spending falls below the minimum amount, you can buy some groceries from 7 Eleven to cover the shortfalls.

Credits to Verbatin for highlighting to me the extra use of an EZ-Link.

.jpg)

.jpg)