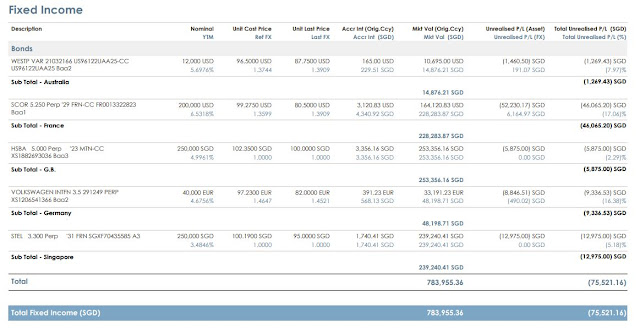

This portfolio is currently sitting on significant Mark-to-Market losses on bonds especially with USD/EUR Perpetual Bonds falling to low 80s. Note that I have about GBP10.5k cash that belongs to this portfolio sitting in Interactive Brokers, which I have manually added to the Portfolio Statement figure.

Though glaring, I am concerned but not worried as I intend to hold the bonds until they get called/matured. Further, the longer you hold a bond, the more bond interest you will receive (time is on your side).

What I would need to watch is whether the respective Loan Interest rate of each currency exceeds the Bond Interest rate with Singtel 3.3% Perpetual of possible concern soon (especially if Fed continues to keep raising interest rates). My strategy to handle this situation, for this specific portfolio, is to use the expected Bond Call proceeds from HSBC 5% Perpetual in September 2023 to fully pay off the outstanding SGD Loan (this means I need to endure at most a number of months of negative carry in the event SGD Loan Rates exceed Singtel Bond's 3.3% crediting rate).

Unlike other asset types, bonds will be called/redeemed at 100% by the Issuer unless there is a Default. For the bonds in my portfolio, I am confident in the Issuers and firmly believe the price declines currently are entirely due to interest rate expectations and not representative of any financial trouble of the Issuers.

Margin Ratio continues to be safe/comfortable at 78% region.

Regards, Newbie

This blogpost is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

1 comment:

Great read, thank you.

Post a Comment