Click to see a detail explanation on how to calculate PTB ratio of STI

I doubt there is a site that gives a free daily update of STI price earnings (PE) ratio. All this while, I have been relying on the monthly update of STI PE ratio from ifast report. You may read on how to check the PE ratios of various regions from the link I provided.

I am curious on how to compute it myself instead and intend to publish it in this blog. As the update is more of a manual process, I definitely won’t be able to update it regularly. Most importantly is the understanding process on how to compute it.

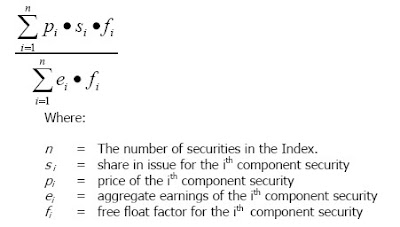

First of all, let us take a look at the formula of calculating our ST Index. The picture below explains everything. It is taken from section 8.3 of the rules in FTSE ST Index Series.

Take note if you read the capping rules from section 5.5, it is mentioned that the capping factor is not needed in the computation of ST Index. So I can ignore it for the time being.

I am not interested in the calculation of ST Index as the information is easily available from many sources. I am interested in computing the PE ratio instead. However the calculation of PE ratio is not explained in the rules.

If I see the FTSE UK Index series, there is a guide in showing how to calculate the index and PE ratio. Both the UK and ST index are computed by the same formula like the above but without the capping factor. So I believe the PE ratio should be computed by the same formula also. On page 31 of the guide, it is mentioned that the PE ratio of FTSE UK is computed as follows:

Now after knowing the formula, it is time to put some data into action. All of the data required are easily available to public. I tried to put those numbers into excel and to my surprise I found the PE ratio to be 9.81 on 11 Sep.

The ratio seems to be reasonable after amending a wrong syntax in the excel formula (previously calculated at 6.91). Please do not rely on it as it may not be accurate. I need to counter check with the PE ratio published by ifast report next month.

Take note data for EPS and market capitalisation are extracted from DBS Vickers while the free float data is compiled from latest DBS Vickers research reports and annual reports. These are the data that are needed to be ready in advance. The other numbers are simply automated calculation by excel.

Attached is a 15-year historical chart of STI PE ratio for your perusal. Chart is courtesy of Bloomberg.

25 comments:

there was an error in the syntax of my excel formula. i have amended it and the new PE is 9.08

actually the calculation is simple.

1) sum all stocks capitalisation multiply by free float factor

2) sum all stocks earnings by free float factor

3) divide (1) by (2)

viola! you get the PE. but of course if you get the data wrong, it will be rubbish in and rubbish out

try it yourself :)

there is another way of calculating the PE ratio of index

P(I) = (P1 X W1) + (P2 X W2)

P(I) is the PE ratio of the index.

P is the PE ratio of the corresponding stock.

W is the weightage of the stock in the index expressed in percentage.

e.g. if one stock has PE of 10 and weightage of 33.33% and another has PE of 20 and weightage of 66.66%, the PE ratio of the index will be:

P(I) = (10 X .3333) + (20 X .6666) = 3.33 + 13.33 = 16.66

thanks to Alchemist from e-investing.in website

Hi Mike Dirnt,

Great work! Utterly impressed.

While 9.08 might seem low, your data seems pretty ok. But as you've said it, we can double check with the ifast report.

The overall p/e for the index is a useful to guide to do a litmus test for the localised market in general, hence I'm not so particular in getting it "right".

By the way, I'm interested in getting the rolling p/e (i.e. using the lastest 4 quarters of earnings) chart for STI. If you happen to come across it, I'll appreciate if you can let me know. Thanks a million!

hi market uncle,

i regret to inform that there was an error again in my calculation. i need to amend it twice to get to the right PE on 2 Sep. Maybe i was too excited to get the end result with my complicated excel formula. haha

The good thing is i found the error when i was trying to update PE ratio for 8 Sep.

by the way, i have replied to your same comment that supposedly you should post in this article. but instead you posted on the wrong article yesterday. :)

Below is my reply from your yesterday post:

thanks. i see you write good analysis! keep it up.

i wonder why did you post in the wrong section. :)

i did post another method to calculate the PE ratio. but that one you need to open latest FTSE report, check the individual weight of stocks from the index and multiply by its PE. then add up all the values and you get the PE ratio.

this second method requires manual input from latest FTSE report. so i rather extract from DBS Vickers and put into excel to do the automatic calculation.

unfortunately we got limited free research data for our market. so i have never came across rolling PE. will let you know if i find out a source.

September 8, 2008 11:03 PM

Hi,

Sorry for posting at the wrong section. Only realise it when it didn't appear on this section and I can't remember where I post it too. Thanks for the repost of your reply.

By the way, calculation of index P/E is a labourous process prone to error, so best to do it only when the market is really really in a bad shape (like now? :)

hi,

you are right its a tedious process. but its tedious for the first time only. now after getting my excel formula right, its just a matter of simple extraction from dbs vickers.

all i need is extract and paste those data into my excel, then i get my PE ratio. probably less than 5 min work. :)

btw the following forumula is WRONG as claimed by a forummer mentioned above. take note.

WRONG -> P(I) = (P1 X W1) + (P2 X W2)

yes market is really in bad shape now. earnings are not so bad but prices are pushed down further. fundamentally i believe there will be a support to how low a PE can be, assuming earnings is maintained. maybe its good to study how low the PE was during past crisis?

Cutting and pasting from DBS vickers is fine. If can further automate by downloading itself would be better :)

Anyway, if you can get hold of the P/E chart for STI from inception to date (term P/E band chart), I believe there must be a P/E value that captures maybe 9 out of 10 market bottoms -- i.e. 90 percentile bottom index P/E.

There is no way to pin point the bottom, but the past could be a guide to find the 90 percentile bottom P/E (defined above).

Without the actual stats, a market P/E below 10 could be a good bet.

But one word of caution, low P/E can mean two things:

1) price is depressed (good thing)

2) earnings expected to plunged (like now for many companies) leading to higher forward p/e

Anyway, using Value Averaging, i.e. buying more when you think the price is cheap could be put to use, especially for index ETFs.

i think i better not pursue in getting an automated extraction. i will do manually as and when is required. i dont want to get involved in any legal issues :P

tell me if you can find a good report of historical PE ratios during the crisis. i will try to find if there is. im sure its in one of the research reports.

by the way, i just realised that S&P is at a staggering TTM pe ratio of 25! that is very high! so better exercise cautious and hold your long term purchases for the time being.

A quick glance I saw a mistake on YangZiJiang EPS. Yanzijiang earned about SGD0.02 last quarter. How could it possible have EPS0.30 a year?

thank you so much. the reporting currency is wrong.

i have updated the data. :)

A DJ news that confirmed my calculation of STI TTM PE ratio is right.

0058 GMT [Dow Jones] Singapore market is trading at all-time low on trailing PE, currently below levels reached in previous crises, says UBS. Broker says STI trades at 10.1X trailing PE vs 11.2X during Asian crisis and 10.9X during SARS. Says while macro outlook challenging, it should not get as bad as in 1998; "the economic fallout is hard to ascertain, but most likely may not match the severity seen during the Asian crisis." Says key difference this time is that regulators in developed markets are turning on the liquidity taps, SGD interest rates should not escalate, fiscal policies unlikely to be tightened. Says stocks that are trading below both Asian crisis and SARS levels on trailing PE include Venture (V03.SG), CapitaLand (C31.SG) and Keppel Land (K17.SG). (KIG)

Contact us in Singapore. 65 64154 150;

MarketTalk@dowjones.com

END) Dow Jones Newswires

September 16, 2008 20:58 ET (00:58 GMT)

Copyright (c) 2008 Dow Jones & Company, Inc.

Do you have a higher resolution of the 15yr chart? Anyway, seems pretty fine to use the following strategy:

Long term investor: 'value average' (not dollar average), whenever STI PE strikes below 12 or so.

Short term trader: Buy whether STI PE strikes below 12 and exits when it hit 22... and repeat.

is the picture not clear? i got no problem seeing it. any better resolution i got to save as bitmap. :P

email me if you want the report. i will just send you the DMG report where i got the source.

ideally value averaging is good. but with limited capital, i dont think its practical. some averaging done is better than nothing

based on the historical chart, our STI is rarely above the ratio 22 as you mentioned. for short term trader, i doubt they will look to PE ratio at all

The picture is fine, just wanna see whether the exact local maximum and minimum. I can only roughly see it fluctuate between 10's and 20's. (other than 1999, 2000)

Depending on how value average is done. How about this algo:

1) Annual budget to invest is worked out, say X and added to pool of fund: $money

2)

If (STI <= 10) buy $money

else

$money = $money + X

3)

Thus most years will go by without actions and when the time comes, the fund will be emptied.

Sounds pretty difficult to execute by mere human beings. Machine can do better.

in other words you want a zoom in version preferably for a few years of chart. yes the range is screwed by the high PE ratio prior to dotcom. i see if i can get the chart.

your idea seems ok. in other words to accumulate cash during market bull run.

another possible strategy is to buy during major correction of the index.

buy with 20% of $money when index drop by 10%

buy with another 20% of $money when index drop another 10%

and so on...

i think its good to have some a plan or strategy during a bear market. But most importantly now lets wait for this crisis to be over!

Hi Mike, very useful information out there. Can I clarify with you where do you get the free float factor/ weighted % average component of each component stock? You mention about the FTSE Report having this number? Can I please have the link or directions on how to get the report? Would love to calculate the index P/E myself. Thanks a dozen.

for the free float shares in %, need to open annual reports or see DBS analysts report

about the weightage of each component that makes up the STI, you can refer from the following link:

1) http://forums.hardwarezone.com.sg/showthread.php?t=2105243

2) click the link from my post on 05-10-2008, 01:42 PM

i dont know why i cant find the source anymore

Actually making an average P/E is really tricky: P/E ratio has a different meaning for shares with negative earnings (losses). A low P/E is good. But when it goes below 0, a low P/E is bad. By putting all earnings together and making an average, the companies in the red are actually making your average P/E look more attractive, whereas they should make it less attractive.

That is why some stock-quote sites give a P/E of 0.0 for companies in the red, and I suppose they are excluded from any official average P/E computation. But excluding them also means your P/E doesn't reflect market valuation anymore.

Second thing, since the economic situation is changing so suddenly, P/E ratio based on 2008 earnings are not very significant of today's valuation. Forward P/E (based on on 2009 earnings) would be more significant of the market price, but earning estimates are pretty fuzzy for this year too.

Hi Marti,

"By putting all earnings together and making an average, the companies in the red are actually making your average P/E look more attractive, whereas they should make it less attractive."

im afraid to say you are not right in here. please look at the formula carefully

in short, if a company got negative earnings, the cumulative earnings will fall thus overall PE will rise

yes i agree that historical earnings may not be relevant going forward. from historical you can make an educated guess going forward. see my following post:

http://sti-stocksinfo.blogspot.com/2009/01/singapore-market-is-cheap.html

My mistake, I read the formula too fast.

I'm still somewhat not comfortable lumping together loss and profit makers into an average. Right now losses are often massive asset depreciations, they are huge but not a true reflection of a normal business profitability. I ended-up doing my own P/E average by only taking profit-makers, it gives the value of profitable businesses only but I only buy those anyways ;)

yeah initially i was confused about the negative earnings as well. but if you understand the formula, it should be ok to lump them together.

anyway the formula is put up by FTSE themself so it is should be right

btw i have check my PE ratio with the Bloomberg one, they are quite close :)

Hi Mike, great work and thanks for the post. BTW, where do you find the info on the P/E of the STI on Bloomberg? Thanks.

hi Nigel,

i got a visitor of this blog who has a bloomberg terminal at work. so i asked him once a while just to counter check my calculation :P

by the way, im not updating this post anymore. pls visit the following link for the latest update of PE and PTB ratios:

http://sti-stocksinfo.blogspot.com/2009/03/update-on-pe-and-ptb-ratios-of-sti.html

Hi Mike,

I'm curious to find out how to actually compute PE ratio. Still don't quite understand the formula.

Would you be able to send em the excel file for me to discover and learn?

Hi there,

Sorry I am actually a student doing some qf stuff. Was wondering how am I able to obtain the floating factor of each stocks. thanks loads.

Wei Ren

Post a Comment