I don’t buy the idea of cutting losses or to sell into strengths like what some of the short term traders say. If you have been following my blog, you will know that I have been holding on to big paper losses for many months already. Despite those paper losses, I can assure you that I can still sleep soundly at nights.

I am still looking forward to add some value stocks into my portfolio. I have spent some time to identify a few quality penny stocks which I think have the potential in reaping better returns when market recovers. I will post those purchases as usual in my monthly portfolio update.

I foresee my next purchases to be lesser in the coming months due to a cut in my gross income and furthermore I need to raise cash at the same time for my new flat which will be ready by 2011.

There were 3 transactions for the month of January 2009.

Bought iShares MSCI EAFE, price at USD$45.980

Bought Capitaland (PSBP), new average price at $2.825

Bought SGX (PSBP), new average price at $5.298

In one of my previous articles, I have mentioned that I intend to set up a supplementary portfolio consisting of global Exchange Traded Funds (ETF). I have already gotten some exposure to stocks in the emerging markets through Vanguard Emerging Markets (VWO). In order to reduce the volatility of my supplementary portfolio, I have added iShares MSCI EAFE (EFA).

For those who are not aware, EFA is an index fund that aims to provide investment return with stocks in the European, Australasian and Far Eastern markets and whose return tends to correlate the MSCI EAFE Index. I don’t intend to beat the index but I will be contented to achieve return as close to the index for the next few years.

Some of the top holdings in the index fund include big corporations from around the regions like Nestle, BP (formerly known as British Petroleum), Novartis, HSBC and many more. With investment in such an index fund, I do not need to worry about stocks selection, and the fund itself is already broadly diversified consisting of stocks from multiple sectors. I strongly recommend beginners to construct their stocks portfolio with ETF that can cover the global regions.

I am already on my second month with Phillip Share Builders Plan. I will continue to participate in the plan for the next few months until I see my holdings for these two stocks reaching excessive levels.

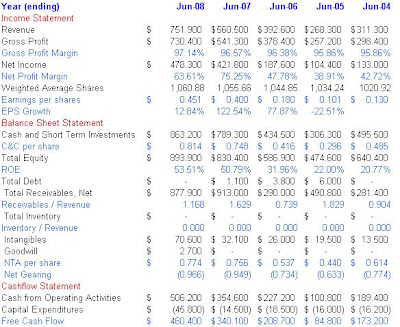

In this post, I am going to share some of the points why I feel SGX deserves a place in everyone’s long term stocks portfolio. Just like what some people suggested keeping stocks like SMRT as a hedge against rising transportation costs, one should also hold SGX as a hedge against rising trading fees. The trading and clearing fees may not be substantial to you but since you are investing and at the same time paying fees to SGX, it is good to be part of SGX business also. Let me give some highlights of SGX financial statements for the past few years.

First of all, SGX is in a business with high profit margins. Whatever revenue comes in, sales will be translated into higher net income for the company. It is evident from the table that SGX has managed to improve its net profit margin since 2005. A business is not a profitable business, if it is not able to generate free cash flow over the years. SGX is a cash cow as you can see that the company only requires small capital for expenditures over the years. Even during its infancy stage in 2004, the company managed to generate free cash flow of $173 million. Going forward, I will expect about the same amount of free cash flow if low trading activities still persist.

SGX has also improved its ROE over the years. I expect the ROE to remain high as the company matures. On top of that, SGX has a fat cash and cash equivalents of $625 million from the latest balance sheet statement and with absolutely no debt at all. Can shareholders expect cash distribution or special dividend payouts in future? I am not sure but it may be possible. However I have mentioned before that valuation is not cheap for SGX. That was the main reason why I did not choose to do lump sum purchase. Monthly purchases through Dollar Cost Averaging (DCA) are therefore suitable for me.

I received total dividends of $39.05 for the month of January 2009.

| No | Stock | Mode | Unrealised P/L (SGD) |

| 1 | ARA | CASH | -60.39% |

| 2 | CAPITACOMM | CASH | -27.76% |

| 3 | CAPITALAND (PSBP) | CASH | -15.04% |

| 4 | CHINA HONGXING | CASH | -67.52% |

| 5 | CHINA MILK | CASH | -48.92% |

| 6 | COSCOCORP | CASH | -76.59% |

| 7 | COURAGE MAR | CASH | -58.33% |

| 8 | FIBRECHEM | CASH | -78.49% |

| 9 | FRASERSCOMM | CASH | -78.18% |

| 10 | FSL TRUST | CASH | -64.14% |

| 11 | GEN INT | CASH | -33.49% |

| 12 | JAYA HLDG | CASH | -80.01% |

| 13 | KEPPELCORP | CASH | 4.68% |

| 14 | KS ENERGY | CASH | -51.30% |

| 15 | MACQ INT INFRA | CASH | -70.94% |

| 16 | PAC ANDES | CASH | -10.63% |

| 17 | PLIFE REIT | CASH | 1.15% |

| 18 | RAFFLES EDUCATION | CASH | -37.05% |

| 19 | ROTARY ENGRG LTD | CASH | -77.14% |

| 20 | SATS | CASH | -18.84% |

| 21 | SGX (PSBP) | CASH | -2.23% |

| 22 | ST ENGG | CASH | 0.09% |

| 23 | SWIBER | CASH | -77.28% |

| 24 | TAI SIN | CASH | -55.92% |

| 25 | TAT HONG | CASH | -22.83% |

| 26 | UOB-KAY HIAN | CASH | -60.48% |

| 27 | VICOM | CASH | -14.08% |

| 28 | VANGUARD EMER MRKTS | CASH | -48.06% |

| 29 | iSHARES MSCI EAFE | CASH | -12.71% |

| 30 | BH GLOBAL | CPF | -53.32% |

| 31 | COSCOCORP | CPF | -73.11% |

| 32 | SIAENGG | CPF | -56.82% |

No comments:

Post a Comment