There were 5 transactions for the month of September 2009.

Exercise Cityspring Trust RIGHTS, average price at $0.494

Bought HG Metal, average price at $0.157

Bought SGX (PSBP), new average price at $6.198

Sold partial Keppel Corp at 109.5% gain

Bought Noble Group, average price at $2.488

After the recent months of huge rally across major market indices, I tried to do a filter for some laggard stocks to see if I can catch anything left behind. Laggard stocks are those that have not moved up that much with respect to the market and also its peers. Some of the criteria of the search that I made were that it must be a non-Reit, a penny stock priced below 20 cents and also has the potential of turning around should the economy heat up again. HG Metal suits these criteria.

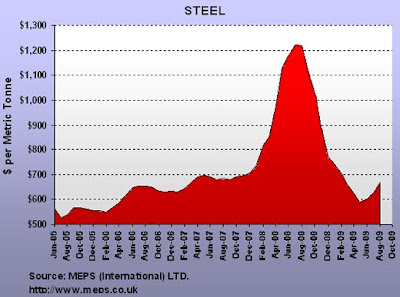

I bought some shares of this veteran company just before the negative publicity on MarketWatch news that steel production has hit a fresh high in August. Nobody can perfectly time the bottom in the price of steel but in my opinion, buying HG Metal at the current price already gives me a good margin of safety for any further downside.

I am willing to hold my investment in HG Metal for the next few years and I look forward to top up some more shares should its share price fall below 10 cents. From what I can see, the price of 10 cents is a good support because it was at this price that S$22.5 million were collected from the recent private placement exercise. I believe the recent tie up of HG Metal, Novo and Posco, one of the largest steel producers in the world, can give a boost to the profitability of HG Metal in the years ahead. After the successful acquisition of BRC Asia, HG Metal can also ride on BRC strong exposure to HDB projects and some infrastructure projects by the Singapore government.

Another successful RIGHTS exercise for me was the Cityspring Infrastructure one. A business trust with a strong sponsorship from Temasek Holdings, owners of three high quality and stable cash generating assets, high current dividend yield, I believe the risk to reward ratio of my investment in this company is attractive enough. Based on my average price, dividend yield is about 15% and I think the downside of its share price is already limited.

Keppel Corp is one of the few stocks in my portfolio that has benefitted from the recent rally. My value in the company has risen so high that it is making up the biggest portion for a single stock in my whole portfolio. To reduce volatility of my whole stocks portfolio, I have decided to take a partial profit from Keppel Corp and switch into Noble Group.

I see a good potential in Noble Group being a future commodity powerhouse and since commodity is one sector that I am lacking of, it is a perfect opportunity for me to buy some shares in this company. I don’t think I bought at the best possible price but certainly I don’t wish to miss the opportunity again. I have overlooked this company when it was trading less than a penny a few months back so I hope I am not too late to go in now. My next buying price will be when it falls below $1.70.

Based on my purchase price and latest quarterly report, I am buying at 15x of annualized earnings per share after stripping off exceptional items. I don’t think that’s too expensive in my opinion. In my Corporate Finance class, I learn that the goal of a firm is to maximize its market share price. The statement is achievable in an efficient market but in an inefficient market where the market is sometimes driven by irrationality, the share price is not really a good barometer for business performance. I prefer to judge the performance of a business from the Net Asset Value (NAV) per share of the company. A good company should gradually increase its NAV per share over the years. Noble Group is an excellent example and you can see from the following picture.

I received total dividends of $346.58 for the month of September 2009.

| Stock | Mode | Unrealised P/L (SGD) | Stock | Mode | Unrealised P/L (SGD) |

| ARA | CASH | -16.67% | NEPTUNE ORIENT LINES | CASH | 35.16% |

| ARMSTRONG | CASH | 108.00% | NOBLE GROUP | CASH | -1.53% |

| CAPITACOMM | CASH | 17.78% | PAC ANDESW110722 | CASH | NA |

| CAPITALAND (PSBP) | CASH | 49.46% | PLIFE REIT | CASH | 48.53% |

| CHINA MILK | CASH | -32.12% | RAFFLES EDUCATION | CASH | -37.73% |

| CITYSPRING | CASH | 16.40% | ROTARY ENGRG LTD | CASH | 14.31% |

| COSCOCORP | CASH | -64.44% | SATS | CASH | 33.89% |

| COURAGE MAR | CASH | -27.88% | SGX (PSBP) | CASH | 35.85% |

| CSE GLOBAL | CASH | 104.37% | ST ENGG | CASH | 20.72% |

| FIBRECHEM | CASH | -88.71% | SWIBER | CASH | -56.46% |

| FRASERSCOMM | CASH | -44.25% | TAI SIN | CASH | -35.26% |

| FRASERSCT | CASH | 6.88% | TAT HONG | CASH | 33.93% |

| FSL TRUST | CASH | -49.54% | UOB-KAY HIAN | CASH | -19.42% |

| GENTING SP | CASH | 71.25% | VICOM | CASH | 16.41% |

| HG METAL | CASH | -23.57% | VANGUARD EMER MRKTS | CASH | -12.92% |

| JAYA HLDG | CASH | -65.95% | iSHARES MSCI EAFE | CASH | 15.21% |

| KEPLAND | CASH | 116.09% | BH GLOBAL | CPF | -18.92% |

| KEPPELCORP | CASH | 109.36% | COSCOCORP | CPF | -59.16% |

| KS ENERGY | CASH | -20.78% | SIAENGG | CPF | -45.87% |

| MACQ INT INFRA | CASH | -63.94% |

5 comments:

Hi Mike,

I don't really understand your statement as follows: "To reduce volatility of my whole stocks portfolio, I have decided to take a partial profit from Keppel Corp and switch into Noble Group". Perhaps you could explain?

My personal opinion is that corporate finance classes teach the wrong stuff about share prices. A company should, technically, be concentrating on growing and building their business and not on maximizing share price. Share price is a RESULT of a good and strong business and companies should not deliberately try to manipulate or boost up the share price for undue reasons.

As for Noble Group, I think 15x PER is expensive unless you consider the fact that Noble's growth is going to be superior to other commodity players in the next 3-5 years. This is because the company relies mainly on scale (it has low net margins - 2.55% for 6M 2009) and also carries significant debt. From their Balance Sheet, I note that most of its current assets are tied up in inventories and prepayments & deposits (US$4B out of current assets total of US$6B), so this is risky as well. In addition, cash flow from ops is also negative and it has been raising cash through senior notes, convertible bonds and recently through a share placement of 438M new shares at S$2.1137. In my view, the company is risky and is trading at high valuations.

Cheers,

Musicwhiz

Hi MW,

If i choose not to sell, I think my Keppel Corp value was forming more than 8% of my overall portfolio. If i still maintain the same holding, should Keppel Corp fall/rise further, my % change in overall portfolio would be more. In other words, im trying to reduce the sensitivity of % change in my portfolio due to Keppel Corp.

In efficient market, the goal is practical. When management acts at the best interests of the shareholders and add value to the company, share price can be fairly reflected. Thus you can make use price as a barometer for business performance. But our market is definitely not an efficient one (IMHO). Thus share price may or not be accurately reflected.

I do agree Noble is a risky company and i have positioned my investment amount accordingly. I am looking forward to ride its potential growth story for the next few years :)

Hello, Mike

May I ask your views on China Milk? If you have analysis of its fair value, pls share. Thanks!

Hi Neroli,

To tell you the truth, i have never like to do a fair value calculation of a stock. The price you get will depend on many assumptions. So if rubbish in, rubbish goes out.

I prefer to look at the current valuation and its future growth.

As for China Milk, the last time I checked it was at a cheap valuation. The question is, do you really believe in the reporting? Once bitten, twice shy.

I got Fibrechem suspended so i lose faith in all China S-shares. If you noticed, i have cut down a few of my S-shares except for Cosco and China milk. Thus i will not be adding more and I dont really follow up on China Milk.

My stake in China Milk is quite small and i will just hold it.

You might want to read some good comments from Wallstraits forum regarding China Milk.

Hi, Mike

Tks for your comments on China Milk....

Rgds

Neroli

Post a Comment