Even though I have put more cash into stocks, I still stick to my investment principle that is not to put too much weight into a particular stock. I try to keep less than 8% of total investment amount into a single stock. That means I like to keep a broadly diversified selection of stocks. I managed to utilize the remaining free trades with CIMB $1 commission.

There were 8 transactions for the month of December 2008.

Bought Rotary, new average price at $1.006

Bought Jaya Holdings, new average price at $1.354

Bought KS Energy, new average price at $1.540

Bought Capitacomm, new average price at $1.322

Bought ST Engg, price at $2.278

Bought Keppel Corp, price at $3.869

Bought Capitaland (PSBP), price at $2.860

Bought SGX (PSBP), price at $5.390

Rotary and Jaya Holdings were two stocks that I purchased prior to the crisis. I have wanted to average down on them ever since. I feel the sell down on these two stocks are way overdone so it is ideal for me to top up in small amount. No doubt their earnings will be affected in the short term but my long term fundamental views on them still remain the same. I don’t really like to speculate their future earnings but based on their current cash flow and balance sheet statements, I don’t see any short coming in the near term. In fact Rotary is currently priced at their cash per share level. These two are also solid dividend paying stocks in which both of them have never failed to pay since 1995.

On hindsight, I am fortunate not to have exercised my rights with KS Energy at a higher price. I managed to get at a discount of about 66% of the exercise price instead. Therefore the recent purchase brought down my average price to $1.540. I read about the deployment of KS Titan 2 lift boat for offshore wind power operations in the North Sea. I think it is good to tap on other source of energy instead of relying on oil and gas operations only.

Falling price and demand of prime office spaces coupled with refinancing worries for $580 million of debt expiring in March 2009 have hit Capitacomm very hard recently. The commitment by our government of making Singapore the biggest financial centre in the region makes me optimistic of the future of this quality REIT. It fell by more than 80% from previous peak to a low of $0.595 recently. Putting the refinancing worries aside, I feel the 80% fall is already fully factored in for any future fall of office rents. I managed to bring down my average price to $1.322 after purchasing equal number of shares at $0.635.

I am glad to add four more bluechips into my portfolio. Capitaland and SGX were purchased through PSBP while Keppel Corp and ST Engineering were purchased in the open market. Valuation for SGX still remains high. So that is why I don’t wish to buy in lump sum. But it is certainly a good stock to own in the long run and I don’t want to miss the opportunity of buying now. Just look at SGX cash flow statement and you will be impressed by the free cash flow generated!

In my view, Keppel Corp is definitely one of the top conglomerates in Singapore. The news of a possible contract cancellation in late November is a perfect timing for me to buy together after a series of previous sell down too. I don’t want to miss receiving good dividend payout and bonus shares in future from this gem.

Capitaland is one of the top property developers in Singapore. I am not so concerned of their short term earnings and at the same time I don’t want to miss buying at current price through PSBP. If there is any dividend payout, I like the small money to be automatically reinvested at no cost at all.

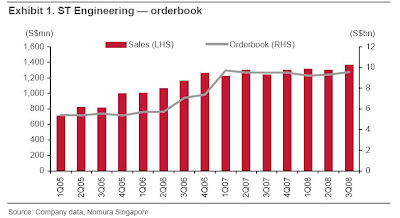

Last but not least, if you are not aware of how defensive ST Engineering can be, I suggest you take a look at their earnings in the previous crisis. Take note, defensive in earnings do not equate to defensive in share price movement. When price is offered to you cheaply while earnings remain the same, it is a no brainer to buy the stock. I present to you a quarterly orderbook of ST Engineering compiled by Nomura to let the picture speaks for itself.

I received total dividends of $70 for the month of December 2008.

| No | Stock | Mode | Unrealised P/L (SGD) |

| 1 | ARA | CASH | -62.45% |

| 2 | CAPITACOMM | CASH | -32.30% |

| 3 | CAPITALAND (PSBP) | CASH | 8.74% |

| 4 | CHINA HONGXING | CASH | -68.38% |

| 5 | CHINA MILK | CASH | -48.92% |

| 6 | COSCOCORP | CASH | -71.85% |

| 7 | COURAGE MAR | CASH | -58.33% |

| 8 | FIBRECHEM | CASH | -76.88% |

| 9 | FRASERSCOMM | CASH | -77.70% |

| 10 | FSL TRUST | CASH | -59.13% |

| 11 | GEN INT | CASH | -31.19% |

| 12 | JAYA HLDG | CASH | -78.90% |

| 13 | KEPPELCORP | CASH | 11.92% |

| 14 | KS ENERGY | CASH | -35.71% |

| 15 | MACQ INT INFRA | CASH | -68.25% |

| 16 | PAC ANDES | CASH | -13.04% |

| 17 | PLIFE REIT | CASH | -2.69% |

| 18 | RAFFLES EDUCATION | CASH | -32.25% |

| 19 | ROTARY ENGRG LTD | CASH | -75.65% |

| 20 | SATS | CASH | -17.06% |

| 21 | SGX (PSBP) | CASH | -5.75% |

| 22 | ST ENGG | CASH | 4.04% |

| 23 | SWIBER | CASH | -73.73% |

| 24 | TAI SIN | CASH | -57.30% |

| 25 | TAT HONG | CASH | -13.90% |

| 26 | UOB-KAY HIAN | CASH | -59.63% |

| 27 | VICOM | CASH | -17.96% |

| 28 | VANGUARD EMER MRKTS | CASH | -45.87% |

| 29 | BH GLOBAL | CPF | -58.23% |

| 30 | COSCOCORP | CPF | -67.67% |

| 31 | SIAENGG | CPF | -57.88% |

No comments:

Post a Comment