I agree with the vision of the directors to make SATS not only a world class food services group targeted to the aviation sector but also a group targeted to the non-aviation sector as well. By tapping into the catering industry like what SFI is doing locally and globally will thus reduce SATS dependency on its aviation related business operations. With the acquisition, both companies can centralize production activities and eliminate duplicate food production sites. It can also eliminate the “middleman” procurement costs with stronger bargaining power due to combined purchasing volume. All these synergies can bring about more cost savings annually and thus boosting income.

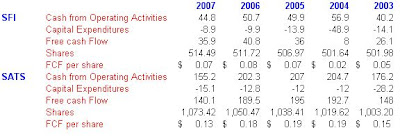

On top of the merits mentioned in the circular, let me touch a little bit on the cash generation portion of these two companies. I have presented the historical Free Cash Flow (FCF) of each company in the table below. As you can see, in future SATS may look forward to benefit from the additional FCF generated by SFI amid at an unstable rate. Only with a good FCF generation, business can move forward and shareholders can be rewarded.

Those are some of the merits that were highlighted in the circular. I think the negative parts of the acquisition are not well brought up. First of all, as a result of the acquisition SATS will move into a slight net debt position from a strong net cash position. I feel at a recessionary times like now, SATS shouldn’t exhaust all of its 600 over million of cash in hands. In my opinion, t is prudent to keep at least a third of the money and use the remaining cash for any acquisition.

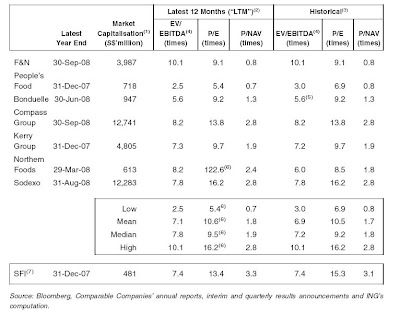

On top of that, the offer price of $0.93 is overpriced as discussed by some shareholders. Based on the last transacted price prior to the announcement, $0.93 is at a premium of 25%. It may seem fair based on the EV/EBITDA valuation and the comparison of take-over premium of selected companies in the past. But how does the valuation fair in terms of simple PE and PTB multiples?

If you see the table above and based on PE and PTB ratios, SFI is already trading at a premium compared to its peers.

I still have some time to decide on the resolution and I will probably do so by the end of this week. Most likely I will go against it due to the negative points that I have mentioned above together with the negative outlook of SFI operations in UK which I have not looked into yet. The price may be justifiable during good times but at times like now, companies need to exercise extra caution while spending especially when all cash in hands are at stake.

No comments:

Post a Comment