According to the report, PTB ratio of banking sector fell to a low of 0.6 back in 1999 during the Asian financial crisis. At the moment banking sector is trading at a PTB ratio of 1.0. In other words, I expect more downside pressure for banking stocks.

There are some other factors which are looked at in the report. I think there are too many for me to list them out in this post, so it is best if you can get a grab of the report yourself. If you are interested to get a copy of the report, you may download it from DBS Vickers or email me so I that can send the report to you.

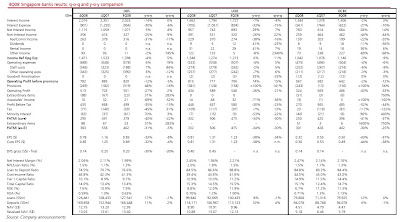

I will just post a summary of banking stocks results as of 4Q2008. I think the table can give an overall picture of the status of our banks.

No comments:

Post a Comment