KTT slide continues with 27.66% dive

Keppel Telecommunications and Transportation (KTT) – KTT shares continued to plunge yesterday - sinking 27.66%, after Friday's 43.9% dive - on sales by substantial shareholder Kapital Asia Pte Ltd, sources said. The two days of sales have wiped $1.4bn off the market capitalisation of KTT, which is more than 80%-owned by Keppel Corporation. The stock ended yesterday at $1.70, down 60% from last Thursday's close of $4.19. 5m shares changed hands yesterday, following the 5.1m traded last Friday. KTT typically has low liquidity. Often, less than 500,000 shares are transacted in a day. Hong Kong based-Kapital Asia, owned by Indonesian businessmen with interests in oil and gas, became a substantial shareholder in KTT in 2006, with 7.34%. By July this year, it had increased its holding to 9.27% or 51.136m shares. Based on KTT's annual report, Kapital Asia, an investment holding company, is controlled by Agus Anwar and Marcel Tjia. KTT filed changes in stockholding to the Singapore Exchange (SGX) after it received notification from Kapital Asia yesterday that the latter sold 2,658,000 shares on Sept 26 at between $4 and $3.50.

Raffles Edu to invest in new Tianjin college

Raffles Education Corporation – Plans to invest RMB3m (S$628,000) in a new college in Tianjin over the next five years, after getting the nod from the Tianjin Education Bureau. The new school - a collaboration with its Tianjin University of Commerce Boustead College in China - will offer advanced diplomas in fashion design, interior design, visual communication, and multimedia design, among others. The first intake is expected in January 2009, but this will not contribute significantly to the group's financial results for FY2009. With the addition of this new college, the group operates three universities and 25 colleges across nine countries in the Asia-Pacific region. For the year ended June 30, 2008, Raffles doubled its net profit to $98.8m, thanks to strong revenue growth, a jump in other operating income, and negative goodwill. Turnover came to $190 million, and EPS rose to 4.33 cents from 2.34 cents previously.

ST Engg US unit clinches US$393m navy deal

ST Engineering – The company's US shipyard unit, VT Halter Marine, has secured a US$393m contract for Phase II of the Egyptian Navy's Fast Missile Craft (FMC) project. This new deal, in addition to another US$13.5 million awarded due to changes in work scope in Phase I brings the total contract value for the overall project for the three FMCs to US$642m. Work commences immediately, and delivery of the first FMC is expected by mid-2012 with full completion by April 2013. ST Engineering had previously announced on Dec 1, 2005 that it had secured the initial Phase I functional design contract for approximately US$29m. At the time, it was estimated that the programme's value could grow to over US$450m after Phase II was added. Two subsequent contract modifications were awarded in November 2006 and June 2007 respectively for procuring the project's long lead items which added US$206.5m to the contract. Subsequent changes in the scope of work further increased the Phase I contract value to the current US$249.2m. This contract is not expected to have any material impact on the consolidated net tangible assets per share and earnings per share of ST Engineering for the current financial year.

NOL, Hamburg party declare battle over Hapag-Lloyd

NOL - Both NOL and the Hamburg consortium have officially declared they have made binding bids for Hapag Lloyd, the container shipping business of Germany's TUI. But both parties declined to show their hands. The Hamburg-based group comprising main investor Kuehne & Nagel boss Klaus-Michael Kuehne as well as Hanse Merkur, the city of Hamburg, HSH Nordbank, Signal Iduna and MM Warburg did not reveal their bid but German newspaper Frankfurter Allgemeine Zeitung reported yesterday that the Hamburg consortium would bid more than 4bn euros (S$8.2bn) including debt for Hapag-Lloyd. NOL also did not reveal details, saying it 'remains bound by strict confidentiality undertakings, which legally restrict the company's ability to share information'. However, with its Temasek parentage the Singapore line is expected to easily match any competing offer. It is believed NOL has arranged a US$6bn loan to fund its bid. Hapag-Lloyd parent TUI is expected to make a decision by the middle of next month. An NOL takeover would make it the world's third biggest container line behind Maersk and Mediterranean Shipping Company.

Source: Kim Eng

Tuesday, September 30, 2008

Monday, September 29, 2008

Review on ST701 Property website

I won’t be surprised if many people including me are not aware the presence of one of the biggest local classifieds on the internet. I came across ST701 website long time ago but only began to register recently when I saw an offer to write a sponsored post about them.

If you are wondering what does ST701 stands for, ST is an abbreviation which is taken from The Straits Times which is an identity of Singapore Press Holdings national English newspaper. The numbers 701 symbolises a search experience of 7 days a week at the 01 place that a user may get. ST701 has a long history of establishments as far as 1969 and its milestones can be summarised by the following picture:

That is so much on the introduction of ST701. Now I am going to write a short review of one of its section that is ST701 Property website.

After browsing for some time, I am impressed with the website which is apart from being an advertising portal; it does provide useful information for buyers or sellers to find out everything about Singapore real estate. For example, it is on one of the “Useful Links” shortcut from the website that I am able to find the following chart from URA:

From an investor point of view, the chart can give a feel of the overall price index of property in Singapore by type. After a fast ran up of prices in 2006 and 2007, now prices seem to slow down or flat. Whether the prices will start a u-turn downwards is anyone guesses. But in my opinion, it may remain flat for some time like in post 2003 before it starts to go up again as land is scarce in Singapore and population is set to increase in future.

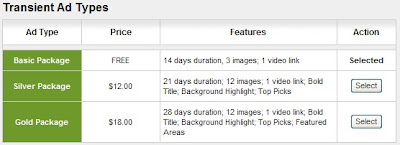

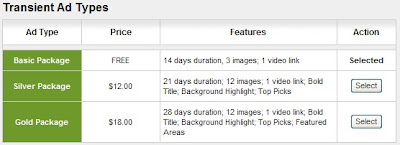

If you are planning to sell your HDB or private property, ST701 is a good place to advertise your offer. Simply register a free account with them and follow ST701 step-by-step guide to advertise your property. With their basic package, you are able to advertise your property for free up to duration of 14 days. For longer durations, you may refer to the following charges:

Another useful feature on the website is the “Just Ask” section. You may post any property related questions there and someone who has the answer can just reply to that post. It is actually an alternative to forum threads style. From the posts that I see, there are more questions asked than answers rendered and some of the answers are infested with agents trying to sell their services. Maybe ST701 can employ a neutral person to help answer some these questions.

In overall, ST701 Property is definitely one of the recommended one stop solutions for all your property needs. There is a thing that can be improved from ST701 Property website especially the interaction section. I am sure people are also interested to find answers to their questions rather than for the sake of advertising only. In my opinion, there could have been better interactions among different people if the "Just Ask" section is converted into a forum instead.

If you are wondering what does ST701 stands for, ST is an abbreviation which is taken from The Straits Times which is an identity of Singapore Press Holdings national English newspaper. The numbers 701 symbolises a search experience of 7 days a week at the 01 place that a user may get. ST701 has a long history of establishments as far as 1969 and its milestones can be summarised by the following picture:

That is so much on the introduction of ST701. Now I am going to write a short review of one of its section that is ST701 Property website.

After browsing for some time, I am impressed with the website which is apart from being an advertising portal; it does provide useful information for buyers or sellers to find out everything about Singapore real estate. For example, it is on one of the “Useful Links” shortcut from the website that I am able to find the following chart from URA:

From an investor point of view, the chart can give a feel of the overall price index of property in Singapore by type. After a fast ran up of prices in 2006 and 2007, now prices seem to slow down or flat. Whether the prices will start a u-turn downwards is anyone guesses. But in my opinion, it may remain flat for some time like in post 2003 before it starts to go up again as land is scarce in Singapore and population is set to increase in future.

If you are planning to sell your HDB or private property, ST701 is a good place to advertise your offer. Simply register a free account with them and follow ST701 step-by-step guide to advertise your property. With their basic package, you are able to advertise your property for free up to duration of 14 days. For longer durations, you may refer to the following charges:

Another useful feature on the website is the “Just Ask” section. You may post any property related questions there and someone who has the answer can just reply to that post. It is actually an alternative to forum threads style. From the posts that I see, there are more questions asked than answers rendered and some of the answers are infested with agents trying to sell their services. Maybe ST701 can employ a neutral person to help answer some these questions.

In overall, ST701 Property is definitely one of the recommended one stop solutions for all your property needs. There is a thing that can be improved from ST701 Property website especially the interaction section. I am sure people are also interested to find answers to their questions rather than for the sake of advertising only. In my opinion, there could have been better interactions among different people if the "Just Ask" section is converted into a forum instead.

Labels:

Others

Friday, September 26, 2008

Daily news - 26 Sep

Yanlord dismisses rumours of links with China graft case

Yanlord Land Group yesterday dismissed market rumours of links with a graft case concerning a former Chinese official and lifted the trading halt on its shares. The rumours surrounded the sale of units to Kang Huijun, a former vice-governor of the Pudong New Area, allegedly at a steep discount in 2001 and 2006 in exchange for help in securing land-use rights to land parcels in Pudong. Yanlord shares slipped further when trading resumed yesterday, down 4.8 per cent to 99 cents. In a filing with SGX, the Chinese property developer said the prices at which its units were sold to Mr Kang were set in view of the publicity benefits his residency could have on the sale of units at the development. Yanlord denied having received any help from Mr Kang to secure land-use rights.

OUB Centre to get $540m adjacent office tower

United Overseas Bank and OUB Centre will invest $540 million to jointly develop a new commercial tower in the heart of Raffles Place. The 38-storey development will take shape next to the existing OUB Centre tower and retail mall. The three components will together be known as One Raffles Place. Due for completion in 2011, the tower will provide 350,000 square feet of prime Grade A office space. The site has a remaining tenure of around 75 years but there are plans to top this up to 99 years. The $540 million investment excludes land cost and will be financed through syndicated loans from several financial institutions. OUB Centre, which counts Overseas Union Enterprise, UOL Group and the Kuwait Investment Office among its shareholders, owns an 81.54 per cent stake in the partnership. An anticipated economic slowdown and the US financial turmoil have affected outlook for the office property sector.

Source: Kim Eng

Yanlord Land Group yesterday dismissed market rumours of links with a graft case concerning a former Chinese official and lifted the trading halt on its shares. The rumours surrounded the sale of units to Kang Huijun, a former vice-governor of the Pudong New Area, allegedly at a steep discount in 2001 and 2006 in exchange for help in securing land-use rights to land parcels in Pudong. Yanlord shares slipped further when trading resumed yesterday, down 4.8 per cent to 99 cents. In a filing with SGX, the Chinese property developer said the prices at which its units were sold to Mr Kang were set in view of the publicity benefits his residency could have on the sale of units at the development. Yanlord denied having received any help from Mr Kang to secure land-use rights.

OUB Centre to get $540m adjacent office tower

United Overseas Bank and OUB Centre will invest $540 million to jointly develop a new commercial tower in the heart of Raffles Place. The 38-storey development will take shape next to the existing OUB Centre tower and retail mall. The three components will together be known as One Raffles Place. Due for completion in 2011, the tower will provide 350,000 square feet of prime Grade A office space. The site has a remaining tenure of around 75 years but there are plans to top this up to 99 years. The $540 million investment excludes land cost and will be financed through syndicated loans from several financial institutions. OUB Centre, which counts Overseas Union Enterprise, UOL Group and the Kuwait Investment Office among its shareholders, owns an 81.54 per cent stake in the partnership. An anticipated economic slowdown and the US financial turmoil have affected outlook for the office property sector.

Source: Kim Eng

Labels:

Company News

Thursday, September 25, 2008

Daily news - 25 Sep

Yanlord shares hit by graft trial of China ex-official

Yanlord Group – Shares of Yanlord Group went into a tailspin yesterday, hurt by market rumours linking it to a corruption trial in Shanghai involving a former Chinese official. Following a request by Yanlord, share trading was halted at 2 pm, pending an announcement in response to the market talk. But the stock had by then plummeted as low as 99 cents before ending the morning session at $1.04, down 22 cents or 17.5 per cent. According to a China magazine, Caijing, the group allegedly allowed a former Shanghai official - currently on trial for suspected corruption - to buy an apartment at a price substantially below market levels. Caijing said in an online report that Yanlord allegedly allowed Kang Huijun, former deputy chief of the Pudong district in Shanghai, to buy a luxury apartment at Yanlord Riverside Garden in the prosperous Lujiazui area, at a steeply discounted price of 8,300 yuan (S$1,719) per square metre in 2001, at a time when the prevailing market price was 11,000-12,000 yuan per sq m.

Allgreen consortium wins Nanjing commercial sit

Allgreen Properties – A three-party consortium, which includes Singapore-listed Allgreen Properties, has won the bid for a commercial site in China's Nanjing City. Allgreen, which participated in the tender exercise through wholly owned subsidiary Belfin Investments, said the 17,014 square metre site is designated for hotel, commercial and office use. The purchase price is 200 million yuan (S$41.6 million). The other members in the consortium are subsidiaries of Kerry Properties and Shangri-la Asia. To undertake the acquisition and development, the consortium will set up a foreign-owned enterprise in China. Allgreen, Kerry Properties and Shangri-La will have respective stakes of 15, 45 and 40 per cent. Allgreen said in its announcement yesterday that it would benefit from the joint venture because of the partners' expertise in and understanding of China's property market. Kerry Properties will provide project development, construction management and project consultancy services, while the Shangri-La group will provide hotel management services. Allgreen has other joint investments with the two partners in Shanghai, Tianjin and Tangshan and more joint projects with Kerry in Chengdu, Shenyang and Qinhuangdao. The maximum total investment cost for this latest Nanjing site is about 1.5 billion yuan.

Source: Kim Eng

Yanlord Group – Shares of Yanlord Group went into a tailspin yesterday, hurt by market rumours linking it to a corruption trial in Shanghai involving a former Chinese official. Following a request by Yanlord, share trading was halted at 2 pm, pending an announcement in response to the market talk. But the stock had by then plummeted as low as 99 cents before ending the morning session at $1.04, down 22 cents or 17.5 per cent. According to a China magazine, Caijing, the group allegedly allowed a former Shanghai official - currently on trial for suspected corruption - to buy an apartment at a price substantially below market levels. Caijing said in an online report that Yanlord allegedly allowed Kang Huijun, former deputy chief of the Pudong district in Shanghai, to buy a luxury apartment at Yanlord Riverside Garden in the prosperous Lujiazui area, at a steeply discounted price of 8,300 yuan (S$1,719) per square metre in 2001, at a time when the prevailing market price was 11,000-12,000 yuan per sq m.

Allgreen consortium wins Nanjing commercial sit

Allgreen Properties – A three-party consortium, which includes Singapore-listed Allgreen Properties, has won the bid for a commercial site in China's Nanjing City. Allgreen, which participated in the tender exercise through wholly owned subsidiary Belfin Investments, said the 17,014 square metre site is designated for hotel, commercial and office use. The purchase price is 200 million yuan (S$41.6 million). The other members in the consortium are subsidiaries of Kerry Properties and Shangri-la Asia. To undertake the acquisition and development, the consortium will set up a foreign-owned enterprise in China. Allgreen, Kerry Properties and Shangri-La will have respective stakes of 15, 45 and 40 per cent. Allgreen said in its announcement yesterday that it would benefit from the joint venture because of the partners' expertise in and understanding of China's property market. Kerry Properties will provide project development, construction management and project consultancy services, while the Shangri-La group will provide hotel management services. Allgreen has other joint investments with the two partners in Shanghai, Tianjin and Tangshan and more joint projects with Kerry in Chengdu, Shenyang and Qinhuangdao. The maximum total investment cost for this latest Nanjing site is about 1.5 billion yuan.

Source: Kim Eng

Labels:

Company News

Wednesday, September 24, 2008

Daily news - 24 Sep

Cosco units secure US$256m of contracts

Cosco Corp (Singapore) – through 51 per cent-owned Cosco Shipyard Group (CSG) - has won newbuilding and conversion contracts worth US$256.2 million, its first new orders since July. The newbuilding contracts were awarded by a German customer to CSG's subsidiary, Cosco Dalian Shipyard, which will build two 80,000 dwt Kamsarmax bulk carriers for a total contract value of US$108 million. Cosco said the first 30 per cent instalment payments for the contracts have been received, and the two vessels are scheduled for delivery in 2010 and 2011 respectively. The other orders were nine conversion contracts valued at US$148.2 million, which CSG secured through subsidiaries Cosco Nantong Shipyard, Cosco Dalian Shipyard, Cosco Zhoushan Shipyard and Cosco Guangdong Shipyard. The contracts were awarded by various customers from the US, China, Hong Kong, India and Italy. They comprise one oil tanker-to-FPSO conversion from a repeat customer valued at US$60 million, one forward hull conversion worth US$21.7 million, and seven oil tanker-to-bulk carrier conversions totalling US$66.5 million. The projects are slated for progressive completion by the fourth quarter of next year.

StarHub CFO worried about credit tightening

StarHub Ltd – Singapore's second-largest phone company, said it is concerned that customers will scale back their spending on telecommunications and television services because of the fallout from the financial turmoil in the United States. 'My biggest worry is that there's suddenly credit tightening, not on StarHub, but for the corporates' and smaller businesses, chief financial officer Kwek Buck Chye said in a phone interview from Hong Kong yesterday. Consumers 'will still use our services but less'. Slowing economic growth in Singapore amid the global credit crisis may undermine demand for Star-Hub's services, Mr Kwek said. Still, StarHub is sticking to its 2008 sales growth forecast of 7 per cent, which was lowered from a 10 per cent estimate in May.

CapitaLand JV awards US$500m contract

CapitaLand - a joint venture with Abu Dhabi-based Mubadala, has awarded the main construction contract for Rihan Heights, the first phase of its US$5-6 billion flagship project Arzanah in Abu Dhabi. The contract, valued at AED 1.9 billion (about US$500 million) has been awarded to a joint venture between Malaysia's Sunway Construction and Abu Dhabi-based Silver Coast Construction & Boring Est. Capitala said the contract cost of AED 1.9 billion is within budget and is part of the estimated total development cost of Arzanah. Wong Heang Fine, acting CEO of Capitala, said: 'We have achieved a significant advantage with the completion of our enabling works ahead of schedule. Main construction works are due to commence this coming November. We are on target to complete Rihan Heights and start the gradual handover of residences to buyers in the first quarter of 2011.' Capitala was formed this year to design, build, manage and maintain integrated communities in Abu Dhabi. Mubadala has a 51 per cent stake and CapitaLand the other 49 per cent.

Source: Kim Eng

Cosco Corp (Singapore) – through 51 per cent-owned Cosco Shipyard Group (CSG) - has won newbuilding and conversion contracts worth US$256.2 million, its first new orders since July. The newbuilding contracts were awarded by a German customer to CSG's subsidiary, Cosco Dalian Shipyard, which will build two 80,000 dwt Kamsarmax bulk carriers for a total contract value of US$108 million. Cosco said the first 30 per cent instalment payments for the contracts have been received, and the two vessels are scheduled for delivery in 2010 and 2011 respectively. The other orders were nine conversion contracts valued at US$148.2 million, which CSG secured through subsidiaries Cosco Nantong Shipyard, Cosco Dalian Shipyard, Cosco Zhoushan Shipyard and Cosco Guangdong Shipyard. The contracts were awarded by various customers from the US, China, Hong Kong, India and Italy. They comprise one oil tanker-to-FPSO conversion from a repeat customer valued at US$60 million, one forward hull conversion worth US$21.7 million, and seven oil tanker-to-bulk carrier conversions totalling US$66.5 million. The projects are slated for progressive completion by the fourth quarter of next year.

StarHub CFO worried about credit tightening

StarHub Ltd – Singapore's second-largest phone company, said it is concerned that customers will scale back their spending on telecommunications and television services because of the fallout from the financial turmoil in the United States. 'My biggest worry is that there's suddenly credit tightening, not on StarHub, but for the corporates' and smaller businesses, chief financial officer Kwek Buck Chye said in a phone interview from Hong Kong yesterday. Consumers 'will still use our services but less'. Slowing economic growth in Singapore amid the global credit crisis may undermine demand for Star-Hub's services, Mr Kwek said. Still, StarHub is sticking to its 2008 sales growth forecast of 7 per cent, which was lowered from a 10 per cent estimate in May.

CapitaLand JV awards US$500m contract

CapitaLand - a joint venture with Abu Dhabi-based Mubadala, has awarded the main construction contract for Rihan Heights, the first phase of its US$5-6 billion flagship project Arzanah in Abu Dhabi. The contract, valued at AED 1.9 billion (about US$500 million) has been awarded to a joint venture between Malaysia's Sunway Construction and Abu Dhabi-based Silver Coast Construction & Boring Est. Capitala said the contract cost of AED 1.9 billion is within budget and is part of the estimated total development cost of Arzanah. Wong Heang Fine, acting CEO of Capitala, said: 'We have achieved a significant advantage with the completion of our enabling works ahead of schedule. Main construction works are due to commence this coming November. We are on target to complete Rihan Heights and start the gradual handover of residences to buyers in the first quarter of 2011.' Capitala was formed this year to design, build, manage and maintain integrated communities in Abu Dhabi. Mubadala has a 51 per cent stake and CapitaLand the other 49 per cent.

Source: Kim Eng

Labels:

Company News

Paying advance bills with Manhattan card (Revised)

I am sure everyone knows the high cash rebates as offered by Standard Chartered Manhattan credit card if you make huge transactions. A fellow visitor of this blog suggested paying our bills in advance so as to enjoy the highest tier of 5% cash rebates. I know he got a huge chunk of monthly bills to settle; so basically he has been been paying bills in advance every month with the card.

Take note you need to spend at least $3001 in a month to qualify for the 5% rebates which will be credited 1 month after that quarter. For various bill sizes, I want to compute the cash values at the end of the year by paying in advance with Manhattan credit card and by making normal payment like Xtrasaver card for various bill sizes.

I created four scenarios with monthly bill sizes of $2000, $1000, $800 and $600. Under each scenario, two options of payment are used. They are payment using Manhattan and Xtrasaver cards.

I made a few assumptions to simplify my calculation.

In conclusion, it is not true that Manhattan credit card is beneficial only for spending on big tickets but it is also beneficial for those who have huge combined household bills. It can really help to save your bills annually.

Take note you need to spend at least $3001 in a month to qualify for the 5% rebates which will be credited 1 month after that quarter. For various bill sizes, I want to compute the cash values at the end of the year by paying in advance with Manhattan credit card and by making normal payment like Xtrasaver card for various bill sizes.

I created four scenarios with monthly bill sizes of $2000, $1000, $800 and $600. Under each scenario, two options of payment are used. They are payment using Manhattan and Xtrasaver cards.

I made a few assumptions to simplify my calculation.

1) Manhattan acts like debit card. That means transaction and settlement is on same day

2) Minimum monthly spending of $3000 instead of $3001 is used to qualify for Manhattan 5% cash rebates

3) Cash rebates are credited at the end of the quarter for Manhattan credit card

Scenario A

Monthly Bills = $2,000

Quarterly Bills = $6,000

Annually Bills = $24,000

Peter and Sam keep aside $6000 for bills every quarter

Remaining money are kept in bank with interest of 1.2% per annum

Scenario B

Monthly Bills = $1,000

Quarterly Bills = $3,000

Annually Bills = $12,000

Peter and Sam keep aside $3000 for bills every quarter

Remaining money are kept in bank with interest of 1.2% per annum

Scenario C

Monthly Bills = $800

Quarterly Bills = $2,400

Annually Bills = $9,600

Peter and Sam keep aside $10000 at the beginnning of the year for bills

Remaining money are kept in bank with interest of 1.2% per annum

Scenario D

Monthly Bills = $600

Quarterly Bills = $1,800

Annually Bills = $7,200

Peter and Sam keep aside $8000 at the beginnning of the year for bills

Remaining money are kept in bank with interest of 1.2% per annum

From all the above scenarios, the conclusion is a no brainer suggestion to use Manhattan credit card if you really have a huge chunk of bills to settle off. You can see a big difference in the remaining amount of money kept in the bank or money market funds at the end of the year if you choose this option.

I did not try to compute under other scenarios where the monthly bills get smaller than $600 though. You may try similar calculation yourself to see whether you are better off to pay in advance to earn that 5% rebates. The only drawback of choosing Manhattan credit card to pay for your bill is that you need to go down to the billing organisation to pay instead of setting up a recurring standing instruction to charge under Manhattan credit card. This is because the rebates is entitled only for retail spending.

2) Minimum monthly spending of $3000 instead of $3001 is used to qualify for Manhattan 5% cash rebates

3) Cash rebates are credited at the end of the quarter for Manhattan credit card

Scenario A

Monthly Bills = $2,000

Quarterly Bills = $6,000

Annually Bills = $24,000

Peter and Sam keep aside $6000 for bills every quarter

Remaining money are kept in bank with interest of 1.2% per annum

Scenario B

Monthly Bills = $1,000

Quarterly Bills = $3,000

Annually Bills = $12,000

Peter and Sam keep aside $3000 for bills every quarter

Remaining money are kept in bank with interest of 1.2% per annum

Scenario C

Monthly Bills = $800

Quarterly Bills = $2,400

Annually Bills = $9,600

Peter and Sam keep aside $10000 at the beginnning of the year for bills

Remaining money are kept in bank with interest of 1.2% per annum

Scenario D

Monthly Bills = $600

Quarterly Bills = $1,800

Annually Bills = $7,200

Peter and Sam keep aside $8000 at the beginnning of the year for bills

Remaining money are kept in bank with interest of 1.2% per annum

From all the above scenarios, the conclusion is a no brainer suggestion to use Manhattan credit card if you really have a huge chunk of bills to settle off. You can see a big difference in the remaining amount of money kept in the bank or money market funds at the end of the year if you choose this option.

I did not try to compute under other scenarios where the monthly bills get smaller than $600 though. You may try similar calculation yourself to see whether you are better off to pay in advance to earn that 5% rebates. The only drawback of choosing Manhattan credit card to pay for your bill is that you need to go down to the billing organisation to pay instead of setting up a recurring standing instruction to charge under Manhattan credit card. This is because the rebates is entitled only for retail spending.

In conclusion, it is not true that Manhattan credit card is beneficial only for spending on big tickets but it is also beneficial for those who have huge combined household bills. It can really help to save your bills annually.

Labels:

Credit Cards

Daily news - 23 Sep

SingTel makes bigger IT services play

Singapore Telecommunications is hoping to increase sales from its business segment by moving from basic offerings such as selling Internet connectivity to providing higher- margin, outsourced infocomm services to corporations. According to SingTel's executive vice-president Bill Chang, the company is looking to double revenues from its ICT (infocomm technology) portfolio within the next five years and have them account for half of its business unit sales. 'Two years ago, we had almost zero ICT revenue,' Mr Chang told reporters at a briefing yesterday. SingTel's Singapore operations registered sales of $4.9 billion for the last financial year. Revenue from providing data and Internet services accounted for more than $1 billion of the total figure and the business segment was a key contributor, he said. The company has historically focused on providing basic Internet and data services such as selling access packages to businesses. However, a combination of thinning margins from its consumer business and a growing trend among companies to consolidate their technology supplier base has prompted SingTel to move higher up the corporate technology value chain. With its new business mantra, SingTel will expand its technology partnerships and develop more 'one-stop' ICT offerings for different business sectors. And instead of being the main selling point, the firm's infrastructural services such as Internet connectivity will now be bundled as part of the overall ICT service package.

SIA says premium-class travel 'relatively strong'

Singapore Airlines, which gets 40 per cent of revenue from business passengers, said the credit crisis in the US has not hurt demand for premium-class travel. Demand from business travellers in the US remains 'relatively strong', spokesman Stephen Forshaw said in an e-mail reply to Bloomberg queries. Leisure traffic has declined recently for Asia's most profitable carrier and the airline may alter its route network in response, he said. Economic turmoil and record fuel prices have eroded profits at Asia-Pacific airlines, forcing Qantas Airways, Thai Airways International and Korean Air Lines to cut routes. With the credit crisis in the US deepening and financial institutions cutting at least 125,000 jobs, demand for premium-class travel may wane, an airline grouping official said.

Source: Kim Eng

Singapore Telecommunications is hoping to increase sales from its business segment by moving from basic offerings such as selling Internet connectivity to providing higher- margin, outsourced infocomm services to corporations. According to SingTel's executive vice-president Bill Chang, the company is looking to double revenues from its ICT (infocomm technology) portfolio within the next five years and have them account for half of its business unit sales. 'Two years ago, we had almost zero ICT revenue,' Mr Chang told reporters at a briefing yesterday. SingTel's Singapore operations registered sales of $4.9 billion for the last financial year. Revenue from providing data and Internet services accounted for more than $1 billion of the total figure and the business segment was a key contributor, he said. The company has historically focused on providing basic Internet and data services such as selling access packages to businesses. However, a combination of thinning margins from its consumer business and a growing trend among companies to consolidate their technology supplier base has prompted SingTel to move higher up the corporate technology value chain. With its new business mantra, SingTel will expand its technology partnerships and develop more 'one-stop' ICT offerings for different business sectors. And instead of being the main selling point, the firm's infrastructural services such as Internet connectivity will now be bundled as part of the overall ICT service package.

SIA says premium-class travel 'relatively strong'

Singapore Airlines, which gets 40 per cent of revenue from business passengers, said the credit crisis in the US has not hurt demand for premium-class travel. Demand from business travellers in the US remains 'relatively strong', spokesman Stephen Forshaw said in an e-mail reply to Bloomberg queries. Leisure traffic has declined recently for Asia's most profitable carrier and the airline may alter its route network in response, he said. Economic turmoil and record fuel prices have eroded profits at Asia-Pacific airlines, forcing Qantas Airways, Thai Airways International and Korean Air Lines to cut routes. With the credit crisis in the US deepening and financial institutions cutting at least 125,000 jobs, demand for premium-class travel may wane, an airline grouping official said.

Source: Kim Eng

Labels:

Company News

Monday, September 22, 2008

Daily news - 22 Sep

NOL will definitely bid for Hapag-Lloyd: report

Neptune Orient Lines (NOL) will definitely bid for TUI container shipping unit Hapag-Lloyd, German paper Welt am Sonntag reported, quoting NOL chief executive office Ronald Widdows. Mr Widdows said his company would bid for Hapag-Lloyd by Sept 26, but added that the chances of TUI selling the business were only 50 per cent, according to the report. The paper also quoted Mr Widdows as saying the global container-shipping business would remain difficult for the next 18 to 24 months.

Source: Kim Eng

Neptune Orient Lines (NOL) will definitely bid for TUI container shipping unit Hapag-Lloyd, German paper Welt am Sonntag reported, quoting NOL chief executive office Ronald Widdows. Mr Widdows said his company would bid for Hapag-Lloyd by Sept 26, but added that the chances of TUI selling the business were only 50 per cent, according to the report. The paper also quoted Mr Widdows as saying the global container-shipping business would remain difficult for the next 18 to 24 months.

Source: Kim Eng

Labels:

Company News

Sunday, September 21, 2008

US market review - 19 Sep

The US market ended historically with S&P index gaining about 121 points on the last two days of the week. That was almost a 10% rise in just two days. The rally was boosted by the government bailout of AIG and a plan for the biggest revamp of US financial market as announced by President Bush himself.

I believe it will take some time for the turmoil in financial market to cool down as liquidity is still of a concern. It is evident from the TED spread chart which is currently at a level of 3. This level was last reached in the year 1987. You may take a look at what TED spread is all about from the link I provided.

Another concern you need to take note is the trailing twelve months S&P PE ratio. It is currently at a ratio of 24.7 which is on the high side I would say. I remember S&P ratio was about 18 in late 2007 and despite of S&P index crashing more than 300 points from peak to trough, the PE ratio is still higher now. That means earnings have dropped tremendously. Some experts commented that the high ratio is meaningless as a major portion of reduced earnings is contributed from stocks in banking sector. You may visit the link if you wish to check PE ratio of various markets.

Let us see the latest S&P daily chart. There are positive trends that you can deduce from the chart. First of all, trading volume had been flat since March but lately there is an evidence of increased volume with a big rise in S&P index. There is also a positive divergence forming on the MACD line. It looks like soon the index is going to test the 200 days moving average for the second time which was held as resistance in late May.

Also with the ban of naked short selling of stocks in US market, it means downward or selling pressure is greatly reduced. I think that is a good move to curb speculators who have been taking advantage of the down trend and abusing the power of shorting without paying financing charges to borrow shares.

In my opinion even though the financial market turmoil is not over yet, now is a good opportunity for long term investors to do some bargain hunting if they have not done so previously. If not, they may miss the ride. As usual, personally I have already picked up some stocks before the rebound and in the beginning of the month.

I believe it will take some time for the turmoil in financial market to cool down as liquidity is still of a concern. It is evident from the TED spread chart which is currently at a level of 3. This level was last reached in the year 1987. You may take a look at what TED spread is all about from the link I provided.

Another concern you need to take note is the trailing twelve months S&P PE ratio. It is currently at a ratio of 24.7 which is on the high side I would say. I remember S&P ratio was about 18 in late 2007 and despite of S&P index crashing more than 300 points from peak to trough, the PE ratio is still higher now. That means earnings have dropped tremendously. Some experts commented that the high ratio is meaningless as a major portion of reduced earnings is contributed from stocks in banking sector. You may visit the link if you wish to check PE ratio of various markets.

Let us see the latest S&P daily chart. There are positive trends that you can deduce from the chart. First of all, trading volume had been flat since March but lately there is an evidence of increased volume with a big rise in S&P index. There is also a positive divergence forming on the MACD line. It looks like soon the index is going to test the 200 days moving average for the second time which was held as resistance in late May.

Also with the ban of naked short selling of stocks in US market, it means downward or selling pressure is greatly reduced. I think that is a good move to curb speculators who have been taking advantage of the down trend and abusing the power of shorting without paying financing charges to borrow shares.

In my opinion even though the financial market turmoil is not over yet, now is a good opportunity for long term investors to do some bargain hunting if they have not done so previously. If not, they may miss the ride. As usual, personally I have already picked up some stocks before the rebound and in the beginning of the month.

Labels:

Market Indicators

Saturday, September 20, 2008

Daily news - 19 Sep

SATS sees business growth despite aviation turmoil

Singapore Airport Terminal Services (SATS) is in a strong financial position and expects to grow both locally and globally despite the turmoil in the aviation industry. The company could leverage on its food service capabilities and expand into other areas, given efforts to position Singapore as an attractive tourist destination, CEO Clement Woon said at a media briefing yesterday. 'Our catering service does not have to be tied to the airport.' At Changi Airport, SATS - of which Singapore Airlines owns 81 per cent - has a market share of 78 per cent for ground and cargo handling and a market share of 83 per cent for inflight catering. Other industry players include CIAS and Swissport. Aside from the aviation industry, SATS also provides food services to hospitals such as St Luke's and NUH. SATS also plans to customise its airport services to suit the needs of its different clients. Currently, its airport handling and catering follows a traditional 'one size fits all' solution. However, going forward, it plans to create differentiated offerings to suit different tiers of customers - premium airlines, full service airlines and low-cost carriers (LCCs). Earlier this week, SATS announced a new low-cost inflight catering facility which will cater to both LCCs and full service airlines come January next year. Another emerging growth avenue is LCCs, Mr Woon said, pointing to LCC handling, given the strong growth of LCCs in Asia. While the bulk of its overseas revenue stems from Asia, SATS also has plans to grow beyond the region through selective acquisitions, increasing its shareholding in existing joint ventures as well as through strategic partnerships with strong global players. In Asia, SATS aims to increase its presence in both India and China.

Source: Kim Eng

Singapore Airport Terminal Services (SATS) is in a strong financial position and expects to grow both locally and globally despite the turmoil in the aviation industry. The company could leverage on its food service capabilities and expand into other areas, given efforts to position Singapore as an attractive tourist destination, CEO Clement Woon said at a media briefing yesterday. 'Our catering service does not have to be tied to the airport.' At Changi Airport, SATS - of which Singapore Airlines owns 81 per cent - has a market share of 78 per cent for ground and cargo handling and a market share of 83 per cent for inflight catering. Other industry players include CIAS and Swissport. Aside from the aviation industry, SATS also provides food services to hospitals such as St Luke's and NUH. SATS also plans to customise its airport services to suit the needs of its different clients. Currently, its airport handling and catering follows a traditional 'one size fits all' solution. However, going forward, it plans to create differentiated offerings to suit different tiers of customers - premium airlines, full service airlines and low-cost carriers (LCCs). Earlier this week, SATS announced a new low-cost inflight catering facility which will cater to both LCCs and full service airlines come January next year. Another emerging growth avenue is LCCs, Mr Woon said, pointing to LCC handling, given the strong growth of LCCs in Asia. While the bulk of its overseas revenue stems from Asia, SATS also has plans to grow beyond the region through selective acquisitions, increasing its shareholding in existing joint ventures as well as through strategic partnerships with strong global players. In Asia, SATS aims to increase its presence in both India and China.

Source: Kim Eng

Labels:

Company News

Friday, September 19, 2008

Daily news - 18 Sep

CMT Management CEO Pua Seck Guan resigns

CapitaMall Trust Management Ltd (CMTML) – The manager of CapitaMall Trust (CMT) has announced the resignation of Pua Seck Guan as CEO, director and member of the executive committee. Mr Pua, who has been with CapitaLand for eight years, will also step down from his position as CEO of CapitaLand Retail Ltd. Mr Pua said that he had resigned to 'pursue personal interests'. Before joining CapitaLand, Mr Pua held senior positions with Lend Lease Asia Holdings and Hotel Properties Ltd. CapitaLand said that the present deputy CEO of CapitaLand Retail Ltd, Lim Beng Chee, will assume the CEO positions of both the retail business and CMTML with effect from Nov 1. Mr Lim, who is presently CEO of CapitaRetail China Trust Management Ltd, will relinquish his post to deputy CEO Wee Hui Kan, with effect from Oct 1. Mr Pua will, however, stay on until the end of October to effect a smooth transition. Mr Lim started his real estate career in DBS Land as an executive for property fund and investment. After DBS Land's merger with Pidemco Land to form CapitaLand, he held various senior positions in investment, asset management and business development.

SembMarine unit wins US$229m Sinopec contract

SembCorp Marine (SembMarine) – PPL Shipyard, a SembMarine unit, has won a US$229m contract from a subsidiary of China oil major Sinopec Corporation. The contract, which came from Sinopec International (HK), is for the construction of a jackup rig, Sinopec Corporation's first to be built outside China and which could pave the way for more deals in the future from the group. The Pacific Class 375 rig to be built is scheduled for delivery in the first quarter of 2011, and will be owned and operated by Sinopec Corporation unit Shanghai Offshore Petroleum Bureau. The high performance jackup rig will be built based on PPL Shipyard's proprietary Pacific Class 375 design and proprietary components. It will be equipped to drill high-pressure and high-temperature wells at 30,000 feet while operating in 375 feet of water and will have accommodation for 120 crew. This contract is not expected to have any material impact on the net tangible assets and EPS of SembMarine for the year ending Dec 31, 2008.

Source: Kim Eng

CapitaMall Trust Management Ltd (CMTML) – The manager of CapitaMall Trust (CMT) has announced the resignation of Pua Seck Guan as CEO, director and member of the executive committee. Mr Pua, who has been with CapitaLand for eight years, will also step down from his position as CEO of CapitaLand Retail Ltd. Mr Pua said that he had resigned to 'pursue personal interests'. Before joining CapitaLand, Mr Pua held senior positions with Lend Lease Asia Holdings and Hotel Properties Ltd. CapitaLand said that the present deputy CEO of CapitaLand Retail Ltd, Lim Beng Chee, will assume the CEO positions of both the retail business and CMTML with effect from Nov 1. Mr Lim, who is presently CEO of CapitaRetail China Trust Management Ltd, will relinquish his post to deputy CEO Wee Hui Kan, with effect from Oct 1. Mr Pua will, however, stay on until the end of October to effect a smooth transition. Mr Lim started his real estate career in DBS Land as an executive for property fund and investment. After DBS Land's merger with Pidemco Land to form CapitaLand, he held various senior positions in investment, asset management and business development.

SembMarine unit wins US$229m Sinopec contract

SembCorp Marine (SembMarine) – PPL Shipyard, a SembMarine unit, has won a US$229m contract from a subsidiary of China oil major Sinopec Corporation. The contract, which came from Sinopec International (HK), is for the construction of a jackup rig, Sinopec Corporation's first to be built outside China and which could pave the way for more deals in the future from the group. The Pacific Class 375 rig to be built is scheduled for delivery in the first quarter of 2011, and will be owned and operated by Sinopec Corporation unit Shanghai Offshore Petroleum Bureau. The high performance jackup rig will be built based on PPL Shipyard's proprietary Pacific Class 375 design and proprietary components. It will be equipped to drill high-pressure and high-temperature wells at 30,000 feet while operating in 375 feet of water and will have accommodation for 120 crew. This contract is not expected to have any material impact on the net tangible assets and EPS of SembMarine for the year ending Dec 31, 2008.

Source: Kim Eng

Labels:

Company News

Thursday, September 18, 2008

Daily news - 17 Sep

Sembcorp wins US$229m contract from Sinopec

Sembcorp Marine – A wholly-owned unit of SembMarine has won a $229m contract to build a jack-up rig for the Hong Kong unit of China Petroleum & Chemical Corp (Sinopec). This is the first rig to be constructed outside of China and delivery is due in the first quarter of 2011, Sembcorp said in a statement on Wednesday.

SATS to start low-cost inflight catering service

Singapore Airport Terminal Services Limited (SATS) – Is spending $2-3m to set up a low-cost inflight catering facility to provide meals to low-cost carriers (LCCs) and full-service airlines requiring alternative meal offerings. Operated by its wholly owned unit, Country Foods Pte Ltd, which SATS bought for $4m in end-2002, the facility is being built at the SATS Inflight Catering Centre 2, and will be ready in January 2009. Established in 1989, Country Foods Pte Ltd has grown from a small food company to become a leading manufacturer and supplier of chilled and frozen processed foods and ready-to-eat meals. SATS currently has two LCC clients - Jetstar Asia and Cebu Pacific. Singapore's largest LCC operator, Tiger Airways, is handled by rival Swissport. The company said the dedicated low-cost inflight catering facility would provide an alternative catering platform that complements SATS' conventional airline catering, enabling it to serve different airline segments using different product offerings and cost structures.

Keppel Seghers inks deal for 'green' projects in Guangdong

Keppel Corp Group – Keppel Seghers Engineering Singapore, a wholly owned subsidiary of Keppel Integrated Engineering (KIE) of KepCorp, is entering into an agreement for environmental infrastructure projects in China's Guangdong province. The framework agreement, with Guangdong GuangYe Environmental Protection Industrial Group Co (GuangYe), outlines the collaboration of the two companies in developing a near-term pipeline of water and solid waste treatment and management projects totalling almost RMB6bn (about S$1.2bn) for cities and counties across Guangdong province. Keppel Seghers already has 70% of the imported waste-to-energy market in China and is involved in developing waste-to-energy plants across the country, including the cities of Suzhou, Shenzhen, Tianjin, Jiangyin and Guangzhou. It has also carried out several wastewater treatment projects in Guangdong province. Guangdong has the largest GDP in China. The framework agreement will not have a material impact on the net tangible assets or earnings per share of Keppel Corp for the financial year ending Dec 31, 2008.

Source: Kim Eng

Sembcorp Marine – A wholly-owned unit of SembMarine has won a $229m contract to build a jack-up rig for the Hong Kong unit of China Petroleum & Chemical Corp (Sinopec). This is the first rig to be constructed outside of China and delivery is due in the first quarter of 2011, Sembcorp said in a statement on Wednesday.

SATS to start low-cost inflight catering service

Singapore Airport Terminal Services Limited (SATS) – Is spending $2-3m to set up a low-cost inflight catering facility to provide meals to low-cost carriers (LCCs) and full-service airlines requiring alternative meal offerings. Operated by its wholly owned unit, Country Foods Pte Ltd, which SATS bought for $4m in end-2002, the facility is being built at the SATS Inflight Catering Centre 2, and will be ready in January 2009. Established in 1989, Country Foods Pte Ltd has grown from a small food company to become a leading manufacturer and supplier of chilled and frozen processed foods and ready-to-eat meals. SATS currently has two LCC clients - Jetstar Asia and Cebu Pacific. Singapore's largest LCC operator, Tiger Airways, is handled by rival Swissport. The company said the dedicated low-cost inflight catering facility would provide an alternative catering platform that complements SATS' conventional airline catering, enabling it to serve different airline segments using different product offerings and cost structures.

Keppel Seghers inks deal for 'green' projects in Guangdong

Keppel Corp Group – Keppel Seghers Engineering Singapore, a wholly owned subsidiary of Keppel Integrated Engineering (KIE) of KepCorp, is entering into an agreement for environmental infrastructure projects in China's Guangdong province. The framework agreement, with Guangdong GuangYe Environmental Protection Industrial Group Co (GuangYe), outlines the collaboration of the two companies in developing a near-term pipeline of water and solid waste treatment and management projects totalling almost RMB6bn (about S$1.2bn) for cities and counties across Guangdong province. Keppel Seghers already has 70% of the imported waste-to-energy market in China and is involved in developing waste-to-energy plants across the country, including the cities of Suzhou, Shenzhen, Tianjin, Jiangyin and Guangzhou. It has also carried out several wastewater treatment projects in Guangdong province. Guangdong has the largest GDP in China. The framework agreement will not have a material impact on the net tangible assets or earnings per share of Keppel Corp for the financial year ending Dec 31, 2008.

Source: Kim Eng

Labels:

Company News

Wednesday, September 17, 2008

Daily news - 16 Sep

CapitaLand's one-north investment costs more

CapitaLand – Said that its investment in one-north hub will now cost $476.8m - up from $380m announced in September 2007 - because of rising construction costs. CapitaLand will own and manage a retail and entertainment zone called the hub at Vista Xchange at JTC's one-north. Partner New Creation Church's Rock Productions, which will own and manage a civic and cultural zone, will invest $499.5m in that project - up from $280m announced last year. Rock's increase is partly due to a planned increase in gross floor area (GFA) at the civic and cultural zone. The zone will now have a GFA of 38,000 square metres, up from 'over 30,000' sq m announced previously. The new investment figures mean that the hub will now cost $976.3m, up from $660m announced in September 2007. CapitaLand and Rock yesterday said that they have awarded a $633m contract for construction of the hub to Hexacon Construction Pte Ltd. The project is expected to be completed by mid-2012. CapitaLand said that despite the higher cost, its projected return will remain the same.

SIA Cargo inks $500m deal with Pratt & Whitney

Singapore Airlines Cargo - Has signed a 10-year, $500m fleet management deal with Pratt & Whitney Global Service Partners. The agreement covers engine maintenance for 13 Boeing 747-400F cargo aircraft powered by Pratt & Whitney PW4000-94 engines, as well as six spare engines. SIA Cargo is one of the world's largest operators of B747-400 freighters, with a network that covers 76 destinations in 38 countries. The wholly owned Singapore Airlines subsidiary, which took over its parent's cargo business in 2001, is ranked fourth worldwide in terms of international freight tonne-kilometres. Pratt and Whitney is a leading player in the aviation maintenance and repair industry. SIA Cargo flew back into the black with a $5m profit for FY07/08 - a $16m reversal from an $11m loss the year before. In recent years, its fleet has been gradually boosted by SIA's B747 freighter conversion programme.

SIA passenger, cargo loads decline in Aug

Singapore Airlines - Softening travel demand and increase in capacity saw SIA fill 79.4% of its seats in August, down from 81.6% a year earlier. The airline's cargo loads dipped 1.2 percentage points year on year to 61%, from 62.2% in August 2007. Overall load factor dipped 1.2 percentage points to 68.2%, from 69.4%. During the month, the airline recorded a 5.3% rise in year-on-year growth in systemwide passenger carriage (measured in revenue passenger kilometres) while capacity (measured in available seat kilometres) grew by 8.2%. The number of passengers carried continued to rise by 2.2% over the same month last year, to 1.66m. SIA said all route regions recorded declines in PLF (passenger load factor) and this was mainly due to the new capacity introduced not fully met by the increase in passenger traffic. It added that softening demand due to the weak US economy contributed to the lower PLF in the Americas routes region.

Olam pumping US$128.4m into Nigerian ventures

Olam Imternational - Will be investing US$128.4m in a sugar refinery and a wheat mill in Nigeria. Olam said yesterday that it will take on these investments through a strategic partnership with the Modandola Group (MG). MG is a Nigerian conglomerate with interests across the shipping, agriculture, real estate and other sectors. Olam will form a joint venture (JV) with MG to set up the sugar refinery and sink in US$91m for a 49%-stake in the partnership. Olam will also acquire a 49%-stake in the MG-owned Standard Flour Mills for US$32.5m, and put in another US$4.9m to raise operating capacity. Both transactions will be funded from borrowings, internal accruals and proceeds from Olam's recent capital raising. The sugar refinery will have a captive port in Lagos and Olam will undertake project management for setting it up. Olam will also handle overall operational activities such as sales and distribution, while MG will look after local support services and relationship management with local regulatory agencies. The sugar refinery will incur a total capital cost of US$190m across FY2009 to FY2011. Production is expected to start in January 2011, reaching full capacity by FY2013.

Source: Kim Eng

CapitaLand – Said that its investment in one-north hub will now cost $476.8m - up from $380m announced in September 2007 - because of rising construction costs. CapitaLand will own and manage a retail and entertainment zone called the hub at Vista Xchange at JTC's one-north. Partner New Creation Church's Rock Productions, which will own and manage a civic and cultural zone, will invest $499.5m in that project - up from $280m announced last year. Rock's increase is partly due to a planned increase in gross floor area (GFA) at the civic and cultural zone. The zone will now have a GFA of 38,000 square metres, up from 'over 30,000' sq m announced previously. The new investment figures mean that the hub will now cost $976.3m, up from $660m announced in September 2007. CapitaLand and Rock yesterday said that they have awarded a $633m contract for construction of the hub to Hexacon Construction Pte Ltd. The project is expected to be completed by mid-2012. CapitaLand said that despite the higher cost, its projected return will remain the same.

SIA Cargo inks $500m deal with Pratt & Whitney

Singapore Airlines Cargo - Has signed a 10-year, $500m fleet management deal with Pratt & Whitney Global Service Partners. The agreement covers engine maintenance for 13 Boeing 747-400F cargo aircraft powered by Pratt & Whitney PW4000-94 engines, as well as six spare engines. SIA Cargo is one of the world's largest operators of B747-400 freighters, with a network that covers 76 destinations in 38 countries. The wholly owned Singapore Airlines subsidiary, which took over its parent's cargo business in 2001, is ranked fourth worldwide in terms of international freight tonne-kilometres. Pratt and Whitney is a leading player in the aviation maintenance and repair industry. SIA Cargo flew back into the black with a $5m profit for FY07/08 - a $16m reversal from an $11m loss the year before. In recent years, its fleet has been gradually boosted by SIA's B747 freighter conversion programme.

SIA passenger, cargo loads decline in Aug

Singapore Airlines - Softening travel demand and increase in capacity saw SIA fill 79.4% of its seats in August, down from 81.6% a year earlier. The airline's cargo loads dipped 1.2 percentage points year on year to 61%, from 62.2% in August 2007. Overall load factor dipped 1.2 percentage points to 68.2%, from 69.4%. During the month, the airline recorded a 5.3% rise in year-on-year growth in systemwide passenger carriage (measured in revenue passenger kilometres) while capacity (measured in available seat kilometres) grew by 8.2%. The number of passengers carried continued to rise by 2.2% over the same month last year, to 1.66m. SIA said all route regions recorded declines in PLF (passenger load factor) and this was mainly due to the new capacity introduced not fully met by the increase in passenger traffic. It added that softening demand due to the weak US economy contributed to the lower PLF in the Americas routes region.

Olam pumping US$128.4m into Nigerian ventures

Olam Imternational - Will be investing US$128.4m in a sugar refinery and a wheat mill in Nigeria. Olam said yesterday that it will take on these investments through a strategic partnership with the Modandola Group (MG). MG is a Nigerian conglomerate with interests across the shipping, agriculture, real estate and other sectors. Olam will form a joint venture (JV) with MG to set up the sugar refinery and sink in US$91m for a 49%-stake in the partnership. Olam will also acquire a 49%-stake in the MG-owned Standard Flour Mills for US$32.5m, and put in another US$4.9m to raise operating capacity. Both transactions will be funded from borrowings, internal accruals and proceeds from Olam's recent capital raising. The sugar refinery will have a captive port in Lagos and Olam will undertake project management for setting it up. Olam will also handle overall operational activities such as sales and distribution, while MG will look after local support services and relationship management with local regulatory agencies. The sugar refinery will incur a total capital cost of US$190m across FY2009 to FY2011. Production is expected to start in January 2011, reaching full capacity by FY2013.

Source: Kim Eng

Labels:

Company News

Monday, September 15, 2008

Daily news - 15 Sep

China Energy to seek board renewal at AGM

China Energy – Set for a board renewal come Sept 29 when its shareholders gather at its annual general meeting (AGM). Last Saturday, the group said its three incumbent independent directors who make up the audit committee (AC) will retire at the AGM. The other three newly appointed directors will seek re-election and form the new AC. This is part of the renewal process within the board as current directors Ong Kian Guan, Robson Lee and Seah Kian Wee have expressed their desire not to seek re-election, China Energy said. Forming the 'new blood' are Peter Lai Hock Meng, former MP Leong Horn Kee and current MP Ong Kian Min - corporate heavyweights who have held several directorships in the government and private sector. The NC has recommended with the board's approval that these three directors will form the new AC upon re-election, with Mr Lai as chairman and Mr Ong as the lead independent director.

Senoko waste plant to be sold to Keppel unit KIE

Keppel Corp – The Senoko Incineration Plant will be sold to a unit of Keppel Corp for eventual public listing, the Singapore government announced. The indicative price is $462m but the final price will be determined once the plant is listed, likely by mid-2009, according to a joint statement from the Finance and Environment and Water Resources Ministries and the Monetary Authority of Singapore. Keppel Integrated Engineering (KIE), the environmental technology and engineering unit of Keppel Corp, was selected for the tender out of five bids received. A KIE unit, Keppel Seghers Engineering Singapore, will operate and maintain the plant under a long-term contract from the government. KIE will inject the Senoko plant into a newly set-up infrastructure trust, which will subsequently be listed on the Singapore Exchange. Keppel said the tender award will have no material impact on its net tangible assets and earnings per share for the year ending Dec 31, 2008.

Source: Kim Eng

China Energy – Set for a board renewal come Sept 29 when its shareholders gather at its annual general meeting (AGM). Last Saturday, the group said its three incumbent independent directors who make up the audit committee (AC) will retire at the AGM. The other three newly appointed directors will seek re-election and form the new AC. This is part of the renewal process within the board as current directors Ong Kian Guan, Robson Lee and Seah Kian Wee have expressed their desire not to seek re-election, China Energy said. Forming the 'new blood' are Peter Lai Hock Meng, former MP Leong Horn Kee and current MP Ong Kian Min - corporate heavyweights who have held several directorships in the government and private sector. The NC has recommended with the board's approval that these three directors will form the new AC upon re-election, with Mr Lai as chairman and Mr Ong as the lead independent director.

Senoko waste plant to be sold to Keppel unit KIE

Keppel Corp – The Senoko Incineration Plant will be sold to a unit of Keppel Corp for eventual public listing, the Singapore government announced. The indicative price is $462m but the final price will be determined once the plant is listed, likely by mid-2009, according to a joint statement from the Finance and Environment and Water Resources Ministries and the Monetary Authority of Singapore. Keppel Integrated Engineering (KIE), the environmental technology and engineering unit of Keppel Corp, was selected for the tender out of five bids received. A KIE unit, Keppel Seghers Engineering Singapore, will operate and maintain the plant under a long-term contract from the government. KIE will inject the Senoko plant into a newly set-up infrastructure trust, which will subsequently be listed on the Singapore Exchange. Keppel said the tender award will have no material impact on its net tangible assets and earnings per share for the year ending Dec 31, 2008.

Source: Kim Eng

Labels:

Company News

NTUC Thrift

I have read about NTUC thrift account before but I never really pay too much attention to it. But today a regular visitor of this blog Cukcuk, alerted me to look further into it.

I find their saving account currently giving out good interest at 2% per annum. While SIBOR is low and money market funds giving out lower interests, I am surprised NTUC Thrift can still give 2% per annum.

The last saving account that I have was Citibank Step-Up account which I managed to step-up till 2%. That account I need to wait patiently for 1 year to step up the interest rate but Thrift account starts off from 2% instead.

I read the FAQ section but did not manage to settle a few questions. Below are some questions which I wrote to NTUC Thrift.

Letter to NTUC Thrift

Hi,

1) May I know the historical yield of dividend payout for Subscription Capital Account?

2) Is the money in the Subscription Capital Account capital guaranteed?

3) I understand full redemption of Subscription Capital is allowed only upon cessation of membership. Which membership is this? Is it The NTUC union membership or thrift membership?

Thanks

Reply from NTUC Thrift

Dear Mr. Mike,

Thank you for your feedback.

The past few years dividend payout is as follow:

Yr Mar 2002/Apr 2003 - 2%

Yr Mar 2003/Apr 2004 - 0.5%

Yr Mar 2004/Apr 2005 - 4%

Yr Mar 2005/Apr 2006 - 5%

Yr Mar 2006/Apr 2007 - 5%

Yr Mar 2007/Apr 2008 - 0%

The money in Subscription Capital A/c is principal protected. If Thrift is not doing well, we are not required to have any dividend payout. For example, the financial year that just ended has no dividend payout because of "paper loss" Thrift suffered.

For every member, they need to open Subcription Capital A/c with a min deposit of $20. This $20 is refundable when a member cease membership with Thrift.

In case if you are not aware, you need to make a one time payment of $20 to NTUC Thrift when opening a Thrift membership. This money is so called your membership fee which will be contributed to your Subscription Capital account. You can potentially earn dividend payout from that account. You may deposit more funds into this capital account if you wish to.

If you don’t wish to contribute more into the capital account, you may make use of NTUC Thrift saving account, fixed deposits and loans to enjoy attractive rates.

I find their saving account currently giving out good interest at 2% per annum. While SIBOR is low and money market funds giving out lower interests, I am surprised NTUC Thrift can still give 2% per annum.

The last saving account that I have was Citibank Step-Up account which I managed to step-up till 2%. That account I need to wait patiently for 1 year to step up the interest rate but Thrift account starts off from 2% instead.

I read the FAQ section but did not manage to settle a few questions. Below are some questions which I wrote to NTUC Thrift.

Letter to NTUC Thrift

Hi,

1) May I know the historical yield of dividend payout for Subscription Capital Account?

2) Is the money in the Subscription Capital Account capital guaranteed?

3) I understand full redemption of Subscription Capital is allowed only upon cessation of membership. Which membership is this? Is it The NTUC union membership or thrift membership?

Thanks

Reply from NTUC Thrift

Dear Mr. Mike,

Thank you for your feedback.

The past few years dividend payout is as follow:

Yr Mar 2002/Apr 2003 - 2%

Yr Mar 2003/Apr 2004 - 0.5%

Yr Mar 2004/Apr 2005 - 4%

Yr Mar 2005/Apr 2006 - 5%

Yr Mar 2006/Apr 2007 - 5%

Yr Mar 2007/Apr 2008 - 0%

The money in Subscription Capital A/c is principal protected. If Thrift is not doing well, we are not required to have any dividend payout. For example, the financial year that just ended has no dividend payout because of "paper loss" Thrift suffered.

For every member, they need to open Subcription Capital A/c with a min deposit of $20. This $20 is refundable when a member cease membership with Thrift.

In case if you are not aware, you need to make a one time payment of $20 to NTUC Thrift when opening a Thrift membership. This money is so called your membership fee which will be contributed to your Subscription Capital account. You can potentially earn dividend payout from that account. You may deposit more funds into this capital account if you wish to.

If you don’t wish to contribute more into the capital account, you may make use of NTUC Thrift saving account, fixed deposits and loans to enjoy attractive rates.

Labels:

Financial Stuffs,

Unit Trusts

Friday, September 12, 2008

Daily news - 12 Sep

Golden Agri and JMH to replace two stocks in STI

Golden Agri-Resources and Jardine Matheson Holdings – The first review of the 30-stock Straits Times Index (STI) since its relaunch in January this year has resulted in the entry of two new components - Golden Agri-Resources and Jardine Matheson Holdings - to replace Thai Beverage PCL and Yangzijiang Shipbuilding Holdings. The replacement takes effect on Sept 22. The STI comprises the top 30 mainboard companies selected by full market capitalisation. On the STI reserve list - to be used in between index reviews - are STX Pan Ocean Co, ComfortDelgro Corp, Ascendas Real Estate Investment Trust, Keppel Telecommunications & Transportation and SMRT Corp. Reserve lists are created at each half-yearly review and contain the next five companies ranked in order of market capitalisation below the STI. In the event of corporate actions or mergers which impact the index between reviews, companies in the reserve list will be included in the STI to replace any component stocks that may be excluded as a result of the corporate actions or mergers. The next review date is March 12 next year.

Olam's gearing still within a comfortable range: CEO

Olam International – Says its group borrowings are still within a comfortable range as its net gearing is still well below the limit agreed with banks. CEO and managing director Sunny Verghese, said Olam’s convenant with the banks for net gearing is five times net debt to equity ratio. It is at 3.17 times, so it has “enough headroom”. Olam has raised almost $750m of capital in the past five months, which included a $307m preferential share offering in April and a US$300m convertible bond issue in July despite tough credit conditions. Consequently, Olam has raised equity capital between last year and this year by 65% to $964m. Olam has made 13 acquisitions since the start of 2007, according to Bloomberg data, and more may follow in the next 12 months, which may need further capital-raising. Its stock currently has 'buy' or 'overweight' calls from brokerage houses such as JPMorgan, Nomura and DMG & Partners Securities in view of its strong profitability. But CIMB-GK recently downgraded the stock to 'underperform' from 'outperform' as it expects Olam's risk profile to increase as it expands upstream and downstream.

OCBC raises stake in Great Eastern

OCBC Bank – Has purchased 582,000 shares in Great Eastern Holdings (GEH) at $14.00 per share for a total consideration of about $8.2m. The purchase has increased its shareholding in GEH from 86.89% to 87.02%.

Source: Kim Eng

Golden Agri-Resources and Jardine Matheson Holdings – The first review of the 30-stock Straits Times Index (STI) since its relaunch in January this year has resulted in the entry of two new components - Golden Agri-Resources and Jardine Matheson Holdings - to replace Thai Beverage PCL and Yangzijiang Shipbuilding Holdings. The replacement takes effect on Sept 22. The STI comprises the top 30 mainboard companies selected by full market capitalisation. On the STI reserve list - to be used in between index reviews - are STX Pan Ocean Co, ComfortDelgro Corp, Ascendas Real Estate Investment Trust, Keppel Telecommunications & Transportation and SMRT Corp. Reserve lists are created at each half-yearly review and contain the next five companies ranked in order of market capitalisation below the STI. In the event of corporate actions or mergers which impact the index between reviews, companies in the reserve list will be included in the STI to replace any component stocks that may be excluded as a result of the corporate actions or mergers. The next review date is March 12 next year.

Olam's gearing still within a comfortable range: CEO

Olam International – Says its group borrowings are still within a comfortable range as its net gearing is still well below the limit agreed with banks. CEO and managing director Sunny Verghese, said Olam’s convenant with the banks for net gearing is five times net debt to equity ratio. It is at 3.17 times, so it has “enough headroom”. Olam has raised almost $750m of capital in the past five months, which included a $307m preferential share offering in April and a US$300m convertible bond issue in July despite tough credit conditions. Consequently, Olam has raised equity capital between last year and this year by 65% to $964m. Olam has made 13 acquisitions since the start of 2007, according to Bloomberg data, and more may follow in the next 12 months, which may need further capital-raising. Its stock currently has 'buy' or 'overweight' calls from brokerage houses such as JPMorgan, Nomura and DMG & Partners Securities in view of its strong profitability. But CIMB-GK recently downgraded the stock to 'underperform' from 'outperform' as it expects Olam's risk profile to increase as it expands upstream and downstream.

OCBC raises stake in Great Eastern

OCBC Bank – Has purchased 582,000 shares in Great Eastern Holdings (GEH) at $14.00 per share for a total consideration of about $8.2m. The purchase has increased its shareholding in GEH from 86.89% to 87.02%.

Source: Kim Eng

Labels:

Company News

Daily news - 11 Sep

Chartered updates Q3 guidance

Chartered Semiconductor Manufacturing - yesterday updated an earlier guidance for its current third quarter. In its customary mid-quarter update, the Singapore contract chipmaker reiterated its earlier Q3 forecast, but said that its revenue and plant capacity utilisation will be at the lower end of its previous guidance range. This is due to 'some changes in customer delivery schedules', the Temasek Holdings-linked company said in a statement. Chartered's third quarter ends on Sept 30.

Sembcorp Marine wins $99m tanker contract

SembCorp Marine – Sembawang Shipyard has won a $99 million contract to convert a 111,567 deadweight ton tanker into a floating, drilling, production, storage and offloading (FDPSO) vessel for Dynamic Producer, a unit of Brazil-based offshore service company Petroserv.

Keppel Offshore and Marine US unit Keppel AmFels, meanwhile, has picked up a US$1.4 million bonus for successful delivery of Scorpion Offshore's fourth jack-up rig.

Noble - Coalmine running normally