Keppel unit's US$780m deal to build four rigs at stake

Keppel Corp's US unit Keppel AmFels' US$780 million deal to build four jackup rigs for US contract drilling services provider Rowan Companies may be at stake as the company announced in a filing with the US Securities and Exchange Commission that it is suspending construction work on one rig and negotiating payment terms on all four. Reuters reported on Monday that Rowan will eliminate its dividend, cancel the building of a jackup rig and suspend construction of another one that its own manufacturing unit is building, as well as the last of four that is being built by Keppel AmFels. This is to counter a fall in oil services demand. It also warned of contract cancellations, blaming tight credit conditions. The company said customers have been asking to delay or terminate their obligations to purchase equipment under construction, notwithstanding firm contractual commitments. 'Keppel AmFels has no obligation to revise its contractual terms on the orders from Rowan and will only accede to requests that do not adversely impact its financial position,' said a Keppel spokesman yesterday. The contract, signed in November 2007, valued each of the rigs at US$195 million and includes the cost of equipment which will be provided by the owner.

CapitaMall Trust will pass tax rebates on to tenants

CapitaMall Trust (CMT), which has pumped around $55 million into revamping Lot One Shoppers' Mall at Choa Chu Kang, said yesterday that it will help its tenants cope with the economic slowdown through various ways. 'We want the tenants to survive so that we can survive,' president and CEO of CapitaLand Liew Mun Leong told the press. CapitaLand manages CMT through an indirect wholly owned subsidiary, CapitaMall Trust Management Limited (CMTML). With the government giving out a 40 per cent property tax rebate for industrial and commercial properties this year in the Budget, CapitaLand has said that it will pass on rebates totalling $41.5 million to tenants in retail, commercial and industrial properties. This could translate to an estimated 4 per cent drop in rents, said Mr Liew.

Source: Kim Eng

Saturday, January 31, 2009

Friday, January 30, 2009

Daily news - 30 Jan

Cosco announces second delivery reschedule

Cosco Corp (Singapore) yesterday announced another rescheduling of delivery dates for four 57,000 dwt bulk carriers, in what looks increasingly like a bizarre reversal of the way the contract wins were announced over the 18 months. Whereas the concern at the time was whether there would be sufficient capacity to fulfil surge of orders coming in, the fear now is whether the reschedulings will keep Cosco's yards busy enough. Cosco said last Friday that it has agreed to reschedule the delivery of seven ships from two sets of contracts signed in August and September 2007. And earlier this month, it announced a variation order under which two of an order for four vessels will be cancelled and the remaining two vessels will be delivered six months later than scheduled. The latest reschedulings are part of a 14-vessel contract worth US$525 million from shipowners in Turkey, Portugal, Greece and India, sealed in June 2007. These vessels were originally scheduled to be delivered between August 2008 and March 2010.

NOL container volume dives

Neptune Orient Lines (NOL) says container volume plunged 24 per cent year-on-year in its six-week Period 12 as demand fell on all major trade lanes. Container volume from Nov 15 to Dec 26, 2008 fell to 218,100 forty-foot equivalent units (FEUs) from 288,600 FEUs in the previous corresponding period. 'The decrease was a result of the rapid deterioration in demand on all major trade lanes and proactive capacity management to reduce costs,' NOL said. Average revenue per FEU, however, rose a marginal 3 per cent to US$2,921 from US$2,834. This was largely due to recovery of bunker fuel costs, NOL said. For full-year 2008, container volume rose 5 per cent to 2.46 million FEUs from 2.36 million in 2007. Average revenue per FEU for the whole year increased 11 per cent to US$3,033 from US$2,740 previously. Average revenue per FEU, however, started dropping off in the last quarter of the year, from a peak of US$3,186 in Period 10.

Source: Kim Eng

Cosco Corp (Singapore) yesterday announced another rescheduling of delivery dates for four 57,000 dwt bulk carriers, in what looks increasingly like a bizarre reversal of the way the contract wins were announced over the 18 months. Whereas the concern at the time was whether there would be sufficient capacity to fulfil surge of orders coming in, the fear now is whether the reschedulings will keep Cosco's yards busy enough. Cosco said last Friday that it has agreed to reschedule the delivery of seven ships from two sets of contracts signed in August and September 2007. And earlier this month, it announced a variation order under which two of an order for four vessels will be cancelled and the remaining two vessels will be delivered six months later than scheduled. The latest reschedulings are part of a 14-vessel contract worth US$525 million from shipowners in Turkey, Portugal, Greece and India, sealed in June 2007. These vessels were originally scheduled to be delivered between August 2008 and March 2010.

NOL container volume dives

Neptune Orient Lines (NOL) says container volume plunged 24 per cent year-on-year in its six-week Period 12 as demand fell on all major trade lanes. Container volume from Nov 15 to Dec 26, 2008 fell to 218,100 forty-foot equivalent units (FEUs) from 288,600 FEUs in the previous corresponding period. 'The decrease was a result of the rapid deterioration in demand on all major trade lanes and proactive capacity management to reduce costs,' NOL said. Average revenue per FEU, however, rose a marginal 3 per cent to US$2,921 from US$2,834. This was largely due to recovery of bunker fuel costs, NOL said. For full-year 2008, container volume rose 5 per cent to 2.46 million FEUs from 2.36 million in 2007. Average revenue per FEU for the whole year increased 11 per cent to US$3,033 from US$2,740 previously. Average revenue per FEU, however, started dropping off in the last quarter of the year, from a peak of US$3,186 in Period 10.

Source: Kim Eng

Labels:

Company News

Thursday, January 29, 2009

CIMB bank time deposits

For the benefits of some fixed income lovers, I just would like to bring up a SGD time deposits promotion which was promoted by CIMB Bank quite some time back. Below is a summary of terms and conditions for the promotion.

- Minimum deposit of SGD10,000 up to a maximum of SGD1,000,000

- Promotion applies to both new and existing customers

- Rates are subject to change in line with prevailing market conditions

- Premature withdrawals are not entitled to published rates and interest payments will be calculated at the Bank’s discretion

- All Singapore and Foreign Currency deposits placed in banks licensed by MAS are guaranteed by the Singapore Government until 2010

Frankly speaking, I don’t quite understand the third term which states that rates are subjected to change. You need to check with the bank whether the rate is locked once you deposit your money inside. If the rate is not locked, that means the rate is not guaranteed!

Labels:

Financial Stuffs

Saturday, January 24, 2009

Highlights of Budget 2009

By now I am sure everyone must have heard of the government package as announced on the Budget 2009. With the estimated economic growth of 5% to -2% in 2009, Singapore is expected to face the worst ever recession. In preparation of that, the main priority of the government is to save jobs with measures like Job Credits to help employers survive the ongoing crisis.

The other key focus of the Budget 2009 is to stimulate lending between banks amidst the credit crunch whereby loans are hard to get approved. Small Medium Enterprises (SME) are expected to benefit from the government moves to take on additional risks from their loans withdrawn at banks.

The other government initiatives are property tax rebate and corporate tax reduction to enhance cash flow in businesses, and double GST credits and personal income tax rebate to help Singaporeans. Finally the government is also spending on building infrastructures and upgrading of our country education system.

All in all, the measures will cost S$20.5 billion of which S$4.9 billion are to be withdrawn from our country reserves. The tables below highlight the key measures in summary as compiled by OCBC Investment Research group.

The other key focus of the Budget 2009 is to stimulate lending between banks amidst the credit crunch whereby loans are hard to get approved. Small Medium Enterprises (SME) are expected to benefit from the government moves to take on additional risks from their loans withdrawn at banks.

The other government initiatives are property tax rebate and corporate tax reduction to enhance cash flow in businesses, and double GST credits and personal income tax rebate to help Singaporeans. Finally the government is also spending on building infrastructures and upgrading of our country education system.

All in all, the measures will cost S$20.5 billion of which S$4.9 billion are to be withdrawn from our country reserves. The tables below highlight the key measures in summary as compiled by OCBC Investment Research group.

Labels:

Others

Friday, January 23, 2009

Daily news - 23 Jan

CapitaMall Trust DPU dips in Q4

CapitaMall Trust (CMT), Singapore's biggest property trust, said that distributable income for the fourth quarter fell 2.1 per cent as it faced higher finance costs. Distributable income for the three months ended Dec 31, 2008, was $61 million, down from $62.3 million in 2007. Distribution per unit (DPU) fell to 3.65 cents, from 3.82 cents in 2007. The trust is a unit of Singapore's largest property group, CapitaLand. Q4 net property income rose 11.1 per cent to $85.9 million, from $77.3 million in Q4 2007. Turnover was boosted by Atrium@Orchard, which CMT bought in August 2008, as well as higher revenue from new and renewed leases and from the completion of asset enhancement works. But finance costs rose 61.4 per cent to $30 million, causing a year-on- year drop in Q4 net income. The increased finance costs were partly due to the convertible bonds CMT issued to fund the Atrium acquisition. For the full 2008 financial year, distributable income rose 12.9 per cent to $238.4 million, up from $211.2 million in 2007. DPU rose to 14.29 cents from 13.34 cents.

MapletreeLog distributable income up 44% in Q4

Mapletree Logistics Trust (MapletreeLog) yesterday reported total distributable income of $28.3 million for the fourth quarter ended Dec 31, 2008, up 43.7 per cent from last year's corresponding period. But the distribution per unit (DPU) of 1.46 cents for the quarter was 18 per cent lower than Q4 2007's DPU of 1.78 cents. MapletreeLog attributed the drop to the full quarter impact from dilution following the rights issue completed in August last year. For the full year, DPU was 7.24 cents, 10.2 per cent higher than last year's 6.57 cents. Last year, Chua Tiow Chye, CEO of Mapletree Logistics Trust Management (MLTM), the Reit's manager, had said that the rights issue would leave MapletreeLog with a 'robust balance sheet' which would help make it 'well positioned to operate in the current more uncertain times'. Net property income for Q4 2008 rose by $9.8 million to $45.1 million. This was helped by a $12.1 million rise in gross revenue to $52.4 million due mainly to contributions from 11 new properties acquired during the year. There was also a $1.4 million fall in Q4 borrowing costs despite the enlarged portfolio. As at Dec 31, 2008, the trust's portfolio comprises 81 properties valued at $2.9 billion, including a $94.1 million revaluation gain. No new acquisitions have been planned for the near term.

Source: Kim Eng

CapitaMall Trust (CMT), Singapore's biggest property trust, said that distributable income for the fourth quarter fell 2.1 per cent as it faced higher finance costs. Distributable income for the three months ended Dec 31, 2008, was $61 million, down from $62.3 million in 2007. Distribution per unit (DPU) fell to 3.65 cents, from 3.82 cents in 2007. The trust is a unit of Singapore's largest property group, CapitaLand. Q4 net property income rose 11.1 per cent to $85.9 million, from $77.3 million in Q4 2007. Turnover was boosted by Atrium@Orchard, which CMT bought in August 2008, as well as higher revenue from new and renewed leases and from the completion of asset enhancement works. But finance costs rose 61.4 per cent to $30 million, causing a year-on- year drop in Q4 net income. The increased finance costs were partly due to the convertible bonds CMT issued to fund the Atrium acquisition. For the full 2008 financial year, distributable income rose 12.9 per cent to $238.4 million, up from $211.2 million in 2007. DPU rose to 14.29 cents from 13.34 cents.

MapletreeLog distributable income up 44% in Q4

Mapletree Logistics Trust (MapletreeLog) yesterday reported total distributable income of $28.3 million for the fourth quarter ended Dec 31, 2008, up 43.7 per cent from last year's corresponding period. But the distribution per unit (DPU) of 1.46 cents for the quarter was 18 per cent lower than Q4 2007's DPU of 1.78 cents. MapletreeLog attributed the drop to the full quarter impact from dilution following the rights issue completed in August last year. For the full year, DPU was 7.24 cents, 10.2 per cent higher than last year's 6.57 cents. Last year, Chua Tiow Chye, CEO of Mapletree Logistics Trust Management (MLTM), the Reit's manager, had said that the rights issue would leave MapletreeLog with a 'robust balance sheet' which would help make it 'well positioned to operate in the current more uncertain times'. Net property income for Q4 2008 rose by $9.8 million to $45.1 million. This was helped by a $12.1 million rise in gross revenue to $52.4 million due mainly to contributions from 11 new properties acquired during the year. There was also a $1.4 million fall in Q4 borrowing costs despite the enlarged portfolio. As at Dec 31, 2008, the trust's portfolio comprises 81 properties valued at $2.9 billion, including a $94.1 million revaluation gain. No new acquisitions have been planned for the near term.

Source: Kim Eng

Labels:

Company News

Thursday, January 22, 2009

Daily news - 22 Jan

Reits seek cut in payout to as low as 50%

Some Reit managers have urged the government to reduce the minimum payout ratio to Reit unitholders to as low as 50 per cent, from 90 per cent now, while still allowing the trusts to enjoy tax concessions. And they have even proposed a tax holiday on distributable income that they do not pay out. The suggestions are aimed at helping Reits conserve cash to get them through today's tight credit market conditions. Addressing concerns about a substantial loss of tax revenue, some Reit managers have suggested that the tax holiday on income that is not distributed could be limited to two years to help Reits ride out the current tough environment. Among the issues is also fairness in tax treatment in relation to other listed and non-listed entities. Some Reit unitholders may not be happy with a lower distribution payout ratio, as it will create more uncertainty about returns. This could be a bugbear, especially for corporate investors such as funds and insurance companies that have obligations to achieve target returns for their own investors and policy holders. (BT)

Analyst Comment:

The proposal to reduce minimum payout ratio to Reit unitholders and still retain tax concessions is one option that many Reit managers are exploring to gain more flexibility and build up its cash reserves under the current tough credit conditions. However, we believe that not all Reit managers would be willing or would need to substantially to adopt this measure. Firstly, some Reits had just ironed out the near term refinancing issues, such as Ascendas-Reit, which had done a placement and has obtained sufficient credit facilities to refinance its loans for the next two years; and Suntec Reit and CCT which had highlighted their strong relationship with banks. Secondly, reducing the minimum payout ratio will remove the basic premise for investing in Reits. Thirdly, reducing the payout ratio may also not help the Reits to build up its cash reserves in any big and meaningful way. In relation to the proposal to keep the tax exemptions even after cutting the payout, we believe the government will face a big hurdle as it will have to grapple with the issue of fairness to other listed and non-listed. (Anni Kum)

Gallant loses final appeal on disputed land

Gallant Venture – The Business Times has reported that Gallant Venture's subsidiaries have lost the final appeal to PT Rafflesia Matrawisatra over a land dispute. This has been an ongoing dispute for the last two years, with the Supreme Court of Indonesia in Jakarta pronouncing PT Rafflesia as the owners of the disputed lands of about 963,353 square metres. This judgment represents a sharp turnaround from previous legal proceedings, where PT Rafflesia's claims were earlier rejected by Bintan's Tanjung Pinang District Court in June 2007. The Riau High Court subsequently also affirmed the decision of the Tanjung Pinang District Court in January 2008.

To recap, in April 2006, PT Rafflesia sued Gallant's subsidiaries the ownership over 963,353 sq m of land on Bintan Resorts. Gallant , however, claims that it has land titles certifying that it owns some 863,353 sq m of the land in dispute. The outstanding 100,000 sq m was the subject of dispute between PT Rafflesia and BLR. This land is now occupied by part of the Resort. The court has ordered that the defendants relinquish their rights over the disputed lands within 14 days from the publication of the judgment and demolish any buildings on the lands. Gallant’s subsidiaries were also ordered to pay Rafflesia compensation of Rp. 33.25m for survey fee, Rp. 57.54bn (or S$7.7 million) for loss of income, and a cash charge of Rp 500,000, according to BT.

This dispute represents the sometimes murky nature of property transactions, in particular undeveloped land, which we have previously cited as a risk to Gallant’s land development plans. However, this dispute represents less than 0.5% of Gallant’s land portfolio in Bintan. While Gallant had previously said that it has no adverse financial exposure to the lawsuit because shareholder Parallax Venture Partners XXX Ltd (PVP) has agreed to indemnify in full any losses or damages as a result of this suit, the result of this lawsuit further highlights the risk of land development that Gallant faces. We will seek further clarification from the company.

Source: Kim Eng

Some Reit managers have urged the government to reduce the minimum payout ratio to Reit unitholders to as low as 50 per cent, from 90 per cent now, while still allowing the trusts to enjoy tax concessions. And they have even proposed a tax holiday on distributable income that they do not pay out. The suggestions are aimed at helping Reits conserve cash to get them through today's tight credit market conditions. Addressing concerns about a substantial loss of tax revenue, some Reit managers have suggested that the tax holiday on income that is not distributed could be limited to two years to help Reits ride out the current tough environment. Among the issues is also fairness in tax treatment in relation to other listed and non-listed entities. Some Reit unitholders may not be happy with a lower distribution payout ratio, as it will create more uncertainty about returns. This could be a bugbear, especially for corporate investors such as funds and insurance companies that have obligations to achieve target returns for their own investors and policy holders. (BT)

Analyst Comment:

The proposal to reduce minimum payout ratio to Reit unitholders and still retain tax concessions is one option that many Reit managers are exploring to gain more flexibility and build up its cash reserves under the current tough credit conditions. However, we believe that not all Reit managers would be willing or would need to substantially to adopt this measure. Firstly, some Reits had just ironed out the near term refinancing issues, such as Ascendas-Reit, which had done a placement and has obtained sufficient credit facilities to refinance its loans for the next two years; and Suntec Reit and CCT which had highlighted their strong relationship with banks. Secondly, reducing the minimum payout ratio will remove the basic premise for investing in Reits. Thirdly, reducing the payout ratio may also not help the Reits to build up its cash reserves in any big and meaningful way. In relation to the proposal to keep the tax exemptions even after cutting the payout, we believe the government will face a big hurdle as it will have to grapple with the issue of fairness to other listed and non-listed. (Anni Kum)

Gallant loses final appeal on disputed land

Gallant Venture – The Business Times has reported that Gallant Venture's subsidiaries have lost the final appeal to PT Rafflesia Matrawisatra over a land dispute. This has been an ongoing dispute for the last two years, with the Supreme Court of Indonesia in Jakarta pronouncing PT Rafflesia as the owners of the disputed lands of about 963,353 square metres. This judgment represents a sharp turnaround from previous legal proceedings, where PT Rafflesia's claims were earlier rejected by Bintan's Tanjung Pinang District Court in June 2007. The Riau High Court subsequently also affirmed the decision of the Tanjung Pinang District Court in January 2008.

To recap, in April 2006, PT Rafflesia sued Gallant's subsidiaries the ownership over 963,353 sq m of land on Bintan Resorts. Gallant , however, claims that it has land titles certifying that it owns some 863,353 sq m of the land in dispute. The outstanding 100,000 sq m was the subject of dispute between PT Rafflesia and BLR. This land is now occupied by part of the Resort. The court has ordered that the defendants relinquish their rights over the disputed lands within 14 days from the publication of the judgment and demolish any buildings on the lands. Gallant’s subsidiaries were also ordered to pay Rafflesia compensation of Rp. 33.25m for survey fee, Rp. 57.54bn (or S$7.7 million) for loss of income, and a cash charge of Rp 500,000, according to BT.

This dispute represents the sometimes murky nature of property transactions, in particular undeveloped land, which we have previously cited as a risk to Gallant’s land development plans. However, this dispute represents less than 0.5% of Gallant’s land portfolio in Bintan. While Gallant had previously said that it has no adverse financial exposure to the lawsuit because shareholder Parallax Venture Partners XXX Ltd (PVP) has agreed to indemnify in full any losses or damages as a result of this suit, the result of this lawsuit further highlights the risk of land development that Gallant faces. We will seek further clarification from the company.

Source: Kim Eng

Labels:

Company News

Wednesday, January 21, 2009

Daily news - 21 Jan

SPC reports 55.4% fall in earnings to $229.7m

Singapore Petroleum Company – Despite its profit warning last month, integrated Singapore Petroleum Company yesterday said that thanks to prudent inventory hedging, it managed to chalk up net profit of $229.7 million for FY 2008 - albeit 55.4 per cent lower than 2007's all-time record of $514.7 million. This was achieved on the back of a 26.9 per cent increase in revenue to $11.1 billion from 2007's $8.8 billion. Earnings per share, however, fell by 55.3 per cent to 44.61 cents from 99.9 cents a year ago. SPC - which is in upstream oil exploration and production (E&P) and downstream refining/marketing - is paying a final ordinary dividend of eight cents per share, bringing its total dividend payout for the year to 28 cents, or a payout ratio of about 63 per cent of net profit. Its chairman Choo Chiau Beng said that '2008 had been a most challenging year. Oil prices and refining margins climbed to record highs in mid-2008 and (then) fell sharply in the second half'. 'SPC had adopted a prudent risk management policy towards hedging the group's inventory. Thus, despite writing down inventory at year-end to account for the severe drop in oil prices, the group turned in a profitable performance for 2008.' SPC's results came even as crude oil prices yesterday slipped further to US$33 a barrel amidst a global economic slowdown, or more than US$100 down from the peak of US$147-plus a barrel last July.

KTT's profit up marginally

Keppel Telecommunications & Transportation (KTT) managed to achieve a marginal rise in net profit for 2008 despite lower contributions from associates, a poor showing from its network engineering unit and impairment and foreign exchange losses. The 12 months ended Dec 31, 2008, saw a net profit of $52 million, against 2007's $51.4 million. This translated to a 1.1 per cent increase in earnings per share for the year to 9.4 cents. Turnover rose 25 per cent to $128.87 million, helped largely by a revenue boom from its logistics arm, Keppel Logistics. KTT has recommended a first and final dividend of three cents per share, half of the amount in 2007.

Full-year net profit from the company's three divisions - logistics, network engineering and investments - stood at $16.76 million, $9.09 million and $26.18 million respectively. The logistics segment saw a 41 per cent jump in sales in 2008 to $101 million due to an increase in warehousing distribution and container handling services in Singapore and Foshan, China. Contribution from TradeOneAsia, a company which KTT acquired in June 2007, also helped lift the division's full-year sales, the firm said in a regulatory filing. However, turnover for KTT's network engineering unit fell 11 per cent to $27.4 million due to poorer performances in Malaysia and Thailand. Net profit from investments fell 15 per cent to $26.1 million year-on-year due to higher taxes, as well as lower contributions from associated companies such as MobileOne. M1, which is 20 per cent owned by KTT, last week reported a 12.6 per cent drop in 2008 net income to $150.1 million due to heightened competition with the dawn of mobile number portability last year.

Mandarin Oriental sells Macau hotel stake for HK$1.6 billion

Mandarin Oriental International, a member of the Jardine Matheson Group, said yesterday that it has agreed to sell its 50 per cent interest in the 416-room Mandarin Oriental in Macau for HK$1.6 billion (S$307 million). The company will sell its stake to Sociedade de Turismo e Diversoes de Macau (STDM). Mandarin Oriental's partner in the hotel, Shun Tak Holdings, will also sell its 50 per cent stake to STDM. The carrying value of the group's 50 per cent stake in the hotel as at Dec 31, 2007 was US$15.7 million and its contribution to the group's Ebitda (earnings before interest, tax, depreciation and amortisation) in 2007 was US$10.2 million, the company said. On the sale's completion, Mandarin Oriental will receive proceeds of about US$90 million with a post-tax gain of about US$75 million, which will be recognised in 2009. The proceeds will be used for the group's general corporate purposes, it said. Completion of the sale is expected by the end of May 2009. The sale is conditional upon approval of the arrangements by Shun Tak's and STDM's respective shareholders as well as other regulatory formalities. As part of the agreement to sell, Mandarin Oriental and Shun Tak also have the right to participate equally in any increase in the hotel site's value - over and above the agreed value of HK$1.6 billion - which might arise if the property were to be redeveloped or sold to a third party in the future. The property will be rebranded by STDM. However, under a short-term management arrangement, Mandarin Oriental will continue to manage the hotel for up to two years to ensure a smooth transition.

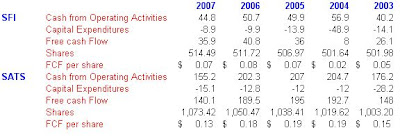

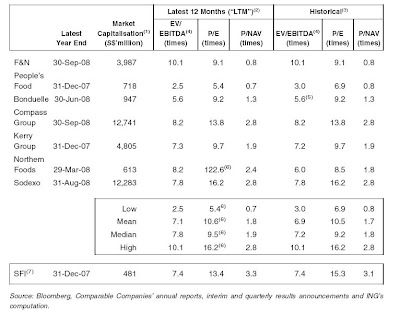

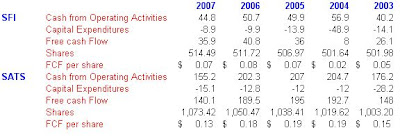

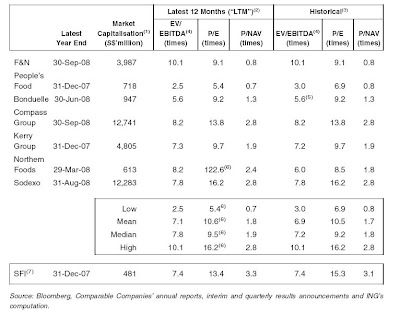

SATS shareholders okay SFI takover

Singapore Airport Terminal Services (SATS) & Singapore Food Industries (SFI) – Minority shareholders of SATS have given their company the nod to buy a controlling stake in SFI from Temasek Holdings. Almost 70 per cent of minority votes cast at a meeting yesterday were in favour of SATS buying 359.7 million SFI ordinary shares equivalent to a 69.6 per cent stake. The offer price is 93 cents a share - a total of $334.5 million. The move will trigger a general offer for all 157.1 million SFI shares, which could lift the total bill to $509 million. SATS chief executive Clement Woon said SFI shareholders will get the offer document within two weeks. 'We only needed 50 per cent plus one vote to get this through, but what we got is overwhelming support,' he said. 'There is still a lot of work to do. We will move ahead with the general offer first, then start work on our integration plan.' SATS' controlling shareholder Singapore Airlines, with a stake of just over 80 per cent, abstained from yesterday's vote, leaving minorities to decide. SATS needs to secure at least 90 per cent of SFI's shares to de-list the food company and 100 per cent for total control.

Source: Kim Eng

Singapore Petroleum Company – Despite its profit warning last month, integrated Singapore Petroleum Company yesterday said that thanks to prudent inventory hedging, it managed to chalk up net profit of $229.7 million for FY 2008 - albeit 55.4 per cent lower than 2007's all-time record of $514.7 million. This was achieved on the back of a 26.9 per cent increase in revenue to $11.1 billion from 2007's $8.8 billion. Earnings per share, however, fell by 55.3 per cent to 44.61 cents from 99.9 cents a year ago. SPC - which is in upstream oil exploration and production (E&P) and downstream refining/marketing - is paying a final ordinary dividend of eight cents per share, bringing its total dividend payout for the year to 28 cents, or a payout ratio of about 63 per cent of net profit. Its chairman Choo Chiau Beng said that '2008 had been a most challenging year. Oil prices and refining margins climbed to record highs in mid-2008 and (then) fell sharply in the second half'. 'SPC had adopted a prudent risk management policy towards hedging the group's inventory. Thus, despite writing down inventory at year-end to account for the severe drop in oil prices, the group turned in a profitable performance for 2008.' SPC's results came even as crude oil prices yesterday slipped further to US$33 a barrel amidst a global economic slowdown, or more than US$100 down from the peak of US$147-plus a barrel last July.

KTT's profit up marginally

Keppel Telecommunications & Transportation (KTT) managed to achieve a marginal rise in net profit for 2008 despite lower contributions from associates, a poor showing from its network engineering unit and impairment and foreign exchange losses. The 12 months ended Dec 31, 2008, saw a net profit of $52 million, against 2007's $51.4 million. This translated to a 1.1 per cent increase in earnings per share for the year to 9.4 cents. Turnover rose 25 per cent to $128.87 million, helped largely by a revenue boom from its logistics arm, Keppel Logistics. KTT has recommended a first and final dividend of three cents per share, half of the amount in 2007.

Full-year net profit from the company's three divisions - logistics, network engineering and investments - stood at $16.76 million, $9.09 million and $26.18 million respectively. The logistics segment saw a 41 per cent jump in sales in 2008 to $101 million due to an increase in warehousing distribution and container handling services in Singapore and Foshan, China. Contribution from TradeOneAsia, a company which KTT acquired in June 2007, also helped lift the division's full-year sales, the firm said in a regulatory filing. However, turnover for KTT's network engineering unit fell 11 per cent to $27.4 million due to poorer performances in Malaysia and Thailand. Net profit from investments fell 15 per cent to $26.1 million year-on-year due to higher taxes, as well as lower contributions from associated companies such as MobileOne. M1, which is 20 per cent owned by KTT, last week reported a 12.6 per cent drop in 2008 net income to $150.1 million due to heightened competition with the dawn of mobile number portability last year.

Mandarin Oriental sells Macau hotel stake for HK$1.6 billion

Mandarin Oriental International, a member of the Jardine Matheson Group, said yesterday that it has agreed to sell its 50 per cent interest in the 416-room Mandarin Oriental in Macau for HK$1.6 billion (S$307 million). The company will sell its stake to Sociedade de Turismo e Diversoes de Macau (STDM). Mandarin Oriental's partner in the hotel, Shun Tak Holdings, will also sell its 50 per cent stake to STDM. The carrying value of the group's 50 per cent stake in the hotel as at Dec 31, 2007 was US$15.7 million and its contribution to the group's Ebitda (earnings before interest, tax, depreciation and amortisation) in 2007 was US$10.2 million, the company said. On the sale's completion, Mandarin Oriental will receive proceeds of about US$90 million with a post-tax gain of about US$75 million, which will be recognised in 2009. The proceeds will be used for the group's general corporate purposes, it said. Completion of the sale is expected by the end of May 2009. The sale is conditional upon approval of the arrangements by Shun Tak's and STDM's respective shareholders as well as other regulatory formalities. As part of the agreement to sell, Mandarin Oriental and Shun Tak also have the right to participate equally in any increase in the hotel site's value - over and above the agreed value of HK$1.6 billion - which might arise if the property were to be redeveloped or sold to a third party in the future. The property will be rebranded by STDM. However, under a short-term management arrangement, Mandarin Oriental will continue to manage the hotel for up to two years to ensure a smooth transition.

SATS shareholders okay SFI takover

Singapore Airport Terminal Services (SATS) & Singapore Food Industries (SFI) – Minority shareholders of SATS have given their company the nod to buy a controlling stake in SFI from Temasek Holdings. Almost 70 per cent of minority votes cast at a meeting yesterday were in favour of SATS buying 359.7 million SFI ordinary shares equivalent to a 69.6 per cent stake. The offer price is 93 cents a share - a total of $334.5 million. The move will trigger a general offer for all 157.1 million SFI shares, which could lift the total bill to $509 million. SATS chief executive Clement Woon said SFI shareholders will get the offer document within two weeks. 'We only needed 50 per cent plus one vote to get this through, but what we got is overwhelming support,' he said. 'There is still a lot of work to do. We will move ahead with the general offer first, then start work on our integration plan.' SATS' controlling shareholder Singapore Airlines, with a stake of just over 80 per cent, abstained from yesterday's vote, leaving minorities to decide. SATS needs to secure at least 90 per cent of SFI's shares to de-list the food company and 100 per cent for total control.

Source: Kim Eng

Labels:

Company News

Tuesday, January 20, 2009

Daily news - 20 Jan

MAS gives REITs clarity on Leverage ratios

REIT managers here have been given more breathing space on borrowing limits by the MAS, which has clarified how downward revaluations of properties should be treated. MAS confirmed that if the aggregate leverage has gone up because of a decline in property values, it will not amount to a breach of leverage limits. MAS also pointed out that refinancing of existing debt by a REIT is not to be construed as incurring additional borrowings. MAS also said that it will permit REITs to raise debt for refinancing purposes earlier than the actual maturity of the debt to be refinanced, without having to include such funds raised in the aggregate leverage limit, provided that the funds are set aside solely for the purpose of repaying the maturing debt. This clarification would ease the pressure on these REITs to recapitalise through raising fresh equity and reduce pressure on the unit price of these REITs. However, ratings agencies will continue to be nervous about property depreciation. Any downward revaluation of the underlying property would raise the loan-to-valuation ratios as far as banks lending to REITs are concerned. In a separate development, MAS is understood to have sought feedback recently on whether the current minimum distribution payout ratio for S-REITs should be lowered, from 90 per cent of distributable income currently to, say, 75-80 per cent. This is in response to a need to conserve cash.

Source: Kim Eng

REIT managers here have been given more breathing space on borrowing limits by the MAS, which has clarified how downward revaluations of properties should be treated. MAS confirmed that if the aggregate leverage has gone up because of a decline in property values, it will not amount to a breach of leverage limits. MAS also pointed out that refinancing of existing debt by a REIT is not to be construed as incurring additional borrowings. MAS also said that it will permit REITs to raise debt for refinancing purposes earlier than the actual maturity of the debt to be refinanced, without having to include such funds raised in the aggregate leverage limit, provided that the funds are set aside solely for the purpose of repaying the maturing debt. This clarification would ease the pressure on these REITs to recapitalise through raising fresh equity and reduce pressure on the unit price of these REITs. However, ratings agencies will continue to be nervous about property depreciation. Any downward revaluation of the underlying property would raise the loan-to-valuation ratios as far as banks lending to REITs are concerned. In a separate development, MAS is understood to have sought feedback recently on whether the current minimum distribution payout ratio for S-REITs should be lowered, from 90 per cent of distributable income currently to, say, 75-80 per cent. This is in response to a need to conserve cash.

Source: Kim Eng

Labels:

Company News

Monday, January 19, 2009

Daily news - 19 Jan

Capitala in financing agreement

CapitaLand's Abu Dhabi unit Capitala has entered into an agreement to provide future buyers of its maiden project in the city with up to 85 per cent financing. Under the finance agreement with Abu Dhabi Finance, buyers of homes in Capitala's US$5-6 billion Arzanah development will qualify for loans of up to 85 per cent of the property's value; with loan terms of up to 30 years, flexible repayment methods and debt service ratios of up to 55 per cent. Traditionally, homebuyers in Abu Dhabi pay for their properties upfront. Capitala is 49 per cent owned by CapitaLand, Singapore's largest property developer, while the remaining 51 per cent stake is held by Mubadala Development Company, Abu Dhabi's state-owned investment vehicle.

Source: Kim Eng

CapitaLand's Abu Dhabi unit Capitala has entered into an agreement to provide future buyers of its maiden project in the city with up to 85 per cent financing. Under the finance agreement with Abu Dhabi Finance, buyers of homes in Capitala's US$5-6 billion Arzanah development will qualify for loans of up to 85 per cent of the property's value; with loan terms of up to 30 years, flexible repayment methods and debt service ratios of up to 55 per cent. Traditionally, homebuyers in Abu Dhabi pay for their properties upfront. Capitala is 49 per cent owned by CapitaLand, Singapore's largest property developer, while the remaining 51 per cent stake is held by Mubadala Development Company, Abu Dhabi's state-owned investment vehicle.

Source: Kim Eng

Labels:

Company News

Sunday, January 18, 2009

Buying an endowment plan

As much as possible I don’t usually recommend people taking up an endowment plan. In my opinion, you can achieve the same objectives if you do the saving yourself. To have an idea of the message that I am trying to relay across, I suggest you read my article on the Best endowment plan first.

Now if you are aware of the pitfalls of an endowment plan but still decided that such a forced saving plan is suitable for you, nobody can really stop you. Ultimately a lousy saving plan is still better than having no plan at all. In this article, I am going to share some of the factors that you need to look out for before deciding on a plan.

Endowment is supposed to be a saving plan. Therefore one should not rely on to it as a mean for protection. As such, I will ignore the protection portion in the rest of this article. Take the protection coverage as an added bonus but not as a requirement.

Before deciding on a regular premium endowment plan, you need to ask yourself how much you are willing to save each month. Of course it does not make sense to sign up for an expensive plan if you cannot afford it. With the amount that you are comfortable with, request an advisor to introduce you a plan and to generate you a Benefit Illustration (BI) of the plan. A typical BI will look something like the picture below.

There are two sections of a BI which are the death benefit and cash value. As I have said, I will skip the death benefit section which is too immaterial to consider. At the cash value section, there are three important columns that you should focus on. They are the age of policy, premiums paid and guaranteed amount. I think the first two columns are self explanatory. The guaranteed cash section is the most important part of a BI. It shows the minimum amount that you will receive upon termination or on maturity of your policy. Also from these three columns, you can know at what age your endowment plan can breakeven. For the above plan, the breakeven age is only after 20 years. The other sections are the non-guaranteed sections which are based on certain projections. One should ignore these sections as they are just estimates and are not guaranteed.

Finally when comparing endowment plans, one should compute the guaranteed Yield To Maturity (YTM) of the plan. YTM is the so called return on your premiums paid. Obviously the higher the guaranteed YTM for the same period, the better is the plan. Let me show two plans available in the market. Can you guess which plan is better in terms of guaranteed YTM?

Plan A

Period of premium payment: 15 years

Maturity year: 20 year

Annual premium: $2,801

Total premiums paid at end of 15 years: $42,015

Maturity value: $66,009

Components of maturity value: $65,000 (guaranteed) and $1,009 (non-guaranteed)

Plan B

Period of premium payment: 12 years

Maturity year: 21 year

Annual premium: $2,847

Total premiums paid at end of 12 years: $34,166

Maturity value: $64,558

Components of maturity value: $40,000 (guaranteed) and $24,558 (non-guaranteed)

At first glance Plan B looks better because you are paying lesser premiums and for a shorter period. But if you calculate their guaranteed YTM, Plan A has a much higher guaranteed yield than Plan B. If you can afford to pay $2800 per annum, why settle for a plan which gives you a lesser return? You can compute the YTM of both plans with MS Excel XIRR function. Take a look at my example on how to use the function.

Attached below is an illustration of calculating the YTM of those plans in MS Excel.

In conclusion, it is important that you look at the guaranteed portion of an endowment plan if you decide to take up one. Compare the YTM of other plans with similar maturing period and pick the one which gives a higher guaranteed rate. Of course you may want to compare with the yield of a risk free rate of similar maturity to see if it is worthwhile to sign up for such a plan.

Now if you are aware of the pitfalls of an endowment plan but still decided that such a forced saving plan is suitable for you, nobody can really stop you. Ultimately a lousy saving plan is still better than having no plan at all. In this article, I am going to share some of the factors that you need to look out for before deciding on a plan.

Endowment is supposed to be a saving plan. Therefore one should not rely on to it as a mean for protection. As such, I will ignore the protection portion in the rest of this article. Take the protection coverage as an added bonus but not as a requirement.

Before deciding on a regular premium endowment plan, you need to ask yourself how much you are willing to save each month. Of course it does not make sense to sign up for an expensive plan if you cannot afford it. With the amount that you are comfortable with, request an advisor to introduce you a plan and to generate you a Benefit Illustration (BI) of the plan. A typical BI will look something like the picture below.

There are two sections of a BI which are the death benefit and cash value. As I have said, I will skip the death benefit section which is too immaterial to consider. At the cash value section, there are three important columns that you should focus on. They are the age of policy, premiums paid and guaranteed amount. I think the first two columns are self explanatory. The guaranteed cash section is the most important part of a BI. It shows the minimum amount that you will receive upon termination or on maturity of your policy. Also from these three columns, you can know at what age your endowment plan can breakeven. For the above plan, the breakeven age is only after 20 years. The other sections are the non-guaranteed sections which are based on certain projections. One should ignore these sections as they are just estimates and are not guaranteed.

Finally when comparing endowment plans, one should compute the guaranteed Yield To Maturity (YTM) of the plan. YTM is the so called return on your premiums paid. Obviously the higher the guaranteed YTM for the same period, the better is the plan. Let me show two plans available in the market. Can you guess which plan is better in terms of guaranteed YTM?

Plan A

Period of premium payment: 15 years

Maturity year: 20 year

Annual premium: $2,801

Total premiums paid at end of 15 years: $42,015

Maturity value: $66,009

Components of maturity value: $65,000 (guaranteed) and $1,009 (non-guaranteed)

Plan B

Period of premium payment: 12 years

Maturity year: 21 year

Annual premium: $2,847

Total premiums paid at end of 12 years: $34,166

Maturity value: $64,558

Components of maturity value: $40,000 (guaranteed) and $24,558 (non-guaranteed)

At first glance Plan B looks better because you are paying lesser premiums and for a shorter period. But if you calculate their guaranteed YTM, Plan A has a much higher guaranteed yield than Plan B. If you can afford to pay $2800 per annum, why settle for a plan which gives you a lesser return? You can compute the YTM of both plans with MS Excel XIRR function. Take a look at my example on how to use the function.

Attached below is an illustration of calculating the YTM of those plans in MS Excel.

In conclusion, it is important that you look at the guaranteed portion of an endowment plan if you decide to take up one. Compare the YTM of other plans with similar maturing period and pick the one which gives a higher guaranteed rate. Of course you may want to compare with the yield of a risk free rate of similar maturity to see if it is worthwhile to sign up for such a plan.

Labels:

Insurance

Friday, January 16, 2009

Daily news - 16 Jan

Developer sales plumb new depths

Home sales hit record lows in 2008 as developers sold just 4,351 homes, representing the lowest figure in at least 10 years (previous lows were 5,156 and 5,520 units in 2003 and 1998 respectively). The figure is also significantly lower than the annual 10-year average of 8,200 units. Last month, developers recorded just 131 transactions, with only 157 units being launched. Some developers are still preparing developments for launch. UOL is expected to launch a 646-unit development at Simei Street 4, billed as a luxury condominium for upgraders in 1H09. Frasers Centrepoint is also said to be preparing to launch Caspian, a 712-unit development on Boon Lay Way. Far East Organisation is said to be readying its launch of a development in Choa Chu Kang this year.

Sembcorp looks set to win billion dollar Oman deal

SembCorp Industries looks on course to win its second multi-billion dollar power and desalination project in the Middle East, having reportedly just been named 'preferred bidder' for the US$1 billion-plus Salalah independent water and power project (IWPP) in Oman. Specialist publication MEED, or the Middle East Business Intelligence, reported this on Wednesday, following an earlier report this week by Infrastructure Journal which said that Omani officials had told Sembcorp that it would be named as the IWPP's preferred bidder 'imminently'. It suggests that Sembcorp's joint venture with Oman Investment Corporation (OIC) has been chosen from the final grouping of three contenders for the project. Sembcorp when contacted yesterday declined comment at this time. Its bid to undertake the Salalah IWPP began early last year, with the Omani government whittling down a list of eight prequalified international groups to just three in July.

Source: Kim Eng

Home sales hit record lows in 2008 as developers sold just 4,351 homes, representing the lowest figure in at least 10 years (previous lows were 5,156 and 5,520 units in 2003 and 1998 respectively). The figure is also significantly lower than the annual 10-year average of 8,200 units. Last month, developers recorded just 131 transactions, with only 157 units being launched. Some developers are still preparing developments for launch. UOL is expected to launch a 646-unit development at Simei Street 4, billed as a luxury condominium for upgraders in 1H09. Frasers Centrepoint is also said to be preparing to launch Caspian, a 712-unit development on Boon Lay Way. Far East Organisation is said to be readying its launch of a development in Choa Chu Kang this year.

Sembcorp looks set to win billion dollar Oman deal

SembCorp Industries looks on course to win its second multi-billion dollar power and desalination project in the Middle East, having reportedly just been named 'preferred bidder' for the US$1 billion-plus Salalah independent water and power project (IWPP) in Oman. Specialist publication MEED, or the Middle East Business Intelligence, reported this on Wednesday, following an earlier report this week by Infrastructure Journal which said that Omani officials had told Sembcorp that it would be named as the IWPP's preferred bidder 'imminently'. It suggests that Sembcorp's joint venture with Oman Investment Corporation (OIC) has been chosen from the final grouping of three contenders for the project. Sembcorp when contacted yesterday declined comment at this time. Its bid to undertake the Salalah IWPP began early last year, with the Omani government whittling down a list of eight prequalified international groups to just three in July.

Source: Kim Eng

Labels:

Company News

Thursday, January 15, 2009

Daily news - 15 Jan

Ezra Q1 profit falls 93% on lack of one-time gain

Ezra Holdings yesterday said that net profit for its first quarter to Nov 30 fell 93 per cent to US$9.3 million from US$138.9 million in the year-ago period. Sales were up 149 per cent to US$113 million but other operating income fell to negative US$10.6 million from US$140.3 million, due to non-recurring gains of US$146.3 million in Q1 2008 from the disposal of interest in a subsidiary, the company said. It also disclosed a US$3.4 million increase in net foreign exchange loss for the reported quarter. Earnings per share was 1.60 US cents, from 23.92 US cents a year ago. Sales for the quarter rose US$67.6 million, with US$38 million coming from its new energy services division; US$19.9 million from its marine services division due to an increase in procurement and equipment supply and engineering activities in Vietnam; and US$9.7 million from the offshore support services, helped by revenue recognised from newly delivered tugs. The company held cash and cash equivalents of US$92.8 million as at end November, while net cash from operating activities was US$11.6 million. The company had secured and unsecured debt due within a year of US$121.7 million, with another US$99.7 million repayable after one year. It had net assets of US$363.9 million, down slightly quarter on quarter but up 45 per cent on the previous year.

Source: Kim Eng

Ezra Holdings yesterday said that net profit for its first quarter to Nov 30 fell 93 per cent to US$9.3 million from US$138.9 million in the year-ago period. Sales were up 149 per cent to US$113 million but other operating income fell to negative US$10.6 million from US$140.3 million, due to non-recurring gains of US$146.3 million in Q1 2008 from the disposal of interest in a subsidiary, the company said. It also disclosed a US$3.4 million increase in net foreign exchange loss for the reported quarter. Earnings per share was 1.60 US cents, from 23.92 US cents a year ago. Sales for the quarter rose US$67.6 million, with US$38 million coming from its new energy services division; US$19.9 million from its marine services division due to an increase in procurement and equipment supply and engineering activities in Vietnam; and US$9.7 million from the offshore support services, helped by revenue recognised from newly delivered tugs. The company held cash and cash equivalents of US$92.8 million as at end November, while net cash from operating activities was US$11.6 million. The company had secured and unsecured debt due within a year of US$121.7 million, with another US$99.7 million repayable after one year. It had net assets of US$363.9 million, down slightly quarter on quarter but up 45 per cent on the previous year.

Source: Kim Eng

Labels:

Company News

Tuesday, January 13, 2009

Daily news - 13 Jan

DBS denies exposure to Kuwait firm

DBS Group said yesterday it has no exposure to a troubled Middle Eastern bank, contrary to media reports and market speculation that dragged its shares down as much as 3.9 per cent during the day. The counter was hit amid speculation that DBS could be exposed to Kuwait's Global Investment House, which has defaulted on most of its debt. Denying any such exposure, DBS also said in a statement issued after the market closed yesterday that it has 'maintained the strength of its balance sheet through careful management of credit, market and operational risks, and continues to vigilantly monitor credit trends in its loan portfolio'. DBS shares finished the day 3.7 per cent lower at $8.11. Global Investment, Kuwait's largest investment bank, said on Thursday last week that it has defaulted on most its loan repayments because the gridlock in global credit markets has hampered the refinancing of short-term debt. Global said that it is 'in default on the majority of its financial indebtedness' after a capital-repayment default on a syndicated facility in the second half of December 2008 and because of a 'cross-default provision'. It also said it is 'committed' to completing debt restructuring 'as soon as is practicable.'

Source: Kim Eng

DBS Group said yesterday it has no exposure to a troubled Middle Eastern bank, contrary to media reports and market speculation that dragged its shares down as much as 3.9 per cent during the day. The counter was hit amid speculation that DBS could be exposed to Kuwait's Global Investment House, which has defaulted on most of its debt. Denying any such exposure, DBS also said in a statement issued after the market closed yesterday that it has 'maintained the strength of its balance sheet through careful management of credit, market and operational risks, and continues to vigilantly monitor credit trends in its loan portfolio'. DBS shares finished the day 3.7 per cent lower at $8.11. Global Investment, Kuwait's largest investment bank, said on Thursday last week that it has defaulted on most its loan repayments because the gridlock in global credit markets has hampered the refinancing of short-term debt. Global said that it is 'in default on the majority of its financial indebtedness' after a capital-repayment default on a syndicated facility in the second half of December 2008 and because of a 'cross-default provision'. It also said it is 'committed' to completing debt restructuring 'as soon as is practicable.'

Source: Kim Eng

Labels:

Company News

Monday, January 12, 2009

Daily news - 12 Jan

Training, not layoffs, is the SATS recipe

Singapore Airport Terminal Services (SATS) – The catering arm of SATS is unlikely to resort to lay-offs, choosing instead to cross-train its people and tap synergies to boost productivity in these trying times. 'We do a lot of in-house training and re-skilling of people. We are proactively cross-training people so we have a more dynamic workforce,' said executive chef John Sloane, adding that retrenchment is not on the agenda. Chefs from SATS' majority-owned subsidiary Country Foods, which manufactures and distributes frozen and chilled food products, now sometimes help out when there are manpower constraints - and vice versa. If the proposed acquisition of Singapore Food Industries (SFI) goes through, it will be another string to the bow for SATS. SATS has proposed the acquisition of a 69.62 per cent stake in SFI for $334.5 million from Temasek's wholly-owned subsidiary Ambrosia Investment.

Thailand's AIS won't be selling iPhone

Advanced Info Service, Thailand's largest mobile phone operator, said on Friday it had failed to reach agreement with Apple Inc to offer the 3G iPhone in the Thai market. 'We don't accept Apple's proposal to bring iPhone to the Thai market because we don't think it will be good for us in terms of business,' chief executive Vikrom Sriprataks told reporters over the weekend. AIS's smaller rival, True Move PCL, a unit of True Corp plans to launch the 3G iPhone in Thailand from Jan 16, making it the first operator to sell the new phone in the fast-growing market.

Source: Kim Eng

Singapore Airport Terminal Services (SATS) – The catering arm of SATS is unlikely to resort to lay-offs, choosing instead to cross-train its people and tap synergies to boost productivity in these trying times. 'We do a lot of in-house training and re-skilling of people. We are proactively cross-training people so we have a more dynamic workforce,' said executive chef John Sloane, adding that retrenchment is not on the agenda. Chefs from SATS' majority-owned subsidiary Country Foods, which manufactures and distributes frozen and chilled food products, now sometimes help out when there are manpower constraints - and vice versa. If the proposed acquisition of Singapore Food Industries (SFI) goes through, it will be another string to the bow for SATS. SATS has proposed the acquisition of a 69.62 per cent stake in SFI for $334.5 million from Temasek's wholly-owned subsidiary Ambrosia Investment.

Thailand's AIS won't be selling iPhone

Advanced Info Service, Thailand's largest mobile phone operator, said on Friday it had failed to reach agreement with Apple Inc to offer the 3G iPhone in the Thai market. 'We don't accept Apple's proposal to bring iPhone to the Thai market because we don't think it will be good for us in terms of business,' chief executive Vikrom Sriprataks told reporters over the weekend. AIS's smaller rival, True Move PCL, a unit of True Corp plans to launch the 3G iPhone in Thailand from Jan 16, making it the first operator to sell the new phone in the fast-growing market.

Source: Kim Eng

Labels:

Company News

Saturday, January 10, 2009

Daily news - 9 Jan

NOL moving Americas HQ to Arizona

Neptune Orient Lines (NOL) is relocating its Americas regional headquarters to the greater Phoenix area in Arizona from its present location in Oakland, California, during the second half of the year. The move, mainly to cut costs, is expected to be completed by the third quarter. 'The headquarters shift is part of NOL's global strategy to place its cost structure on a more sustainable footing in the face of the current economic downturn, while continuing to provide the highest standards of service to its customers,' NOL said. 'We're excited to announce that Arizona will be the new home for our regional headquarters,' said NOL's regional president for the Americas, John Bowe. 'The greater Phoenix area will be a cost-effective base of operations for us and we're going to a state that is well-known for its support and encouragement of business.' The relocation is the latest in a series of cost-saving measures NOL has put in place over the past few months amid the deepening global slowdown in container trade. Other initiatives undertaken by the group include reducing capacity in its major ocean trade lanes, cutting jobs, laying up ships and restructuring its logistics business.

Source: Kim Eng

Neptune Orient Lines (NOL) is relocating its Americas regional headquarters to the greater Phoenix area in Arizona from its present location in Oakland, California, during the second half of the year. The move, mainly to cut costs, is expected to be completed by the third quarter. 'The headquarters shift is part of NOL's global strategy to place its cost structure on a more sustainable footing in the face of the current economic downturn, while continuing to provide the highest standards of service to its customers,' NOL said. 'We're excited to announce that Arizona will be the new home for our regional headquarters,' said NOL's regional president for the Americas, John Bowe. 'The greater Phoenix area will be a cost-effective base of operations for us and we're going to a state that is well-known for its support and encouragement of business.' The relocation is the latest in a series of cost-saving measures NOL has put in place over the past few months amid the deepening global slowdown in container trade. Other initiatives undertaken by the group include reducing capacity in its major ocean trade lanes, cutting jobs, laying up ships and restructuring its logistics business.

Source: Kim Eng

Labels:

Company News

Friday, January 9, 2009

Singapore Treasury Bills

What are Treasury Bills?

SGS Treasury Bills (T-Bills) are short-term debt securities that are issued by the Singapore Government. The tenors for T-Bills range from 7 days to 1 year.

T-Bills are a useful and low risk investment tool that investors could take advantage of.

Why Invest in Treasury Bills?

Why leave the rest of the money in your savings deposits when you could earn higher interest investing in T-Bills? The current yield for a 3 month T-Bill is better than the local banks' savings rate.

T-Bills offer flexibility with no lock-in period; thus you will be able to liquidate your investment whenever you need the money. You can even choose to liquidate just part of it (in multiples of 1000 units).

While some fixed deposits might offer higher interest as a promotion, they usually require you to lock up your deposit for the entire tenure, and require a minimum investment of quite a significant sum. Unlike those, T-Bills only require a minimum investment of less than $1000. If you are unwilling to lock-up a huge chunk of your funds in fixed deposits, T-Bills could be suitable for you.

For equities investors, T-Bills could come in useful during occasions when you are standing on the sidelines and waiting for the next opportunity. Make your money work harder for you by parking your spare cash in T-Bills to earn some interest.

How do Treasury Bills work?

T-Bills have a fixed maturity date and have zero coupons. During the tenor, the owner of the T-Bills will not receive any interest payments. Instead, the T-Bills are sold at a discount and redeemed at par value upon maturity.

For example, if you purchase 1000 units of a 1-year T-Bill at a yield of 1% per annum, you will only need to pay $990 and you will receive $1000 upon maturity a year later.

Similarly for 1000 units of an 86-day T-Bill at a yield of 1% per annum, you will need to pay $998 and you will receive $1000 upon maturity 3 months later.

To find out more on Treasury Bills, visit our website, email dcm@phillip.com.sg or call 6531 1603.

Article extracted from Phillip Capital

SGS Treasury Bills (T-Bills) are short-term debt securities that are issued by the Singapore Government. The tenors for T-Bills range from 7 days to 1 year.

T-Bills are a useful and low risk investment tool that investors could take advantage of.

Why Invest in Treasury Bills?

Why leave the rest of the money in your savings deposits when you could earn higher interest investing in T-Bills? The current yield for a 3 month T-Bill is better than the local banks' savings rate.

T-Bills offer flexibility with no lock-in period; thus you will be able to liquidate your investment whenever you need the money. You can even choose to liquidate just part of it (in multiples of 1000 units).

While some fixed deposits might offer higher interest as a promotion, they usually require you to lock up your deposit for the entire tenure, and require a minimum investment of quite a significant sum. Unlike those, T-Bills only require a minimum investment of less than $1000. If you are unwilling to lock-up a huge chunk of your funds in fixed deposits, T-Bills could be suitable for you.

For equities investors, T-Bills could come in useful during occasions when you are standing on the sidelines and waiting for the next opportunity. Make your money work harder for you by parking your spare cash in T-Bills to earn some interest.

How do Treasury Bills work?

T-Bills have a fixed maturity date and have zero coupons. During the tenor, the owner of the T-Bills will not receive any interest payments. Instead, the T-Bills are sold at a discount and redeemed at par value upon maturity.

For example, if you purchase 1000 units of a 1-year T-Bill at a yield of 1% per annum, you will only need to pay $990 and you will receive $1000 upon maturity a year later.

Similarly for 1000 units of an 86-day T-Bill at a yield of 1% per annum, you will need to pay $998 and you will receive $1000 upon maturity 3 months later.

To find out more on Treasury Bills, visit our website, email dcm@phillip.com.sg or call 6531 1603.

Article extracted from Phillip Capital

Labels:

Financial Stuffs

Thursday, January 8, 2009

Daily news - 8 Jan

CapitaLand shares retreat on rights rumour

CapitaLand shares shed 8.2 per cent on market speculation that it is planning a rights issue. Responding to queries, the group issued this statement: “In response to various media and analyst queries that CapitaLand is planning a rights issue, CapitaLand wishes to state that we will not comment on such market rumour or speculation. CapitaLand regularly receives and reviews various proposals of a business, financing or other nature. It is CapitaLand's disclosure policy to make the appropriate announcements if and when required, in accordance with the SGX-ST Listing Rules.” This follows a Dow Jones news report saying that the group is considering a rights issue to raise capital, but there has been no definite decision, quoting a “person familiar with the situation”.

Delong to post full-year loss on demand slump

Delong Holdings, which put hundreds of workers on unpaid leave last October and shut several furnaces in China, yesterday said it will be reporting a loss for the full year ended Dec 31, 2008. The profit warning came as the global financial crisis hit China's steel demand in the latter half of 2008. The Singapore-listed Chinese steel company said given the slower demand, the group had moved decisively in October 2008 to scale down production at four of its smaller blast furnaces to reduce costs. The four furnances account for about 30 per cent of the group's annual production. 'However, higher raw material prices coupled with the writedown of inventory to net realisable value in 4Q2008, offset the cost savings and contributed to the group's FY2008 loss,' it said in a statement to the Singapore Exchange. Delong's board assured shareholders that despite the tighter operating environment, it has sufficient financial resources to meet its working capital requirements. 'The group has existing secured and unsecured credit facilities with various domestic and foreign financial institutions which can be called upon if any such need arises,' Delong said. As at end-September 2008, Delong's cash and cash equivalent stood at S$139.49 million, down from S$291.16 million a year earlier. Delong said yesterday that it remains confident about the long-term potential of China's steel industry.

Noble Group says shipping unit insured for oil spill claims

Noble Group Ltd, a Hong Kong-based commodity supplier whose shipping unit is being sued in California after an oil spill, says the business is insured for such claims. The suit includes claims for clean-up costs and damages to natural resources, Noble said yesterday in an e-mailed response to Bloomberg queries. The unit is insured for any civil liability arising out of the incident, the company said, without specifying an amount. The state of California on Tuesday filed a suit against unit Fleet Management, which operated the 900-foot Cosco Busan that struck a bridge support in San Francisco Bay in November 2007. Noble already faces charges in the US that it falsified documents to cover up its role in the ensuing oil spill that killed marine life, disrupted fishing and closed beaches.

Source: Kim Eng

CapitaLand shares shed 8.2 per cent on market speculation that it is planning a rights issue. Responding to queries, the group issued this statement: “In response to various media and analyst queries that CapitaLand is planning a rights issue, CapitaLand wishes to state that we will not comment on such market rumour or speculation. CapitaLand regularly receives and reviews various proposals of a business, financing or other nature. It is CapitaLand's disclosure policy to make the appropriate announcements if and when required, in accordance with the SGX-ST Listing Rules.” This follows a Dow Jones news report saying that the group is considering a rights issue to raise capital, but there has been no definite decision, quoting a “person familiar with the situation”.

Delong to post full-year loss on demand slump

Delong Holdings, which put hundreds of workers on unpaid leave last October and shut several furnaces in China, yesterday said it will be reporting a loss for the full year ended Dec 31, 2008. The profit warning came as the global financial crisis hit China's steel demand in the latter half of 2008. The Singapore-listed Chinese steel company said given the slower demand, the group had moved decisively in October 2008 to scale down production at four of its smaller blast furnaces to reduce costs. The four furnances account for about 30 per cent of the group's annual production. 'However, higher raw material prices coupled with the writedown of inventory to net realisable value in 4Q2008, offset the cost savings and contributed to the group's FY2008 loss,' it said in a statement to the Singapore Exchange. Delong's board assured shareholders that despite the tighter operating environment, it has sufficient financial resources to meet its working capital requirements. 'The group has existing secured and unsecured credit facilities with various domestic and foreign financial institutions which can be called upon if any such need arises,' Delong said. As at end-September 2008, Delong's cash and cash equivalent stood at S$139.49 million, down from S$291.16 million a year earlier. Delong said yesterday that it remains confident about the long-term potential of China's steel industry.

Noble Group says shipping unit insured for oil spill claims

Noble Group Ltd, a Hong Kong-based commodity supplier whose shipping unit is being sued in California after an oil spill, says the business is insured for such claims. The suit includes claims for clean-up costs and damages to natural resources, Noble said yesterday in an e-mailed response to Bloomberg queries. The unit is insured for any civil liability arising out of the incident, the company said, without specifying an amount. The state of California on Tuesday filed a suit against unit Fleet Management, which operated the 900-foot Cosco Busan that struck a bridge support in San Francisco Bay in November 2007. Noble already faces charges in the US that it falsified documents to cover up its role in the ensuing oil spill that killed marine life, disrupted fishing and closed beaches.

Source: Kim Eng

Labels:

Company News

Selected bluechips dividend policy

I came across an article Lower dividends on the cards as earnings wither by Lynette Khoo in Buinsess Times a few days back. I see the compilation is good so I thought of sharing it here. It’s not so much about the dividend yield but it is the dividend policy of some bluechips that some investors may find the information useful to them.

Labels:

Stocks Information

Singapore market is cheap

After my last update on STI a few weeks back, Singapore market has rebounded from its bottom to a new 2-month high of 1959.5 on the 7 Jan 2009. From the valuation ratios that I have calculated, PE ratio of STI was at 6.57 and PTB ratio of STI was at 1.27.

In my opinion, our Singapore market is still cheap. Take note the earnings used by me were the trailing 12-months (TTM). How about the earnings going forward? Of course when future earnings are expected to decline, the PE ratio is not going to stay at the same low level. But you can do some extrapolation based on the TTM PE ratio.

The table below will give an idea of what STI PE ratio is going to be if earnings are to drop by so much and assuming price remains the same level. Now you can make a smart estimate of what our forward STI PE ratio is going to be.

Taking a worst case scenario of 30% decline in earnings, our PE ratio will be 9.39 which is still more than 60% discount of a 10-year average PE ratio according to Macquarie (read comments).

In my opinion, our Singapore market is still cheap. Take note the earnings used by me were the trailing 12-months (TTM). How about the earnings going forward? Of course when future earnings are expected to decline, the PE ratio is not going to stay at the same low level. But you can do some extrapolation based on the TTM PE ratio.

The table below will give an idea of what STI PE ratio is going to be if earnings are to drop by so much and assuming price remains the same level. Now you can make a smart estimate of what our forward STI PE ratio is going to be.

Taking a worst case scenario of 30% decline in earnings, our PE ratio will be 9.39 which is still more than 60% discount of a 10-year average PE ratio according to Macquarie (read comments).

| TTM PE ratio (6 Jan 2009) | Earnings drop by | PE ratio |

| 6.57 | 10.00% | 7.30 |

| 20.00% | 8.21 | |

| 30.00% | 9.39 | |

| 40.00% | 10.95 | |

| 50.00% | 13.14 | |

| 60.00% | 16.43 | |

| 70.00% | 21.90 | |

| 80.00% | 32.85 | |

| 90.00% | 65.70 |

Labels:

Stocks Articles

Sample W-8BEN form

If you intend to buy stocks in the US, you will need to fill up the W-8BEN form. I got a problem filling up that form the first time. I have put up a sample form showing the important sections that you need to fill in. Just follow the sample and mail it. That is all.

Labels:

Stocks Articles

Wednesday, January 7, 2009

Daily news - 7 Jan

CCT Secures Refinancing for S$580 million CMBS Due March 2009

CapitaCommercial Trust (CCT) has entered into a facility agreement with DBS, Standard Chartered Bank, UOB and The Bank of Tokyo-Mitsubishi UFJ, Ltd, for a secured three-year term loan of up to S$580 million for CCT. The term loan will be drawndown in March 2009 to refinance the borrowings under the S$580 million commercial mortgage-backed securities (CMBS). The CMBS is secured by the seven properties in the initial portfolio. However, the term loan will only be secured by Capital Tower. As a result, out of CCT’s portfolio of eleven properties, eight properties with a total asset value of S$2.8 billion will be free of any encumbrance. This will provide CCT with financial flexibility in managing its capital and balance sheet. The all-in interest cost is well within CCT's projections. In addition, CCT has decided to abort the redevelopment of Market Street Car Park into a Grade A office/commercial building. Although the Manager had stated in April 2008 that the decision on the planned redevelopment would be made only after mid-2009, the Manager after taking into consideration the uncertain market outlook, tight credit conditions, high redevelopment cost and significant size of the project, has decided to abort the project immediately. CCT's CEO Ms Lynette Leong said the move will also give assurance and security of tenure to the car park users as well as retail tenants. CCT can move on to enter into longer term leases and adopt longer term plans through repositioning the retail tenant mix and other promotional events or activities to inject vibrancy to the area.

SGX posts record derivatives trades

Singapore Exchange (SGX) – Derivative and exchange-traded funds (ETFs) on the SGX set new trading records in 2008. Total derivatives volume hit nearly 62 million contracts, up by almost 38% compared to the previous period mainly due to a more than eight-fold surge in the number of CNX Nifty Index futures contracts to 12.4 million contracts from 2007's 1.44 million contracts. Other key future contracts - the Nikkei 225, MSCI Taiwan and MSCI Singapore recorded double- digit percentage growth.SGX added that turnover in the total futures and options market for the first nine months of 2008 alone had exceeded full-year 2007 figures followed by a record month in October when 6.86m contracts were traded. Hong Kong also hit records in the derivatives market in 2008 when it registered a record 101 million in volume up to Dec 15, 2008 based on data on its website showed. As for ETFs, total trading value in 2008 more than double to S2.94bn from 2007.

Applications for Spring loans up 3-fold: DBS